Adverse selection in health insurance occurs when individuals with higher health risks are more likely to purchase comprehensive coverage while healthier individuals opt out or choose minimal plans. This imbalance leads to a pool of insured individuals with a greater likelihood of filing claims, increasing overall costs for insurers. Data from the health insurance market consistently show higher claim rates and premiums in plans predominantly chosen by those with chronic illnesses or pre-existing conditions. Insurance companies often respond by raising premiums or restricting coverage options, which can further discourage healthier people from enrolling, exacerbating adverse selection. For example, older adults or individuals with diabetes are more inclined to seek full health coverage, skewing the risk pool. Economists analyze this phenomenon using models that assess how asymmetric information influences consumer behavior and market equilibrium, driving inefficiencies in insurance markets.

Table of Comparison

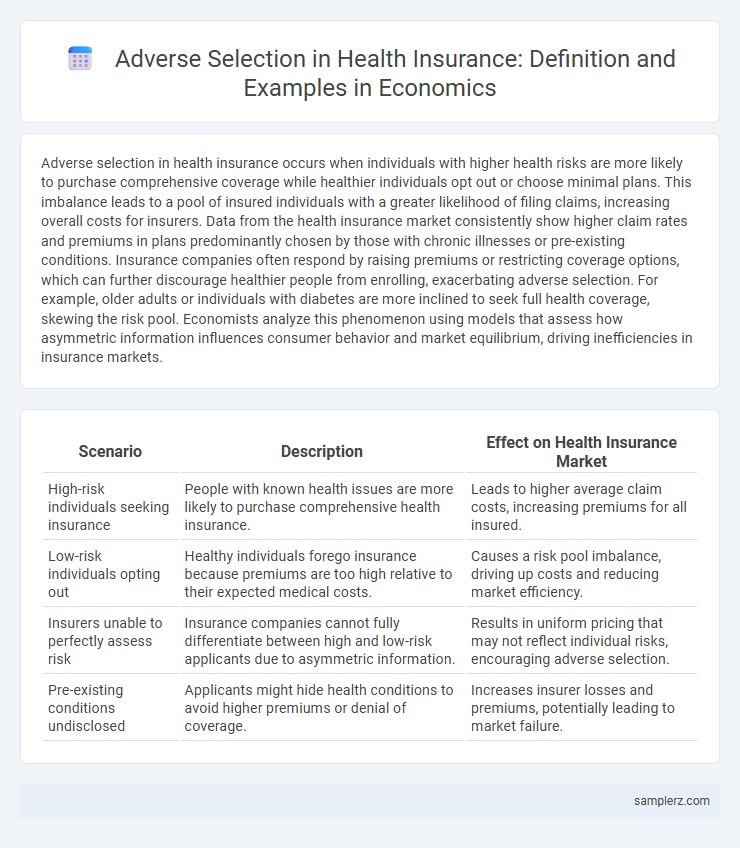

| Scenario | Description | Effect on Health Insurance Market |

|---|---|---|

| High-risk individuals seeking insurance | People with known health issues are more likely to purchase comprehensive health insurance. | Leads to higher average claim costs, increasing premiums for all insured. |

| Low-risk individuals opting out | Healthy individuals forego insurance because premiums are too high relative to their expected medical costs. | Causes a risk pool imbalance, driving up costs and reducing market efficiency. |

| Insurers unable to perfectly assess risk | Insurance companies cannot fully differentiate between high and low-risk applicants due to asymmetric information. | Results in uniform pricing that may not reflect individual risks, encouraging adverse selection. |

| Pre-existing conditions undisclosed | Applicants might hide health conditions to avoid higher premiums or denial of coverage. | Increases insurer losses and premiums, potentially leading to market failure. |

Understanding Adverse Selection in Health Insurance

Adverse selection in health insurance occurs when individuals with higher health risks are more likely to purchase comprehensive coverage, while healthier individuals opt out or choose minimal plans, leading to an imbalanced risk pool. This phenomenon increases the insurer's costs, resulting in higher premiums for all policyholders and potential market failure. Effective strategies to mitigate adverse selection include mandatory enrollment and risk-adjusted premiums based on individual health indicators.

