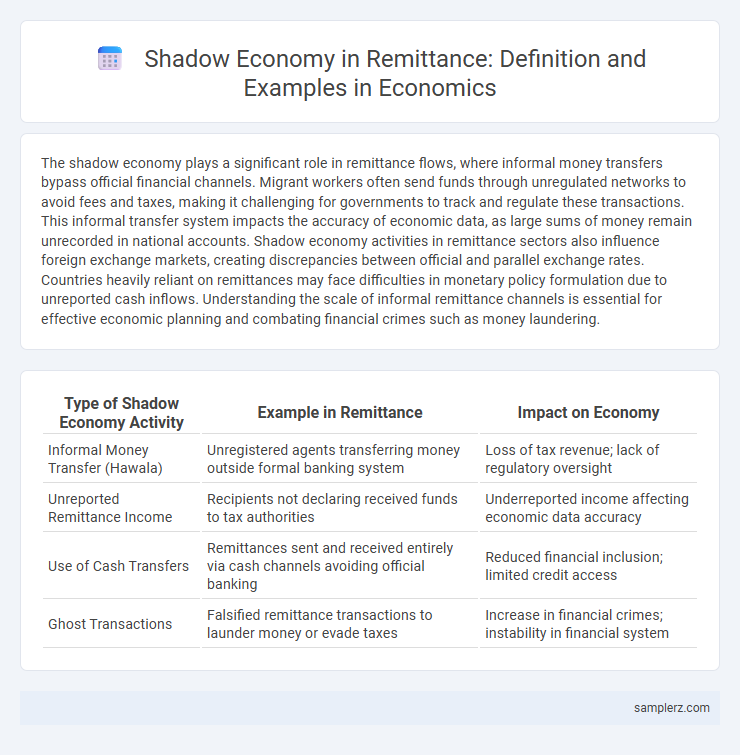

The shadow economy plays a significant role in remittance flows, where informal money transfers bypass official financial channels. Migrant workers often send funds through unregulated networks to avoid fees and taxes, making it challenging for governments to track and regulate these transactions. This informal transfer system impacts the accuracy of economic data, as large sums of money remain unrecorded in national accounts. Shadow economy activities in remittance sectors also influence foreign exchange markets, creating discrepancies between official and parallel exchange rates. Countries heavily reliant on remittances may face difficulties in monetary policy formulation due to unreported cash inflows. Understanding the scale of informal remittance channels is essential for effective economic planning and combating financial crimes such as money laundering.

Table of Comparison

| Type of Shadow Economy Activity | Example in Remittance | Impact on Economy |

|---|---|---|

| Informal Money Transfer (Hawala) | Unregistered agents transferring money outside formal banking system | Loss of tax revenue; lack of regulatory oversight |

| Unreported Remittance Income | Recipients not declaring received funds to tax authorities | Underreported income affecting economic data accuracy |

| Use of Cash Transfers | Remittances sent and received entirely via cash channels avoiding official banking | Reduced financial inclusion; limited credit access |

| Ghost Transactions | Falsified remittance transactions to launder money or evade taxes | Increase in financial crimes; instability in financial system |

Informal Money Transfer Systems in Remittances

Informal Money Transfer Systems (IMTS) play a significant role in the shadow economy by facilitating remittances outside formal banking channels, often bypassing regulatory oversight and taxation. These systems, such as hawala or hundi networks, enable fast, low-cost transfers but lack transparency, contributing to unrecorded capital flows and economic distortions. The widespread use of IMTS in remittance markets highlights challenges in combating money laundering and ensuring financial integrity in many developing economies.

Hawala Networks and Undocumented Cash Flows

Hawala networks facilitate remittance transfers outside formal banking systems, enabling undocumented cash flows that evade regulatory oversight. These informal channels often lack transaction records, contributing to significant shadow economy activities by bypassing official financial institutions. As a result, Hawala systems complicate efforts to track money laundering and tax evasion within cross-border remittances.

Smuggling Funds Through Personal Couriers

Smuggling funds through personal couriers represents a significant segment of the shadow economy within remittances, bypassing formal financial institutions to avoid detection and regulatory scrutiny. This method involves individuals physically transporting cash across borders, often under the radar of customs and banking regulations, facilitating unreported money flows that undermine economic transparency. Estimates suggest that such informal remittance channels contribute billions annually to the global shadow economy, complicating efforts to monitor and control illicit financial activities.

Use of Unlicensed Money Transfer Operators

Unlicensed Money Transfer Operators (MTOs) play a significant role in the shadow economy by facilitating remittances outside formal financial channels. These operators often avoid regulatory oversight, enabling money laundering, tax evasion, and the transfer of illicit funds. The prevalence of unlicensed MTOs undermines government revenue and hampers efforts to ensure financial transparency and security in remittance flows.

Cryptocurrency Channels in Shadow Remittances

Cryptocurrency channels in shadow remittances facilitate unregulated cross-border money transfers, bypassing traditional financial systems and regulatory oversight. These channels enable rapid, low-cost transactions but often evade taxation and anti-money laundering measures, contributing to the growth of the shadow economy. Significant volumes of remittances flow through decentralized exchanges and crypto wallets, complicating efforts to trace and control illicit financial activities.

False Invoicing in Cross-Border Money Transfers

False invoicing in cross-border money transfers is a prevalent method within the shadow economy, enabling individuals and businesses to disguise illicit funds as legitimate transactions. This practice involves inflating or fabricating invoice amounts to transfer money covertly, evading taxes and regulatory scrutiny. According to global estimates, the shadow economy accounts for nearly 10% of global GDP, with false invoicing playing a significant role in remittance flows between developing and developed countries.

Shadow Remittance Flows in Migrant Communities

Shadow remittance flows in migrant communities represent a significant portion of the informal economy, where unregulated money transfers bypass formal banking channels to avoid fees and detection. This underground financial activity not only undermines national tax revenues but also poses risks related to money laundering and economic instability. Studies estimate that informal remittance channels account for up to 50% of total remittance flows in certain migrant populations, highlighting the economic impact of the shadow remittance market.

Black Market Currency Exchanges for Remittances

Black market currency exchanges for remittances significantly contribute to the shadow economy by bypassing official channels and avoiding regulatory scrutiny. These unregulated exchanges often offer better exchange rates than formal financial institutions, attracting migrants who send money home while undermining government tax revenues and monetary policies. The covert nature of these transactions hampers economic transparency, distorts foreign currency flows, and poses challenges for anti-money laundering efforts.

Underground Banking and Off-the-Record Transfers

Underground banking and off-the-record transfers represent significant components of the shadow economy within remittance markets, facilitating unregulated, cross-border fund flows that evade formal financial systems and regulatory oversight. These informal channels enable migrant workers to send money home without incurring fees or scrutiny, but they undermine official economic data and tax revenues, complicating monetary policy and financial inclusion efforts. The pervasive reliance on hawala networks and cash-based transfers reflects persistent trust gaps in formal banking infrastructure across developing economies.

Tax Evasion via Shadow Economy Remittance Practices

Tax evasion through shadow economy remittance practices often involves unreported cross-border money transfers that bypass official banking channels, reducing taxable income for both individuals and businesses. These informal remittance methods undermine government revenue by avoiding financial scrutiny and regulatory compliance, particularly prevalent in sectors with high migrant worker populations. Estimates suggest that shadow economy remittances account for a significant portion of global funds sent home, complicating economic policy and tax collection efforts worldwide.

example of shadow economy in remittance Infographic

samplerz.com

samplerz.com