Moral hazard in the economy occurs when individuals or institutions take excessive risks because they do not bear the full consequences of their actions. A prime example is the 2008 financial crisis, where banks engaged in risky lending practices, knowing they would be bailed out by the government if those risks led to failure. This behavior distorted investment incentives and contributed to widespread economic instability. Insurance markets also exhibit moral hazard, particularly in health insurance. When people have comprehensive coverage, they may consume more medical services than necessary, increasing overall costs for insurers. This phenomenon challenges policymakers to design insurance contracts that balance coverage with incentives for responsible behavior.

Table of Comparison

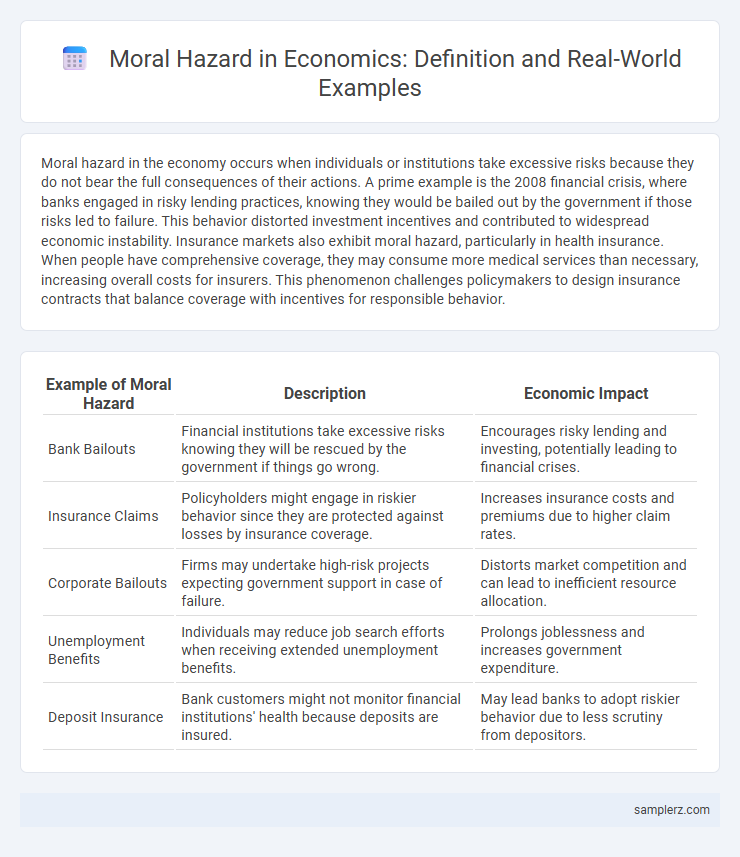

| Example of Moral Hazard | Description | Economic Impact |

|---|---|---|

| Bank Bailouts | Financial institutions take excessive risks knowing they will be rescued by the government if things go wrong. | Encourages risky lending and investing, potentially leading to financial crises. |

| Insurance Claims | Policyholders might engage in riskier behavior since they are protected against losses by insurance coverage. | Increases insurance costs and premiums due to higher claim rates. |

| Corporate Bailouts | Firms may undertake high-risk projects expecting government support in case of failure. | Distorts market competition and can lead to inefficient resource allocation. |

| Unemployment Benefits | Individuals may reduce job search efforts when receiving extended unemployment benefits. | Prolongs joblessness and increases government expenditure. |

| Deposit Insurance | Bank customers might not monitor financial institutions' health because deposits are insured. | May lead banks to adopt riskier behavior due to less scrutiny from depositors. |

Defining Moral Hazard in Economic Contexts

Moral hazard in economic contexts occurs when individuals or institutions engage in risky behavior because they do not bear the full consequences of their actions, often due to asymmetric information or protective measures like insurance or bailouts. A common example is banks taking excessive risks in lending or investments, knowing that government bailouts may cover potential losses. This misalignment of incentives can lead to inefficient market outcomes and increased systemic risk.

