The Phillips curve illustrates the inverse relationship between unemployment and inflation within an economy. When unemployment rates decline, inflation rates tend to increase as demand for goods and services rises, pushing prices upward. Conversely, higher unemployment typically corresponds with lower inflation due to decreased consumer spending and reduced wage pressures. This concept is essential for central banks when formulating monetary policy to balance growth and price stability. For example, during periods of low unemployment in the 1960s United States, inflation rates spiked, demonstrating the Phillips curve in action. Modern economies monitor this trade-off closely to avoid overheating or stagnation.

Table of Comparison

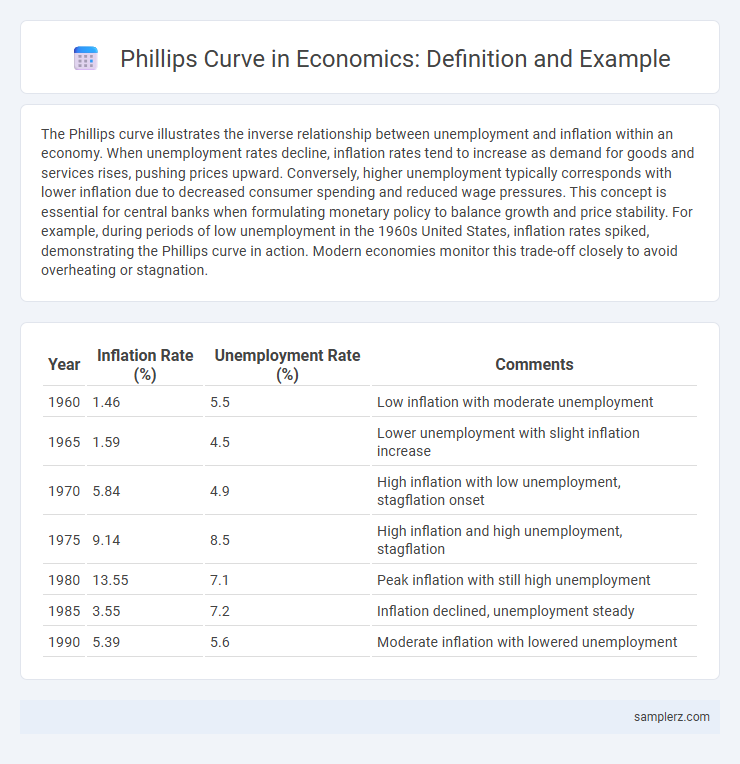

| Year | Inflation Rate (%) | Unemployment Rate (%) | Comments |

|---|---|---|---|

| 1960 | 1.46 | 5.5 | Low inflation with moderate unemployment |

| 1965 | 1.59 | 4.5 | Lower unemployment with slight inflation increase |

| 1970 | 5.84 | 4.9 | High inflation with low unemployment, stagflation onset |

| 1975 | 9.14 | 8.5 | High inflation and high unemployment, stagflation |

| 1980 | 13.55 | 7.1 | Peak inflation with still high unemployment |

| 1985 | 3.55 | 7.2 | Inflation declined, unemployment steady |

| 1990 | 5.39 | 5.6 | Moderate inflation with lowered unemployment |

Introduction to the Phillips Curve in Economics

The Phillips Curve illustrates the inverse relationship between unemployment and inflation, indicating that lower unemployment rates tend to coincide with higher inflation rates in an economy. This economic concept, introduced by economist A.W. Phillips in 1958, highlights the trade-off policymakers face between stabilizing inflation and reducing unemployment. Understanding the Phillips Curve is crucial for central banks in setting monetary policies aimed at balancing price stability with labor market health.

Theoretical Foundations of the Phillips Curve

The theoretical foundations of the Phillips curve illustrate the inverse relationship between unemployment and inflation, where lower unemployment rates tend to correlate with higher inflation due to increased wage pressures. This concept, originally formulated by economist A.W. Phillips in 1958, demonstrates how labor market tightness influences wage-setting behavior and subsequently general price levels. Empirical studies and macroeconomic models often utilize the Phillips curve to analyze trade-offs policymakers face when targeting both inflation and employment goals.

