The Banana Index is a creative economic indicator that measures the strength and stability of a country's currency by comparing the price of a common item like a banana across different nations. This index uses data collected from local markets to highlight currency fluctuations and inflation rates, reflecting purchasing power and economic health. It serves as a simple yet powerful tool for economists and investors to gauge relative currency values in a real-world context. For example, if a banana costs $1 in the United States but 100 yen in Japan, any significant price change in either currency may indicate shifts in exchange rates or inflation. Data on banana prices is gathered from diverse retail locations, providing granular insights into local market conditions. This entity-based approach connects everyday economic data with broader currency market trends, facilitating better-informed financial decisions.

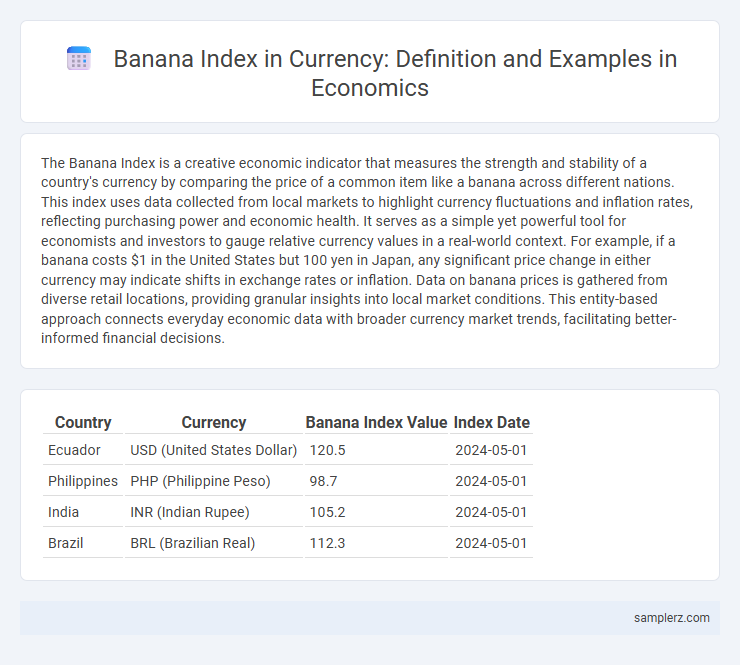

Table of Comparison

| Country | Currency | Banana Index Value | Index Date |

|---|---|---|---|

| Ecuador | USD (United States Dollar) | 120.5 | 2024-05-01 |

| Philippines | PHP (Philippine Peso) | 98.7 | 2024-05-01 |

| India | INR (Indian Rupee) | 105.2 | 2024-05-01 |

| Brazil | BRL (Brazilian Real) | 112.3 | 2024-05-01 |

Understanding the Banana Index in Currency Valuation

The Banana Index measures currency volatility by tracking price fluctuations in commodities like bananas, reflecting broader economic stability and inflation trends. This index highlights how supply chain disruptions or trade policies impact currency strength, making it a valuable tool for investors and policymakers in assessing real-world economic conditions. Understanding the Banana Index helps forecast currency depreciation risks in emerging markets reliant on agricultural exports.

Historical Examples of Banana Index in Global Economies

The Banana Index, originally derived from the price fluctuations of bananas in global trade, has historically highlighted the volatility in currency values within agricultural export-dependent economies such as Ecuador and the Philippines. These countries experienced currency devaluations linked to banana price shocks during the 1980s and 1990s, exposing the vulnerability of commodity-based currencies to market swings. This index remains a key example of how single-commodity reliance can impact national exchange rates in emerging markets.

The Role of Banana Index in Measuring Currency Stability

The Banana Index serves as a unique economic indicator reflecting currency stability through the price fluctuations of bananas, a widely traded commodity sensitive to inflation and exchange rates. By analyzing the Banana Index, economists can assess how currency depreciation impacts import costs and consumer prices in tropical fruit markets. This index offers valuable insights into local purchasing power and macroeconomic stability in countries reliant on banana exports or imports.

Case Studies: Banana Index Application in Developing Nations

The Banana Index measures currency volatility in developing nations by comparing local currency fluctuations against stable commodity prices like bananas, crucial for economies relying on agriculture exports. Case studies from countries such as Ecuador and the Philippines demonstrate how the Banana Index helps policymakers assess inflation risks and currency devaluation linked to export dependency. This index provides actionable insights for stabilizing monetary policies and promoting sustainable economic growth in agriculture-dependent developing nations.

Comparing Banana Index with Traditional Currency Benchmarks

The Banana Index measures currency stability by tracking price fluctuations of bananas in local markets, providing a unique perspective on inflation and purchasing power. Unlike traditional currency benchmarks such as the US Dollar Index (DXY) or Euro Currency Index, which rely on a basket of fiat currencies, the Banana Index captures real-world commodity price volatility and consumer experience. This alternative index highlights economic disparities and inflationary pressures in emerging markets more effectively than abstract currency comparisons.

Economic Impacts of Banana Index Fluctuations

The Banana Index reflects the cost of a typical banana in different currencies, serving as a practical indicator of inflation and purchasing power variations across nations. Fluctuations in the Banana Index directly impact consumer spending patterns, food affordability, and import-export balances in economies highly dependent on banana trade. Shifts in this index also influence wage adjustments, economic inequality, and policy decisions within agricultural and retail sectors.

Banana Index and Its Relevance in Hyperinflation Scenarios

The Banana Index measures the cost of a standard banana in local currency, providing a tangible indicator of purchasing power and price stability during hyperinflation. In hyperinflation scenarios, sharp increases in the Banana Index reflect rapid currency depreciation and the erosion of real income. Tracking changes in the Banana Index helps economists and policymakers assess the severity of inflation and make informed decisions to stabilize the economy.

How the Banana Index Reflects Purchasing Power Parity

The Banana Index measures the price of bananas in various countries to illustrate purchasing power parity (PPP) by comparing local banana costs against a baseline, often the US dollar price. A higher Banana Index indicates that bananas are relatively more expensive in that country, suggesting reduced purchasing power of the local currency. This simple commodity comparison helps economists and analysts assess currency valuation and cost of living differences across nations.

Criticisms and Limitations of the Banana Index Method

The Banana Index method, often used to measure currency valuation relative to purchasing power parity, faces significant criticisms regarding its oversimplification of economic complexities and reliance on a single commodity as a benchmark. Limitations include its vulnerability to price volatility in the banana market, which can distort currency valuation and mask broader economic factors like trade policies or inflation differentials. Economists argue that this method fails to account for diverse consumption patterns and regional economic conditions, reducing its accuracy and applicability in comprehensive currency analysis.

Future Prospects of the Banana Index in Currency Analysis

The Banana Index, a measure of currency volatility influenced by tropical commodity markets, holds significant potential for future currency analysis amid shifting global trade dynamics and climate change impacts on banana production. Enhanced integration of the Banana Index with real-time economic indicators and machine learning models can improve forecasting accuracy in currency valuation and risk management. As tropical agriculture continues to affect export revenues for key economies, the Banana Index is poised to become a vital tool for investors and policymakers in assessing currency stability and inflation trends.

example of banana index in currency Infographic

samplerz.com

samplerz.com