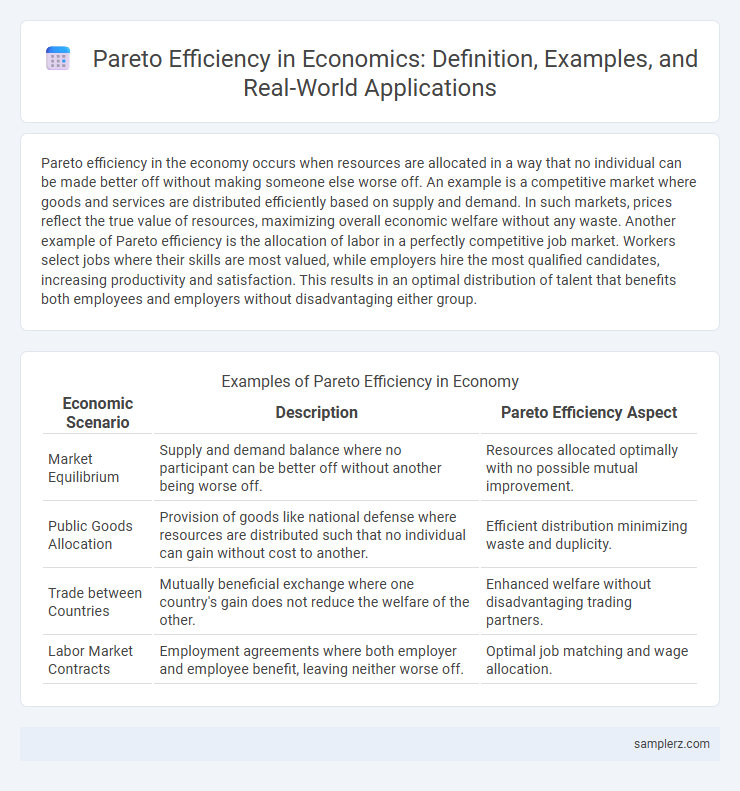

Pareto efficiency in the economy occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off. An example is a competitive market where goods and services are distributed efficiently based on supply and demand. In such markets, prices reflect the true value of resources, maximizing overall economic welfare without any waste. Another example of Pareto efficiency is the allocation of labor in a perfectly competitive job market. Workers select jobs where their skills are most valued, while employers hire the most qualified candidates, increasing productivity and satisfaction. This results in an optimal distribution of talent that benefits both employees and employers without disadvantaging either group.

Table of Comparison

| Economic Scenario | Description | Pareto Efficiency Aspect |

|---|---|---|

| Market Equilibrium | Supply and demand balance where no participant can be better off without another being worse off. | Resources allocated optimally with no possible mutual improvement. |

| Public Goods Allocation | Provision of goods like national defense where resources are distributed such that no individual can gain without cost to another. | Efficient distribution minimizing waste and duplicity. |

| Trade between Countries | Mutually beneficial exchange where one country's gain does not reduce the welfare of the other. | Enhanced welfare without disadvantaging trading partners. |

| Labor Market Contracts | Employment agreements where both employer and employee benefit, leaving neither worse off. | Optimal job matching and wage allocation. |

Real-World Applications of Pareto Efficiency in Modern Economies

Pareto efficiency in modern economies is exemplified by competitive markets where resources are allocated such that no individual can be made better off without making another worse off, as seen in efficient labor markets and consumer goods distribution. Public goods provision, like national defense and clean air regulation, also reflects Pareto optimality by balancing social benefits without diminishing others' welfare. Furthermore, international trade agreements aim for Pareto improvements by creating scenarios where participating countries gain economic benefits without losses to others.

Pareto Efficiency in Market Exchange: Case Studies

Market exchange often achieves Pareto efficiency when resources are allocated so that no participant can be made better off without making another worse off, as seen in perfectly competitive markets where price signals coordinate supply and demand. Case studies in agricultural markets demonstrate how decentralized trade among farmers and buyers leads to efficient distribution of produce, maximizing total welfare without disadvantaging any party. Similarly, financial markets exemplify Pareto efficiency through the optimal allocation of capital, enabling investors and firms to mutually benefit without reducing the gains of others.

Resource Allocation: Achieving Pareto Optimality in Goods Distribution

In economic resource allocation, Pareto efficiency is achieved when goods distribution cannot be adjusted to make one individual better off without making another worse off, exemplifying optimal utilization of resources. Market equilibrium in competitive markets often reflects Pareto optimality, as supply and demand balance ensures efficient allocation of goods. Policy interventions targeting externalities or public goods aim to move allocations closer to Pareto efficiency by correcting market failures.

Public Goods and Pareto Efficiency: Economic Examples

Public goods like national defense and clean air illustrate Pareto efficiency in economics, as their consumption by one individual does not reduce availability for others, maximizing societal welfare without detriment. Efficient allocation occurs when resources are distributed so that no individual can be made better off without making someone else worse off, exemplified by government provision of public goods funded through taxation. This allocation ensures optimal social desirability and resource utilization, reflecting Pareto improvement in economic planning and policy design.

The Role of Government Policies in Promoting Pareto Efficiency

Government policies that reduce market externalities, such as pollution taxes or subsidies for clean energy, play a crucial role in promoting Pareto efficiency by aligning private costs with social costs. Regulatory measures that ensure fair competition and prevent monopolies help allocate resources more effectively, enhancing overall economic welfare. Public investments in education and infrastructure create conditions where all individuals can benefit without making others worse off, supporting Pareto improvements throughout the economy.

Market Failures and Pareto Inefficiency: Key Economic Illustrations

Market failures such as externalities and public goods often illustrate Pareto inefficiency, where resource allocation leads to welfare losses and no individual can be made better off without making someone else worse off. For instance, pollution represents a negative externality causing Pareto inefficiency as firms do not account for environmental damage in production costs, leading to overproduction. Similarly, public goods like national defense are undersupplied in free markets, reflecting Pareto inefficiency due to non-excludability and non-rivalrous consumption.

Pareto Efficiency in International Trade Agreements

Pareto efficiency in international trade agreements occurs when resources are allocated in a way that benefits at least one participating country without making any other country worse off. Trade agreements like NAFTA and the European Union's Single Market exemplify Pareto improvements by reducing tariffs and barriers, enhancing overall economic welfare among member nations. Such agreements optimize comparative advantages, leading to increased consumer choice, lower prices, and higher productivity across the involved economies.

Welfare Economics: Measuring Pareto Optimal Outcomes

Pareto efficiency in welfare economics measures outcomes where no individual can be made better off without making someone else worse off, exemplified by resource allocations in competitive markets. An example includes the allocation of public goods where benefits are maximized without incurring unnecessary costs to others. This concept guides policy decisions aimed at improving social welfare through efficient distribution of resources.

Practical Challenges in Achieving Pareto Efficiency

In real-world economies, achieving Pareto efficiency faces practical challenges such as information asymmetry, where parties lack complete knowledge about preferences and resource availability. Transaction costs and externalities further complicate optimal allocation by causing market failures and inefficiencies. These obstacles hinder reaching a state where no individual can be made better off without making someone else worse off.

Case Examples of Pareto Improvement in Economic Policy

Implementing targeted tax reforms that increase government revenue without reducing overall consumer or producer welfare exemplifies Pareto improvement in economic policy. Trade liberalization agreements that expand market access for domestic producers while lowering prices for consumers demonstrate practical gains without making any party worse off. Public infrastructure investments that enhance productivity and economic output, benefiting multiple sectors simultaneously, serve as clear cases of Pareto efficiency in practice.

example of Pareto efficiency in economy Infographic

samplerz.com

samplerz.com