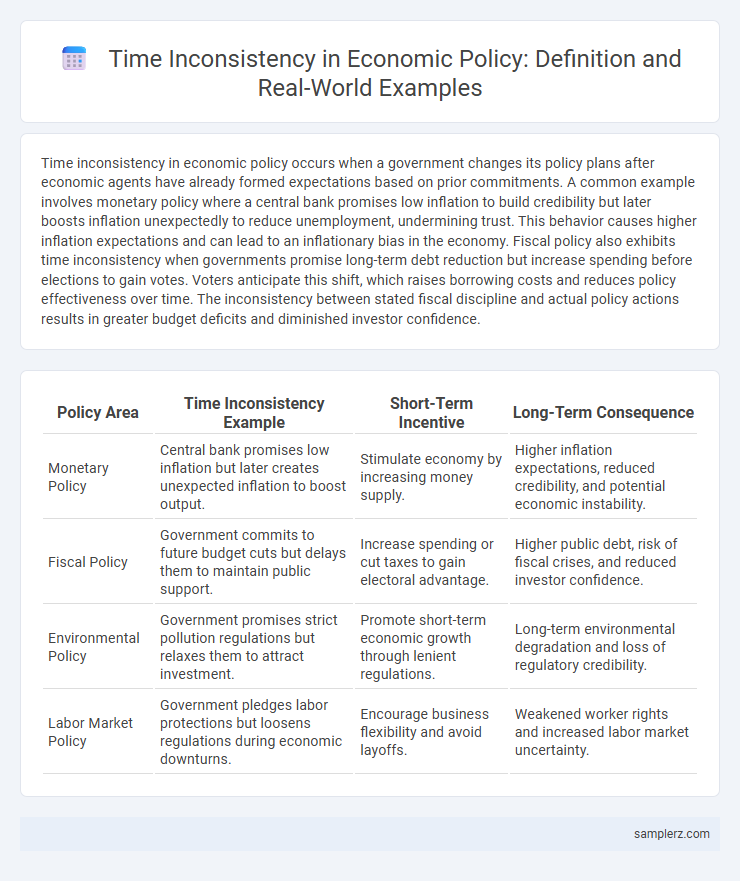

Time inconsistency in economic policy occurs when a government changes its policy plans after economic agents have already formed expectations based on prior commitments. A common example involves monetary policy where a central bank promises low inflation to build credibility but later boosts inflation unexpectedly to reduce unemployment, undermining trust. This behavior causes higher inflation expectations and can lead to an inflationary bias in the economy. Fiscal policy also exhibits time inconsistency when governments promise long-term debt reduction but increase spending before elections to gain votes. Voters anticipate this shift, which raises borrowing costs and reduces policy effectiveness over time. The inconsistency between stated fiscal discipline and actual policy actions results in greater budget deficits and diminished investor confidence.

Table of Comparison

| Policy Area | Time Inconsistency Example | Short-Term Incentive | Long-Term Consequence |

|---|---|---|---|

| Monetary Policy | Central bank promises low inflation but later creates unexpected inflation to boost output. | Stimulate economy by increasing money supply. | Higher inflation expectations, reduced credibility, and potential economic instability. |

| Fiscal Policy | Government commits to future budget cuts but delays them to maintain public support. | Increase spending or cut taxes to gain electoral advantage. | Higher public debt, risk of fiscal crises, and reduced investor confidence. |

| Environmental Policy | Government promises strict pollution regulations but relaxes them to attract investment. | Promote short-term economic growth through lenient regulations. | Long-term environmental degradation and loss of regulatory credibility. |

| Labor Market Policy | Government pledges labor protections but loosens regulations during economic downturns. | Encourage business flexibility and avoid layoffs. | Weakened worker rights and increased labor market uncertainty. |

Real-World Cases of Time Inconsistency in Economic Policy

Central banks frequently face time inconsistency, exemplified by the 1970s U.S. Federal Reserve's initial commitment to low inflation followed by later expansionary policies that spiked inflation. Brazil's economic policy during the 1980s also illustrates time inconsistency, with the government repeatedly abandoning anti-inflation measures to pursue short-term growth. These cases highlight how policymakers' incentives to deviate from announced plans create challenges for stabilizing expectations and achieving long-term economic goals.

