Sterilization in central banking involves offsetting foreign exchange interventions to control money supply. When a central bank buys foreign currency to support the local currency, it injects liquidity into the economy. To neutralize this effect, the bank sells government securities, absorbing the excess liquidity and maintaining monetary stability. Data from the International Monetary Fund highlights several instances where sterilization helped stabilize inflation and exchange rates. For example, the Reserve Bank of India frequently employs sterilization to manage rupee volatility amid capital inflows. This process allows central banks to harness exchange rate control without triggering unwanted inflation or asset bubbles.

Table of Comparison

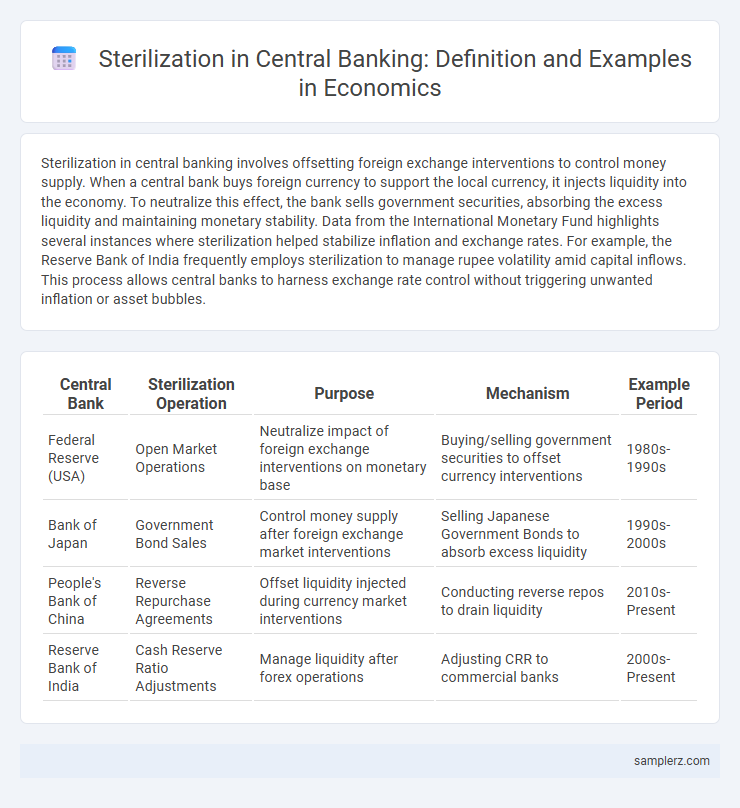

| Central Bank | Sterilization Operation | Purpose | Mechanism | Example Period |

|---|---|---|---|---|

| Federal Reserve (USA) | Open Market Operations | Neutralize impact of foreign exchange interventions on monetary base | Buying/selling government securities to offset currency interventions | 1980s-1990s |

| Bank of Japan | Government Bond Sales | Control money supply after foreign exchange market interventions | Selling Japanese Government Bonds to absorb excess liquidity | 1990s-2000s |

| People's Bank of China | Reverse Repurchase Agreements | Offset liquidity injected during currency market interventions | Conducting reverse repos to drain liquidity | 2010s-Present |

| Reserve Bank of India | Cash Reserve Ratio Adjustments | Manage liquidity after forex operations | Adjusting CRR to commercial banks | 2000s-Present |

Understanding Sterilization in Central Banking

Sterilization in central banking involves offsetting foreign exchange interventions by conducting open market operations to neutralize the impact on the domestic money supply. When a central bank buys foreign currency to weaken its own, it simultaneously sells government bonds to absorb excess liquidity, preventing inflationary pressures. This precise balancing act helps maintain monetary stability while managing exchange rates effectively.

