Hot money in capital flow refers to short-term investments that rapidly move across borders to capitalize on higher interest rates or expected currency fluctuations. A typical example is speculative funds flowing into emerging markets like India or Brazil during periods of high returns, only to exit quickly when economic conditions shift. These inflows can boost stock markets and currency values temporarily but pose risks of sudden capital flight. Another example of hot money involves hedge funds shifting assets between major financial centers such as New York, London, and Hong Kong. These moves often chase interest rate differentials or arbitrage opportunities in bond and currency markets. The rapid inflow and outflow challenge monetary authorities to maintain financial stability and can lead to volatile exchange rates.

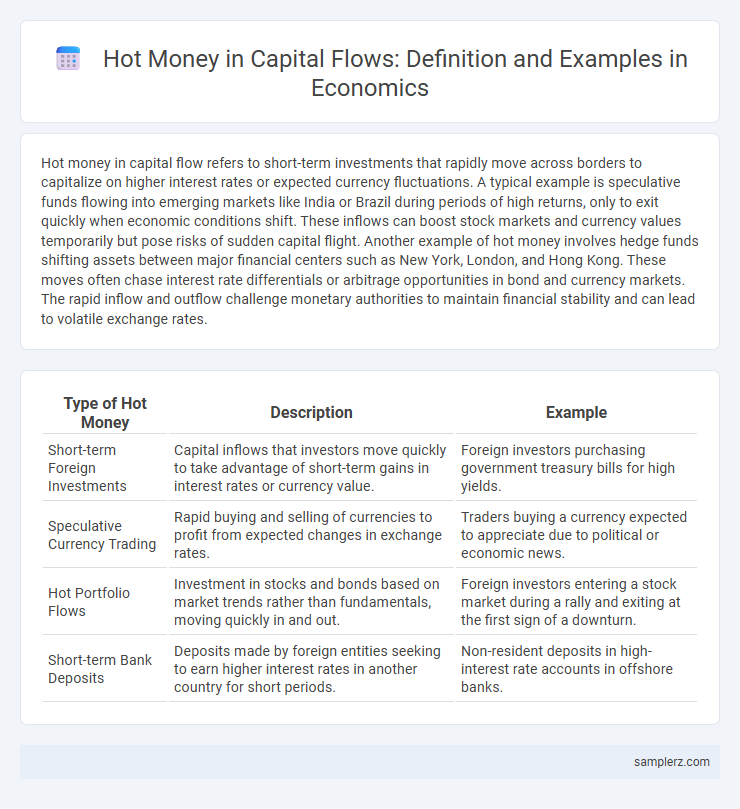

Table of Comparison

| Type of Hot Money | Description | Example |

|---|---|---|

| Short-term Foreign Investments | Capital inflows that investors move quickly to take advantage of short-term gains in interest rates or currency value. | Foreign investors purchasing government treasury bills for high yields. |

| Speculative Currency Trading | Rapid buying and selling of currencies to profit from expected changes in exchange rates. | Traders buying a currency expected to appreciate due to political or economic news. |

| Hot Portfolio Flows | Investment in stocks and bonds based on market trends rather than fundamentals, moving quickly in and out. | Foreign investors entering a stock market during a rally and exiting at the first sign of a downturn. |

| Short-term Bank Deposits | Deposits made by foreign entities seeking to earn higher interest rates in another country for short periods. | Non-resident deposits in high-interest rate accounts in offshore banks. |

What Is Hot Money?

Hot money refers to short-term capital that moves quickly between financial markets seeking the highest short-term returns, often influenced by changes in interest rates or economic outlooks. Examples include speculative investments in foreign exchange markets or sudden inflows into emerging market stocks and bonds during periods of economic optimism. This rapid movement of hot money can cause volatility in capital flows, impacting exchange rates and financial stability in recipient countries.

