The tax wedge in payroll refers to the difference between the total labor cost to the employer and the net take-home pay received by the employee. For example, if an employer pays $50,000 for an employee's salary but the employee receives only $35,000 after income tax and social security contributions, the tax wedge is $15,000. This gap represents mandatory payroll taxes and social charges imposed by governments, influencing labor market decisions. Tax wedges vary significantly across countries and industries, impacting employment costs and worker incentives. In some European countries, tax wedges can exceed 40%, while in others, they remain below 20%. Policymakers analyze tax wedge data to balance revenue needs with economic competitiveness and labor market efficiency.

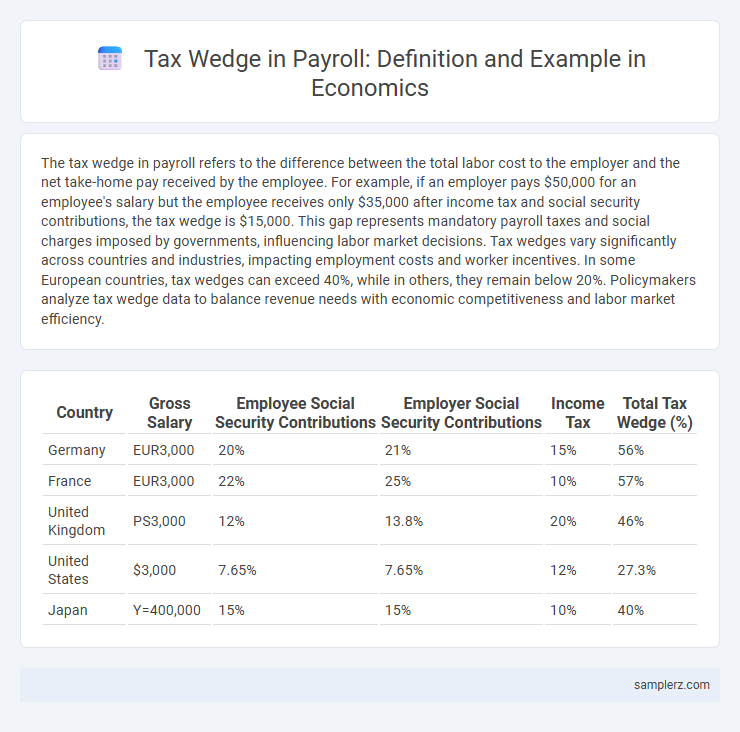

Table of Comparison

| Country | Gross Salary | Employee Social Security Contributions | Employer Social Security Contributions | Income Tax | Total Tax Wedge (%) |

|---|---|---|---|---|---|

| Germany | EUR3,000 | 20% | 21% | 15% | 56% |

| France | EUR3,000 | 22% | 25% | 10% | 57% |

| United Kingdom | PS3,000 | 12% | 13.8% | 20% | 46% |

| United States | $3,000 | 7.65% | 7.65% | 12% | 27.3% |

| Japan | Y=400,000 | 15% | 15% | 10% | 40% |

Understanding the Payroll Tax Wedge: Key Concepts

The payroll tax wedge represents the difference between the total labor cost for employers and the net take-home pay received by employees, including income taxes and social security contributions. In countries like France, this wedge can exceed 45%, significantly impacting both labor market participation and employer hiring decisions. Understanding the payroll tax wedge is crucial for analyzing labor market efficiency and the effects of taxation on employment incentives.

Real-World Examples of Payroll Tax Wedges

France exhibits one of the highest payroll tax wedges in the OECD, with employers and employees collectively paying over 45% of gross wages in social security contributions and income taxes. In contrast, Ireland's payroll tax wedge is significantly lower, around 25%, promoting labor market flexibility and higher employment rates. Germany's complex payroll tax system results in a wedge of approximately 39%, influencing decisions on part-time versus full-time employment.

How Payroll Taxes Impact Employee Take-Home Pay

Payroll taxes significantly reduce employee take-home pay by increasing the tax wedge, which is the difference between total labor costs borne by employers and the net salary received by employees. In countries like France, where payroll taxes can reach over 45% of gross wages, workers see a substantial decrease in disposable income despite high nominal salaries. This tax wedge affects labor market dynamics by influencing employment costs and incentivizing informal work or demand for wage adjustments.

Employer Payroll Tax Contributions Explained

Employer payroll tax contributions represent a significant portion of the tax wedge in labor costs, encompassing mandatory payments such as Social Security, Medicare, and unemployment insurance taxes. These taxes increase the total expense of hiring employees beyond gross wages, impacting business profitability and labor market dynamics. Understanding employer payroll tax rates, which vary by country and region, is essential for accurate economic analysis and effective payroll budgeting.

Comparative Payroll Tax Wedges Across Countries

Payroll tax wedge, the difference between total labor costs and net take-home pay, varies significantly across countries, impacting labor market competitiveness and employment rates. For instance, in 2023, Belgium exhibited one of the highest payroll tax wedges at approximately 55%, while countries like Switzerland maintained lower wedges near 20%, reflecting divergent social security and taxation policies. These disparities influence wage-setting behavior and cross-border labor mobility, making payroll tax wedge a critical factor in comparative economic analyses.

Case Study: Payroll Tax Wedge in the United States

The payroll tax wedge in the United States exemplifies the economic impact of social security and Medicare taxes, where combined employer and employee contributions can reach over 15% of gross wages. This tax wedge influences labor market decisions by increasing the cost of employment for businesses and reducing take-home pay for workers. Studies indicate that higher payroll tax wedges are linked to lower employment rates and slower wage growth, underscoring the delicate balance policymakers must maintain between funding social programs and fostering job creation.

The Payroll Tax Wedge’s Effect on Labor Market Participation

The payroll tax wedge, defined as the difference between the total labor costs for employers and the net take-home pay for employees, significantly influences labor market participation rates. High payroll tax wedges reduce workers' net wages, discouraging labor supply, and simultaneously raise employers' costs, potentially curbing job creation. Empirical studies show countries with lower payroll tax wedges often experience higher employment-to-population ratios due to improved incentives for both hiring and working.

Calculating the Payroll Tax Wedge: Step-by-Step Example

Calculating the payroll tax wedge involves summing employee social security contributions, employer social security contributions, and payroll taxes, then dividing by the employee's gross wage to determine the total tax burden. For example, if an employee's gross salary is $5,000, employee contributions are $500, employer contributions are $700, and payroll taxes amount to $300, the total tax wedge equals ($500 + $700 + $300) / $5,000, or 30%. This calculation highlights the percentage of labor costs consumed by taxes, affecting both net wages and employer expenses.

Policymaker Approaches to Reducing Payroll Tax Wedges

Policymakers often implement targeted payroll tax cuts to reduce the tax wedge, aiming to increase labor market participation and boost employer hiring incentives. Some approaches include lowering social security contributions for low-income workers or introducing wage subsidies to offset employer costs. These measures help close the gap between gross and net wages, improving employment rates and overall economic productivity.

Payroll Tax Wedge and Economic Growth: Interconnected Effects

The payroll tax wedge, which represents the difference between the total labor cost to employers and the net take-home pay of employees, significantly influences economic growth by affecting employment levels and labor market efficiency. High payroll tax wedges increase the cost of hiring, reducing labor demand and discouraging workforce participation, thereby slowing productivity gains and GDP growth. Countries with lower payroll tax wedges typically experience more robust job creation and economic expansion due to improved incentives for both employers and employees.

example of tax wedge in payroll Infographic

samplerz.com

samplerz.com