Historical Examples of the Phillips Curve in Action

The Phillips Curve historically illustrated the inverse relationship between unemployment and inflation, notably during the 1960s when low unemployment in the U.S. coincided with rising wage inflation. The 1970s stagflation challenged this model as simultaneous high inflation and unemployment revealed limitations in its predictive power. Recent analyses highlight how expectations and supply shocks have reshaped the Phillips Curve's applicability in modern economic policy.

Case Study: The Phillips Curve in the United States Economy

The Phillips curve in the United States economy illustrates the inverse relationship between unemployment and inflation, particularly evident during the 1960s when low unemployment correlated with rising inflation. This case study highlights the curve's limitations in the 1970s stagflation period, where high inflation and high unemployment occurred simultaneously, challenging traditional economic models. The example underscores the dynamic interplay between labor market conditions, inflation expectations, and monetary policy in shaping economic outcomes.

The Phillips Curve Experience in the 1970s Stagflation

The Phillips Curve, which traditionally showed an inverse relationship between unemployment and inflation, failed during the 1970s due to stagflation, a period characterized by high inflation and high unemployment simultaneously. This anomalous economic environment in the 1970s challenged the conventional Keynesian framework as supply shocks, particularly oil price hikes, led to both rising inflation and rising unemployment rates. The stagflation experience prompted economists to reconsider the Phillips Curve's stability and incorporate expectations-augmented models reflecting inflation expectations and supply-side factors.

Application of the Phillips Curve in Developing Economies

The Phillips Curve illustrates the inverse relationship between inflation and unemployment, providing a useful framework for developing economies striving to balance growth and price stability. In countries like India and Brazil, policymakers apply the Phillips Curve to implement monetary and fiscal policies that curb inflation without stifling employment. This approach aids in managing economic shocks and structural changes while promoting sustainable development.

The Phillips Curve and Monetary Policy Decisions

The Phillips Curve illustrates the inverse relationship between inflation and unemployment, guiding central banks in adjusting monetary policy to balance these two variables. When unemployment falls below the natural rate, inflation tends to rise, prompting central banks to tighten policy by raising interest rates to prevent overheating. Conversely, during high unemployment and low inflation periods, monetary authorities may lower interest rates to stimulate economic growth and reduce joblessness.

Recent Empirical Evidence on the Phillips Curve

Recent empirical evidence on the Phillips curve highlights a weakening inverse relationship between unemployment and inflation in advanced economies, suggesting inflation responsiveness to labor market slack has diminished. Studies from the Federal Reserve and the Bank of England indicate that factors such as global supply chain shocks and anchoring of inflation expectations have altered traditional Phillips curve dynamics. This evolving evidence challenges the predictive power of the Phillips curve for monetary policy and calls for models incorporating inflation persistence and heterogeneous labor market conditions.

Limitations and Criticisms of the Phillips Curve

The Phillips Curve, illustrating the inverse relationship between inflation and unemployment, faces limitations such as failing to hold consistently in the long run due to inflation expectations adjusting over time. Economists criticize its inability to account for stagflation, where high inflation and high unemployment coexist, undermining its predictive power during supply shocks. Empirical evidence from the 1970s onwards highlights these shortcomings, prompting the development of alternative models like the expectations-augmented Phillips Curve and the New Keynesian Phillips Curve.

Future Outlook: Is the Phillips Curve Still Relevant?

The Phillips Curve, which illustrates an inverse relationship between unemployment and inflation, remains a foundational concept in economic theory despite debates over its current applicability. Recent economic data suggest that factors like globalization, technology advancements, and shifting labor market dynamics have altered this relationship, causing a flatter or less predictable curve in modern economies. Policymakers now emphasize adaptive strategies that consider these changes while assessing inflation-unemployment trade-offs in the evolving global economic landscape.

example of Phillips curve in economy Infographic

samplerz.com

samplerz.com