Characteristics of Hot Money in Capital Flows

Hot money in capital flows is characterized by its short-term nature, rapid movement, and sensitivity to interest rate differentials and economic stability. It often seeks quick profits through speculative investments in assets like stocks, bonds, and currencies, causing volatility in financial markets. This type of capital flow can lead to sudden inflows and outflows that disrupt domestic economies and exchange rates.

Historical Examples of Hot Money Movements

During the 1997 Asian Financial Crisis, rapid inflows and sudden withdrawals of hot money severely destabilized economies like Thailand and Indonesia, causing sharp currency devaluations and stock market crashes. In the early 2000s, Brazil experienced significant volatility as hot money inflows fueled short-term capital gains, followed by abrupt outflows that pressured the exchange rate and capital markets. The 2013 "Taper Tantrum" saw emerging markets such as India and South Africa suffer from sudden reversals in hot money flows after the U.S. Federal Reserve hinted at scaling back quantitative easing.

Hot Money and Emerging Market Volatility

Hot money refers to the rapid inflow and outflow of short-term capital seeking high returns in emerging markets, often causing significant exchange rate fluctuations and stock market volatility. These sudden capital movements can lead to unstable financial conditions, as emerging economies may struggle to manage large swings in liquidity and interest rates. Policymakers in affected countries frequently implement capital controls or monetary interventions to stabilize markets and reduce the disruptive impact of hot money flows.

Causes of Hot Money Inflows and Outflows

Hot money inflows occur when investors rapidly move capital into countries offering higher interest rates or promising asset returns, driven by factors such as monetary policy disparities and political stability. Conversely, hot money outflows are triggered by economic uncertainty, sudden shifts in exchange rates, or tightening monetary policies that prompt investors to withdraw funds quickly. These volatile capital flows significantly impact exchange rates, domestic financial markets, and overall economic stability.

Impact of Hot Money on Currency Stability

Hot money inflows can lead to excessive currency appreciation, creating volatility in exchange rates and undermining currency stability. Rapid outflows of speculative capital often trigger sharp depreciation, forcing central banks to intervene and use foreign reserves to stabilize the currency. This erratic capital movement disrupts monetary policy effectiveness and increases the risk of financial crises in emerging economies.

Regulatory Responses to Hot Money

Regulatory responses to hot money flows often include tightening capital controls, such as imposing taxes on short-term capital inflows or instituting minimum holding periods for foreign investments. Central banks may also intervene by adjusting interest rates or using macroprudential measures to stabilize currency volatility driven by speculative capital. Some countries enhance transparency requirements and improve cross-border capital flow monitoring to prevent rapid inflows and sudden reversals that destabilize financial markets.

Real-World Case Studies: Hot Money in Asia

Hot money flows surged in Asia during the 1997 Asian Financial Crisis, where rapid capital inflow and outflow destabilized markets in Thailand, South Korea, and Indonesia. South Korea experienced a massive withdrawal of short-term foreign investments, contributing to the collapse of the won and requiring an IMF bailout. Thailand's capital flight triggered a devaluation of the baht, highlighting the volatility caused by speculative hot money movements in emerging Asian economies.

Risks Associated with Hot Money Capital Flows

Hot money capital flows, often characterized by rapid and speculative movements of funds, can lead to significant economic volatility and financial instability in emerging markets. These short-term inflows can cause excessive currency appreciation, asset bubbles, and sudden reversals that disrupt domestic investment and economic growth. Governments face challenges in managing monetary policy and maintaining financial stability due to the unpredictable nature of hot money volatility.

Policy Measures to Manage Hot Money Movements

Policy measures to manage hot money movements include capital controls such as transaction taxes on short-term inflows and limits on foreign exchange trading volumes to reduce volatility. Central banks often adjust interest rates or impose reserve requirements on foreign currency deposits to discourage speculative flows. Implementing macroprudential regulations and enhancing financial market transparency also help stabilize capital flows and mitigate the risks posed by volatile hot money.

example of hot money in capital flow Infographic

samplerz.com

samplerz.com