Adverse selection in the economy occurs when buyers or sellers have asymmetric information, leading to market inefficiencies. A common example is the used car market, where sellers possess more knowledge about the vehicle's condition than buyers. This information imbalance often results in buyers offering lower prices, assuming some cars might be low quality or "lemons." Another clear example of adverse selection appears in health insurance markets. Individuals with higher health risks are more likely to seek insurance coverage, while healthier individuals tend to opt out, causing insurers to face disproportionate claims. This dynamic leads to increased premiums, potentially driving even more low-risk participants away from the market.

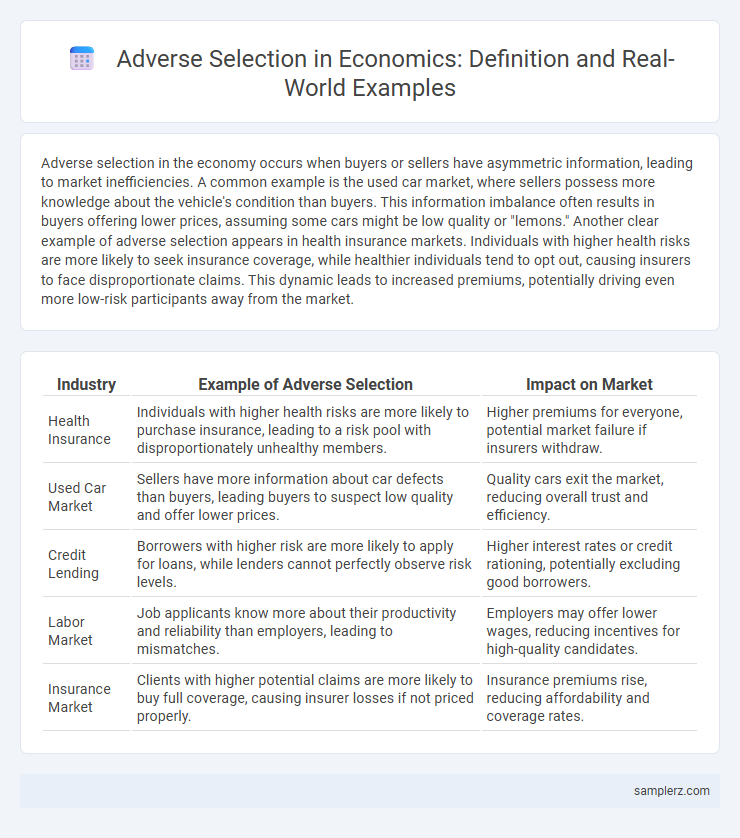

Table of Comparison

| Industry | Example of Adverse Selection | Impact on Market |

|---|---|---|

| Health Insurance | Individuals with higher health risks are more likely to purchase insurance, leading to a risk pool with disproportionately unhealthy members. | Higher premiums for everyone, potential market failure if insurers withdraw. |

| Used Car Market | Sellers have more information about car defects than buyers, leading buyers to suspect low quality and offer lower prices. | Quality cars exit the market, reducing overall trust and efficiency. |

| Credit Lending | Borrowers with higher risk are more likely to apply for loans, while lenders cannot perfectly observe risk levels. | Higher interest rates or credit rationing, potentially excluding good borrowers. |

| Labor Market | Job applicants know more about their productivity and reliability than employers, leading to mismatches. | Employers may offer lower wages, reducing incentives for high-quality candidates. |

| Insurance Market | Clients with higher potential claims are more likely to buy full coverage, causing insurer losses if not priced properly. | Insurance premiums rise, reducing affordability and coverage rates. |

Understanding Adverse Selection in Economic Markets

Adverse selection in economic markets occurs when buyers or sellers have asymmetric information, leading to participation by higher-risk or lower-quality parties. A classic example is the used car market, where sellers possess more knowledge about vehicle condition than buyers, resulting in a market flooded with lemons and driving down overall prices. Financial markets also experience adverse selection when lenders cannot accurately assess borrowers' creditworthiness, causing higher-risk individuals to secure loans at rates intended for safer clients.