Key Causes of Adverse Selection in Health Plans

Adverse selection in health insurance arises primarily from asymmetric information, where individuals possess more knowledge about their health risks than insurers, leading high-risk individuals to purchase more comprehensive coverage. Key causes include the inability of insurers to accurately assess individual health status, the presence of pre-existing conditions, and the lack of mandatory enrollment policies. These factors result in a risk pool skewed towards higher-cost enrollees, driving up premiums and potentially causing market inefficiencies.

Real-World Examples of Adverse Selection Scenarios

Adverse selection in health insurance is exemplified when individuals with pre-existing medical conditions disproportionately seek comprehensive coverage, leading insurers to face higher-than-expected claims costs. For instance, the Affordable Care Act marketplaces experienced adverse selection as sicker individuals disproportionately enrolled, driving up premiums. Insurers mitigate these risks through mechanisms such as risk adjustment and mandatory coverage to balance the pool of insured individuals.

How High-Risk Individuals Impact Insurance Pools

High-risk individuals tend to purchase more comprehensive health insurance plans, driving up average costs within insurance pools. This adverse selection results in insurers raising premiums to cover increased claims, potentially pricing out low-risk individuals. Consequently, the insurance market becomes unstable, with a higher concentration of high-cost policyholders leading to inefficient risk distribution.

The Role of Information Asymmetry in Adverse Selection

Adverse selection in health insurance arises when individuals with higher health risks are more likely to purchase comprehensive coverage, exploiting the insurer's lack of precise information about their true health status. This information asymmetry leads insurers to set higher premiums to offset potential losses, which can drive healthier individuals out of the market, worsening the risk pool. The resulting market inefficiency highlights the critical role of accurate health data and risk assessment in mitigating adverse selection and stabilizing insurance markets.

Consequences of Adverse Selection for Insurers and Policyholders

Adverse selection in health insurance occurs when individuals with higher health risks are more likely to purchase comprehensive coverage, leading insurers to face increased claim costs and reduced profitability. Insurers may respond by raising premiums, which further discourages healthy individuals from buying insurance, exacerbating the risk pool imbalance. Policyholders experience limited coverage options and higher prices, reducing overall market efficiency and access to affordable healthcare.

Case Studies: Adverse Selection in Private vs. Public Health Insurance

Private health insurance markets often experience adverse selection because individuals with higher health risks are more likely to purchase comprehensive plans, leading to increased premiums and market inefficiencies. Public health insurance programs mitigate adverse selection by mandating universal coverage, spreading risk across a broader population and stabilizing costs. Case studies show that in countries with mixed systems, private insurers face challenges in risk classification, while public insurers maintain pool balance through inclusive enrollment policies.

Strategies Insurers Use to Mitigate Adverse Selection

Health insurers use medical underwriting, which involves evaluating applicants' health status to adjust premiums accordingly, reducing the risk of adverse selection. Implementing waiting periods and pre-existing condition exclusions helps discourage high-risk individuals from signing up solely when they need immediate care. Community rating and mandatory participation in group insurance pools ensure risk is spread across a larger, more diverse population, further mitigating adverse selection effects.

Regulatory Responses to Adverse Selection in Healthcare

Regulatory responses to adverse selection in healthcare include the implementation of individual mandates requiring all individuals to obtain health insurance, thereby balancing risk pools and preventing market imbalances. Risk adjustment mechanisms transfer funds from insurers with lower-risk enrollees to those with higher-risk enrollees, mitigating incentives for selective underwriting. Community rating regulations restrict premiums based on demographic factors, promoting equitable access and reducing the likelihood of adverse selection by discouraging insurers from targeting only healthy individuals.

Future Trends: Addressing Adverse Selection in Digital Health Insurance

Emerging digital health insurance platforms utilize advanced algorithms and real-time health data to mitigate adverse selection by accurately pricing risk and tailoring coverage. Machine learning models analyze user behavior and health records to identify high-risk individuals early, enabling proactive interventions and premium adjustments. Blockchain technology enhances transparency and data integrity, fostering trust and reducing information asymmetry between insurers and policyholders.

example of adverse selection in health insurance Infographic

samplerz.com

samplerz.com