Crowding out in the bond market occurs when increased government borrowing leads to higher interest rates, reducing private sector investment. When a government issues a large volume of bonds to finance its deficit, it competes with the private sector for available funds. This competition drives up bond yields, making it more expensive for businesses to raise capital through debt. The effect of crowding out can slow economic growth by limiting the resources available for private investment projects. Investors may prefer government bonds due to their perceived safety, further reducing the demand for corporate bonds. Data from periods of high government borrowing often show a rise in long-term interest rates, illustrating the crowding out phenomenon in bond markets.

Table of Comparison

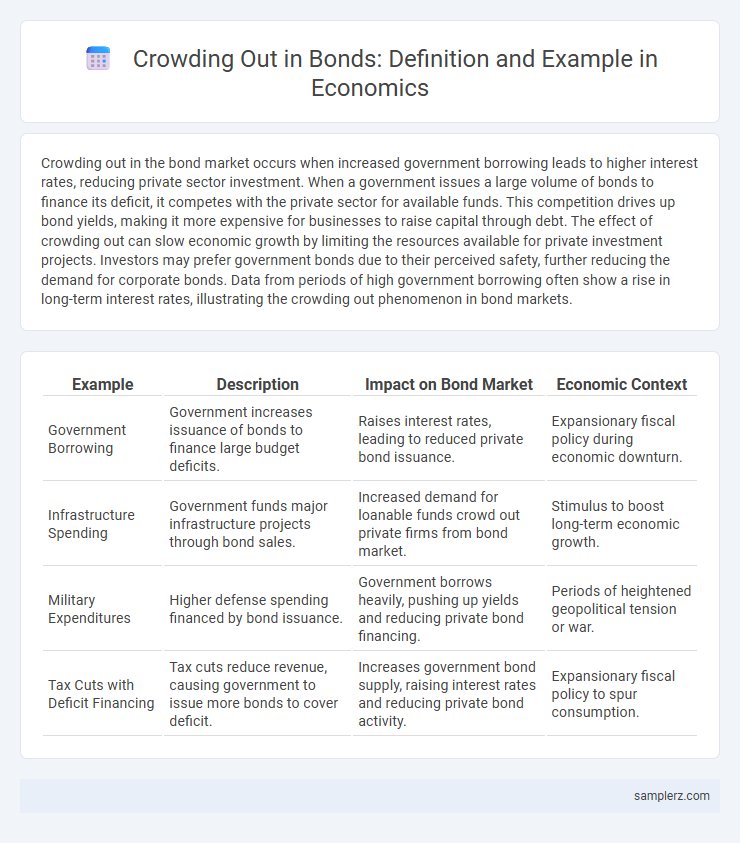

| Example | Description | Impact on Bond Market | Economic Context |

|---|---|---|---|

| Government Borrowing | Government increases issuance of bonds to finance large budget deficits. | Raises interest rates, leading to reduced private bond issuance. | Expansionary fiscal policy during economic downturn. |

| Infrastructure Spending | Government funds major infrastructure projects through bond sales. | Increased demand for loanable funds crowd out private firms from bond market. | Stimulus to boost long-term economic growth. |

| Military Expenditures | Higher defense spending financed by bond issuance. | Government borrows heavily, pushing up yields and reducing private bond financing. | Periods of heightened geopolitical tension or war. |

| Tax Cuts with Deficit Financing | Tax cuts reduce revenue, causing government to issue more bonds to cover deficit. | Increases government bond supply, raising interest rates and reducing private bond activity. | Expansionary fiscal policy to spur consumption. |

Understanding Crowding Out in the Bond Market

Crowding out in the bond market occurs when increased government borrowing leads to higher interest rates, making it more expensive for private companies to raise funds through bonds. As the government issues more bonds to finance its deficit, investors prefer these safer government securities, reducing the demand for corporate bonds. This shift results in limited capital availability for private investments, slowing economic growth due to reduced business expansion.

Classic Cases of Crowding Out and Government Bonds

Classic cases of crowding out in government bonds occur when increased public sector borrowing drives up interest rates, causing private investment to decline. For example, during the 1980s in the United States, large federal deficits led to substantial Treasury bond issuance, pushing yields higher and reducing corporate borrowing. This phenomenon highlights the inverse relationship between government bond supply and private sector credit availability in tight financial markets.

How Fiscal Policy Triggers Bond Crowding Out

Expansionary fiscal policy, such as increased government borrowing through bond issuance, raises demand for loanable funds, driving up interest rates. Higher interest rates make private investment more expensive, leading to reduced business borrowing and spending, illustrating the crowding out effect. This dynamic constrains private sector growth despite government efforts to stimulate the economy through fiscal stimulus.

Real-World Examples of Bond Crowding Out Effects

The U.S. Treasury's increased issuance of government bonds during the 2020 pandemic stimulus led to a surge in public debt, pushing up bond yields and crowding out private investment by raising borrowing costs for corporations. Similarly, Japan's prolonged government bond buying program has limited the room for private sector credit expansion, illustrating bond market crowding out in a low-yield environment. In emerging markets like Brazil, high government bond supply amid fiscal deficits constrained private sector access to capital, demonstrating how bond crowding out can stifle economic growth.

The Role of Interest Rates in Crowding Out through Bonds

Rising interest rates increase government bond yields, attracting investors away from private sector bonds and loans, which elevates borrowing costs for businesses. This shift reduces private investment as firms face higher expenses financing projects, illustrating the crowding out effect. Higher bond yields signal tighter credit conditions, constraining economic growth by limiting capital availability for private enterprises.

Private Investment vs. Government Bonds: Crowding Out Scenarios

Government issuance of bonds often leads to higher interest rates, making borrowing more expensive for private firms and reducing private investment. When the supply of government bonds increases, investors may prefer these safer assets over riskier private investments, diverting capital away from business funding. This shift can result in crowding out, where government borrowing directly diminishes the availability of funds for private sector growth.

Macroeconomic Impact of Bond-Induced Crowding Out

Bond-induced crowding out occurs when increased government borrowing through bond issuance raises interest rates, reducing private investment in the economy. Higher interest rates lead to a decline in capital formation by businesses, which slows economic growth and productivity improvements. This macroeconomic impact limits the effectiveness of fiscal stimulus and can exacerbate budget deficits over time.

Emerging Market Experiences with Bond Crowding Out

Emerging markets often face bond crowding out when government borrowing spikes, leading to higher interest rates that deter private investment. For instance, Brazil's surge in sovereign bond issuance during fiscal deficits raised yields, squeezing corporate bond markets and limiting private sector financing. This dynamic slows economic growth as constrained private investment struggles to match public sector demand for capital.

Lessons from Historical Bond Crowding Out Episodes

Historical bond crowding out episodes demonstrate how excessive government borrowing can elevate interest rates, reducing private sector investment. For instance, the 1980s U.S. experience saw large Treasury issuance push up yields, constraining corporate borrowing and slowing economic growth. These lessons highlight the trade-off between fiscal stimulus and private capital availability during periods of heavy bond financing.

Policy Solutions to Manage Crowding Out in the Bond Sector

Policy solutions to manage crowding out in the bond sector include implementing targeted fiscal reforms that reduce excessive government borrowing and enhance market confidence. Central banks can adopt monetary measures such as adjusting interest rates to balance bond demand and supply efficiently. Encouraging private investment through tax incentives and regulatory easing also helps mitigate the negative impact of crowding out on the bond market.

example of crowding out in bond Infographic

samplerz.com

samplerz.com