Illustrative Examples: Time Inconsistency in Monetary Policy

Central banks often face time inconsistency in monetary policy when they promise low inflation to anchor expectations but later pursue unexpected inflation to boost short-term output, leading to credibility loss. For instance, the 1970s stagflation in the United States demonstrated how discretionary policies intended to reduce unemployment resulted in higher inflation without long-term growth benefits. This dynamic underscores the importance of rules-based policies or independent institutions to maintain credible commitments and stabilize inflation expectations effectively.

Fiscal Policy Decisions Undermined by Time Inconsistency

Fiscal policy decisions often suffer from time inconsistency when governments promise future budget discipline but later increase spending or cut taxes to boost short-term growth, undermining long-term economic stability. This behavior erodes credibility, leading investors to doubt fiscal commitments and demand higher risk premiums on government debt. Such inconsistency can cause inflationary pressures and reduce the effectiveness of stabilization policies, exacerbating economic volatility.

Time Inconsistency and Central Bank Commitment Issues

Time inconsistency in economic policy arises when central banks deviate from previously announced strategies, undermining their credibility and causing inflation expectations to rise. This lack of commitment often leads to higher inflation without output gains, as private agents anticipate policy reversal and adjust behavior accordingly. Effective central bank commitment mechanisms, such as inflation targeting and institutional independence, are critical to mitigate time inconsistency problems and stabilize long-term economic expectations.

Budget Deficits: When Promises Clash with Political Realities

Budget deficits exemplify time inconsistency in economic policy when governments pledge fiscal discipline during election campaigns but subsequently increase spending or cut taxes, undermining those promises. This divergence arises because short-term political incentives encourage expansionary policies, while long-term fiscal sustainability demands restraint. As a result, policymakers face credibility challenges, leading to higher borrowing costs and reduced trust from investors.

Exchange Rate Policies and the Pitfalls of Time Inconsistency

Exchange rate policies often suffer from time inconsistency when central banks deviate from previously announced interventions to stabilize currency values, undermining credibility and triggering market volatility. For example, a government may promise to maintain a fixed exchange rate but later abandon it to pursue short-term economic gains, causing sudden capital flight and inflation. Such policy reversals erode investor trust and complicate long-term economic planning, highlighting the critical challenge of maintaining commitment in exchange rate management.

Pension Reforms Delayed: A Case of Policy Time Inconsistency

Delayed pension reforms exemplify policy time inconsistency by showcasing governments' preference for short-term political gains over long-term fiscal sustainability. This leads to procrastination in adjusting retirement ages or contribution rates, causing mounting public debt and pension system imbalances. Consequently, deferred reforms result in higher future costs and reduced pension adequacy, undermining economic stability and intergenerational equity.

Environmental Regulation and Shifting Policy Commitments

Environmental regulation often faces time inconsistency when governments initially commit to stringent pollution controls but later relax standards to promote short-term economic growth. This shifting policy undermines long-term investment in green technologies and weakens regulatory credibility in addressing climate change. Such policy volatility creates uncertainty for businesses, delaying sustainable innovation and environmental progress.

Taxation Promises: Rhetoric Versus Time-Inconsistent Actions

Time inconsistency in economic policy is exemplified by taxation promises where governments initially pledge low tax rates to gain public support but later impose higher taxes once in power, undermining credibility and trust. This behavior distorts expectations, leading individuals and businesses to anticipate policy reversals, which can reduce investment and economic growth. Empirical studies demonstrate that such time-inconsistent taxation erodes long-term fiscal discipline and impairs optimal resource allocation in the economy.

Policy Failures Driven by Time Inconsistency in Economic Planning

Time inconsistency in economic policy often leads to credibility problems, where initial commitments to low inflation targets are abandoned to spur short-term growth, resulting in higher inflation expectations and economic instability. Central banks may face pressure to deviate from optimal policies, causing fluctuating interest rates and investment uncertainty. Such policy failures highlight the necessity of designing institutions that can credibly commit to long-term economic goals.

example of time inconsistency in policy Infographic

samplerz.com

samplerz.com