Classic Examples of Adverse Selection in Insurance

Adverse selection in insurance arises when individuals with higher risk are more likely to purchase coverage, leading to imbalanced risk pools and increased premiums. Classic examples include health insurance markets where those with pre-existing conditions disproportionately seek coverage, causing insurers to raise prices or limit benefits. This phenomenon disrupts market efficiency by reducing the insurer's ability to accurately assess and price risk.

Adverse Selection in Health Insurance: A Closer Look

Adverse selection in health insurance occurs when individuals with higher health risks are more likely to purchase comprehensive coverage, leading to imbalanced risk pools and increased premiums. Insurers face challenges in pricing policies accurately due to asymmetric information about applicants' health status, resulting in market inefficiencies. This phenomenon can cause healthy individuals to opt out, further exacerbating risk concentration and threatening the viability of insurance providers.

How Adverse Selection Affects the Used Car Market

Adverse selection in the used car market occurs when sellers have more information about vehicle quality than buyers, leading to a higher prevalence of low-quality "lemon" cars. This information asymmetry causes buyers to discount prices to protect against potential defects, reducing overall market efficiency. Consequently, high-quality car owners exit the market, exacerbating the problem and resulting in a market dominated by inferior vehicles.

Financial Markets and the Risk of Adverse Selection

In financial markets, adverse selection occurs when sellers have more information about the quality of an asset than buyers, leading to the potential for high-risk securities to be overrepresented. This information asymmetry drives away low-risk investors, increasing market volatility and reducing overall liquidity. The risk of adverse selection encourages stricter disclosure regulations and the development of credit rating agencies to improve transparency and market efficiency.

The Role of Information Asymmetry in Adverse Selection

Adverse selection in the economy occurs when information asymmetry causes buyers or sellers to make suboptimal decisions, such as when lenders cannot distinguish between high-risk and low-risk borrowers, leading to higher interest rates for all. In the insurance market, individuals with higher health risks are more likely to purchase coverage, while insurers lack precise information, causing premiums to rise and low-risk individuals to opt out. This mismatch reduces market efficiency and can result in market failure due to the lack of accurate information shared between parties.

Real-World Cases of Adverse Selection in Lending

Adverse selection in lending occurs when borrowers with higher risk profiles are more likely to seek loans, leading lenders to face increased default rates. Subprime mortgage crises exemplify this, where lenders extended loans to borrowers with poor credit histories, resulting in widespread loan defaults and financial instability. Peer-to-peer lending platforms also experience adverse selection as less creditworthy individuals are more motivated to obtain funding, elevating the platform's risk exposure.

Government Policies Targeting Adverse Selection

Government policies targeting adverse selection often include mandatory health insurance to prevent only high-risk individuals from enrolling, which balances risk pools and stabilizes premiums. Subsidies and tax incentives further encourage low-risk individuals to participate, reducing information asymmetry between insurers and consumers. Regulatory frameworks requiring disclosure of relevant information enhance market transparency, mitigating adverse selection impacts in sectors like healthcare and auto insurance.

Adverse Selection in Labour Markets: Key Examples

Adverse selection in labour markets occurs when employers cannot accurately assess the true productivity or skills of job applicants, leading to the hiring of less qualified candidates. This phenomenon is evident in sectors with asymmetric information, such as the gig economy, where firms struggle to differentiate between high and low-quality workers. Consequently, adverse selection contributes to wage distortions and inefficient job matches, undermining overall market efficiency.

Strategies to Mitigate Adverse Selection in the Economy

Adverse selection in the economy occurs when buyers or sellers have asymmetric information, leading to market inefficiencies such as high-risk individuals disproportionately participating in markets like insurance or credit. Strategies to mitigate adverse selection include implementing thorough screening processes, using signaling mechanisms like warranties or certifications, and designing incentive-compatible contracts that align the interests of both parties. Regulatory policies and transparency-enhancing tools also play a crucial role in reducing information asymmetry and improving overall market outcomes.

example of adverse selection in economy Infographic

samplerz.com

samplerz.com