Historical Examples of Sterilization Policies

Historical examples of sterilization policies include the Bank of Japan's interventions in the 1960s to neutralize the impact of foreign exchange reserves on domestic money supply. Similarly, the U.S. Federal Reserve implemented sterilized purchases of gold during the Bretton Woods era to maintain fixed exchange rates without expanding monetary base. These cases illustrate how central banks use open market operations to offset balance of payments effects and stabilize inflation and currency value.

Sterilization Tools Used by Central Banks

Central banks employ sterilization tools such as open market operations, including the sale or purchase of government securities, to neutralize the impact of foreign exchange interventions on the domestic money supply. Reserve requirements adjustments compel commercial banks to hold a higher portion of their deposits as reserves, limiting credit creation and controlling liquidity. Currency swaps and issuing central bank bills also serve as effective sterilization methods to stabilize inflation and exchange rates without disrupting monetary policy goals.

Case Study: The Federal Reserve’s Sterilization Efforts

The Federal Reserve's sterilization efforts during the 1980s effectively neutralized the inflationary impact of large-scale foreign capital inflows by offset balance of payments surpluses with open market operations, primarily through the sale of government securities. This approach controlled money supply growth despite persistent dollar interventions to stabilize exchange rates, maintaining inflation targets without disrupting domestic monetary policy. Empirical data from this period highlights the Fed's capacity to decouple exchange rate management from domestic inflation control through sterilization techniques.

Sterilization in the European Central Bank’s Operations

The European Central Bank (ECB) conducts sterilization by offsetting foreign exchange interventions through open market operations, thereby neutralizing the impact on the eurozone money supply. By issuing short-term debt instruments like ECB bills, the central bank absorbs excess liquidity created from currency market activities. This approach maintains price stability while managing exchange rate fluctuations within the monetary policy framework.

China’s Approach to Currency Sterilization

China's central bank employs currency sterilization to manage liquidity and control inflation, primarily through open market operations and issuing central bank bonds. By offsetting foreign exchange interventions that increase the money supply, the People's Bank of China stabilizes the yuan while preventing overheating of the economy. This approach helps maintain monetary policy effectiveness amid large-scale capital inflows and foreign reserve accumulation.

Impact of Sterilization on Exchange Rates

Sterilization in central banking involves offsetting foreign exchange interventions with open market operations to neutralize the impact on money supply, helping stabilize exchange rates. By absorbing excess liquidity created from foreign currency purchases, sterilization reduces inflationary pressures and mitigates currency depreciation risks. This process supports exchange rate stability by preventing excessive fluctuations and maintaining investor confidence in the currency.

Sterilization and Capital Inflows: Emerging Markets

Sterilization in central banking involves offsetting foreign capital inflows to stabilize the domestic money supply, a crucial practice in emerging markets facing volatile capital movements. Central banks, such as those in Brazil and India, conduct sterilization by selling government securities to mop up excess liquidity generated from foreign exchange interventions. Effective sterilization helps control inflationary pressures and maintain monetary stability despite significant capital inflows.

Challenges and Limitations of Sterilization

Sterilization in central banking involves offsetting foreign exchange interventions to stabilize the domestic money supply, but challenges arise from limited domestic financial instruments and fiscal constraints that restrict effective absorption of excess liquidity. Persistent sterilization can lead to increased government debt due to the cost of issuing sterilization bonds, while global capital flows and currency market volatility reduce the central bank's control over exchange rates. Moreover, sterilization may become ineffective when external shocks are large or prolonged, undermining the central bank's monetary policy objectives.

The Future of Sterilization in Global Monetary Policy

Sterilization plays a critical role in central banking by neutralizing the impact of foreign exchange interventions on domestic money supply to maintain price stability. As global monetary policy evolves, central banks are increasingly leveraging advanced tools like quantitative easing alongside sterilization to manage inflation and currency volatility. The future of sterilization involves integrating digital currencies and real-time data analytics to enhance the precision and effectiveness of monetary control in interconnected global markets.

example of sterilization in central banking Infographic

samplerz.com

samplerz.com