Banking Sector: Bailouts and Risky Behavior

In the banking sector, moral hazard arises when financial institutions engage in risky behavior, knowing they might receive government bailouts during crises, which distorts market discipline. The expectation of being rescued reduces incentives for prudent risk management, leading to excessive leverage and systemic vulnerabilities. Historical bailouts, such as those in the 2008 financial crisis, exemplify how safety nets can inadvertently encourage reckless banking practices.

Insurance Industry: Policyholders and Overconsumption

In the insurance industry, moral hazard arises when policyholders engage in riskier behavior or overconsume resources because they are protected from the full financial consequences of their actions. For example, individuals with comprehensive health insurance may overuse medical services, leading to higher overall healthcare costs and inefficiencies in the system. This behavior distorts market incentives, increasing premiums and creating challenges for insurers managing risk and sustainability.

Corporate Governance: Executive Bonuses and Risk

Executive bonuses tied to short-term financial targets can create moral hazard by encouraging excessive risk-taking that jeopardizes long-term company stability. This misalignment between executive incentives and shareholder interests often results in decisions that prioritize immediate profits over sustainable growth. Effective corporate governance frameworks implement balanced compensation structures to mitigate such risks and align management behavior with long-term economic value.

Healthcare: Overutilization Due to Third-Party Payers

In healthcare economics, moral hazard arises when third-party payers, such as insurance companies, cover medical costs, leading patients to overutilize healthcare services beyond necessary levels. This behavior inflates healthcare expenditure and strains resources by reducing the direct cost sensitivity of patients. Studies show that insured individuals tend to visit doctors and opt for more treatments, driving up overall system costs and impacting economic efficiency.

Labor Markets: Unemployment Benefits and Job Search Incentives

Unemployment benefits can create a moral hazard in labor markets by reducing job search incentives, as recipients may delay re-employment due to temporary financial support. Studies show that extended benefit durations correlate with longer unemployment spells, highlighting decreased motivation for active job seeking. Policymakers must balance adequate income support with mechanisms that encourage timely labor market re-entry to mitigate adverse moral hazard effects.

Real Estate: Subprime Mortgages and Lending Practices

Subprime mortgages illustrate moral hazard in real estate by encouraging lenders to issue high-risk loans with little regard for borrowers' ability to repay, knowing they can sell these loans to investors. The 2008 financial crisis highlighted how inflated lending practices led to widespread defaults and a collapse in housing prices. This behavior distorted the market by incentivizing short-term profits over long-term financial stability.

Government Guarantees and Private Sector Risk

Government guarantees, such as deposit insurance or bailouts, create moral hazard by encouraging private sector risk-taking beyond prudent levels, as firms anticipate public support during crises. Financial institutions may engage in risky lending or investment practices, expecting that government interventions will shield them from losses. This distortion undermines market discipline and can lead to systemic vulnerabilities within the economy.

International Aid: Donor Support and Fiscal Discipline

International aid can create moral hazard by reducing recipient governments' incentives to maintain fiscal discipline, as reliance on donor support may encourage excessive public spending. Donor funds often lead to budget deficits being masked, weakening efforts for sustainable economic policies. This dynamic undermines long-term economic stability by promoting dependency rather than accountability in fiscal management.

Moral Hazard in Environmental Policy and Climate Agreements

Moral hazard in environmental policy arises when countries or corporations engage in riskier environmental behavior, assuming that international climate agreements or government interventions will mitigate the consequences. For example, firms might increase pollution, expecting that future regulations or subsidies will cover cleanup costs, undermining the effectiveness of climate commitments like the Paris Agreement. This dynamic complicates enforcement and incentivizes stronger monitoring and transparent accountability mechanisms in global environmental governance.

example of moral hazard in economy Infographic

samplerz.com

samplerz.com