In an oligopoly market structure, the Nash equilibrium occurs when each firm chooses its optimal output or price strategy, given the decisions of its competitors. A classic example is the Cournot model, where firms simultaneously decide quantities to produce, and none can improve profits by unilaterally changing their output. Data from industries like telecommunications show that when two major firms set quantities considering the other's production, the resulting output levels stabilize at the Nash equilibrium point. Another example is the Bertrand model, where firms compete on prices rather than quantities. In markets with homogeneous products, firms set prices equal to marginal cost, resulting in no firm having an incentive to change prices independently. Empirical analysis of gasoline stations in urban areas demonstrates that price adjustments among a few dominant sellers often reflect a Nash equilibrium, maintaining stable prices despite competitive pressures.

Table of Comparison

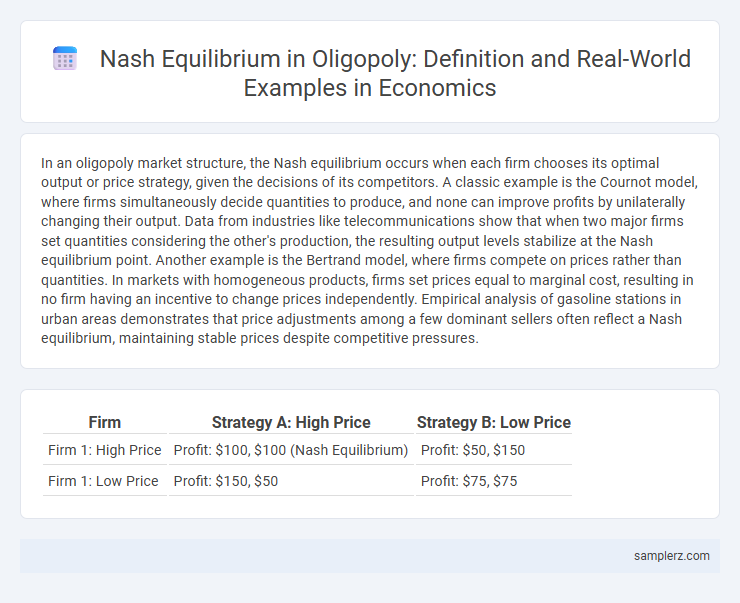

| Firm | Strategy A: High Price | Strategy B: Low Price |

|---|---|---|

| Firm 1: High Price | Profit: $100, $100 (Nash Equilibrium) | Profit: $50, $150 |

| Firm 1: Low Price | Profit: $150, $50 | Profit: $75, $75 |

Introduction to Nash Equilibrium in Oligopoly

In an oligopoly, Nash equilibrium occurs when each firm selects its optimal strategy given the strategies of its competitors, resulting in no firm benefiting from unilaterally changing its output or pricing. A classic example is the Cournot model, where firms simultaneously choose quantities, and equilibrium is reached when each firm's output decision maximizes profit based on the output levels of rival firms. This strategic interdependence underscores how firms in an oligopoly balance competitive actions and market power.

Real-World Examples of Nash Equilibrium in Oligopolistic Markets

In oligopolistic markets, the airline industry exemplifies Nash equilibrium where major carriers like American Airlines and Delta maintain stable pricing to avoid mutual losses from price wars. Similarly, in the smartphone market, Apple and Samsung often settle on pricing strategies that reflect a balance, discouraging aggressive undercutting. These patterns demonstrate firms' strategic interdependence, highlighting how equilibrium outcomes stabilize prices and outputs in oligopolies.

Classic Prisoner’s Dilemma: Oligopoly Pricing Strategies

In oligopoly markets, the Classic Prisoner's Dilemma illustrates how firms often settle on Nash equilibrium by choosing pricing strategies that deter aggressive competition, resulting in stable but suboptimal profits. Each firm independently sets prices to avoid undercutting, even though collusive pricing would yield higher collective profits, highlighting the strategic interdependence within oligopoly structures. The equilibrium outcome reflects mutual best responses, where no firm improves profits by unilaterally changing prices, despite potential gains from cooperation.

Cournot Competition: Output Decisions and Nash Equilibrium

In Cournot competition, firms simultaneously choose output quantities, assuming rivals' production levels remain fixed, leading to a Nash equilibrium where no firm can increase profit by unilaterally changing output. This equilibrium occurs because each firm's optimal production decision depends on competitors' quantities, balancing market supply and price. The resulting output levels typically produce higher prices and profits than perfect competition but lower than monopoly outcomes.

Bertrand Competition: Price Wars and Price Equilibrium

In oligopoly markets, Bertrand competition illustrates a Nash equilibrium where firms set prices simultaneously, leading to intense price wars until prices equal marginal cost. Each firm's incentive to undercut rivals prevents prices from rising above this equilibrium, ensuring zero economic profits in the long run. This model highlights how price competition drives market prices down even with few competitors.

Collusion and the Risk of Deviation in Oligopolies

In oligopolies, the Nash equilibrium often arises when firms tacitly collude to maximize joint profits by setting higher prices, yet the risk of deviation persists as individual firms have an incentive to undercut competitors for greater market share. This delicate balance is vulnerable because any unilateral deviation can trigger price wars, reducing overall profits and destabilizing the cartel-like arrangement. The strategic interdependence in oligopolistic markets highlights how the threat of punishment maintains equilibrium despite the temptation to cheat.

Case Study: Nash Equilibrium in the Airline Industry

In the airline industry, Nash equilibrium occurs when competing airlines choose ticket prices and flight frequencies where no carrier can increase profit by solely changing its strategy. For instance, major airlines often maintain stable pricing within routes despite the potential for undercutting, as aggressive price cuts lead to mutual losses. This strategic interdependence results in an equilibrium where firms balance competitive pricing with capacity decisions to maximize long-term profitability.

Example: Telecommunications Oligopoly and Market Outcomes

In a telecommunications oligopoly, firms often reach a Nash equilibrium by maintaining stable pricing to avoid destructive price wars, where each company recognizes that undercutting competitors results in lower overall profits. For instance, major telecom providers choose similar service plans and prices, anticipating rivals' reactions and thus sustaining market share without aggressive competition. This strategic interdependence leads to equilibrium outcomes characterized by modest price competition and tacit collusion, optimizing profits while limiting consumer choices.

Impacts of Nash Equilibrium on Consumer Prices in Oligopolies

In oligopolies, Nash equilibrium often results in firms setting prices above competitive levels, reducing the incentive to lower prices due to mutual interdependence. This strategic pricing leads to higher consumer prices and reduced market efficiency compared to perfect competition. As a result, consumers face limited price competition, which can diminish consumer surplus and overall economic welfare.

Policy Implications and Regulation of Oligopoly Markets

In oligopoly markets, Nash equilibrium occurs when firms choose strategies such as pricing or output levels where no firm can benefit by unilaterally changing its decision, often resulting in stable but suboptimal market outcomes. Policy implications include the need for regulatory interventions to prevent tacit collusion and promote competition, ensuring consumer welfare and market efficiency. Anti-trust laws and monitoring market concentration metrics like the Herfindahl-Hirschman Index (HHI) are essential tools used by regulators to detect and address anti-competitive Nash equilibrium behaviors.

example of Nash equilibrium in oligopoly Infographic

samplerz.com

samplerz.com