Crowding-out occurs when increased government spending leads to a reduction in private sector investment. For example, if the government borrows heavily to finance infrastructure projects, it may drive up interest rates. Higher interest rates make borrowing more expensive for businesses, causing a decline in private investments. In 2023, several countries experienced crowding-out effects due to expansive fiscal policies. The United States increased its budget deficit through large stimulus packages, resulting in higher bond yields. This rise in yields contributed to reduced corporate borrowing, demonstrating crowding-out in action.

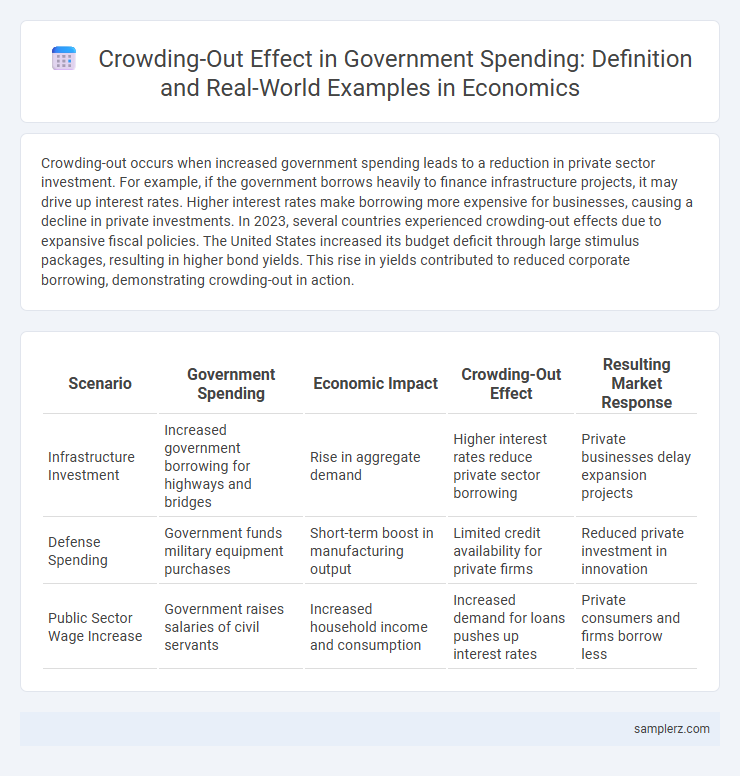

Table of Comparison

| Scenario | Government Spending | Economic Impact | Crowding-Out Effect | Resulting Market Response |

|---|---|---|---|---|

| Infrastructure Investment | Increased government borrowing for highways and bridges | Rise in aggregate demand | Higher interest rates reduce private sector borrowing | Private businesses delay expansion projects |

| Defense Spending | Government funds military equipment purchases | Short-term boost in manufacturing output | Limited credit availability for private firms | Reduced private investment in innovation |

| Public Sector Wage Increase | Government raises salaries of civil servants | Increased household income and consumption | Increased demand for loans pushes up interest rates | Private consumers and firms borrow less |

Understanding Crowding-Out in Government Spending

Crowding-out in government spending occurs when increased public sector borrowing raises interest rates, reducing private investment. For example, a government financing large infrastructure projects through bond issuance can lead to higher loan costs for businesses. This shift diverts resources from private enterprises, potentially slowing economic growth despite increased fiscal activity.

Theoretical Framework: How Crowding-Out Occurs

Crowding-out occurs when increased government spending leads to higher interest rates, which in turn reduce private investment by making borrowing more expensive. According to the classical theoretical framework, government borrowing from financial markets competes with the private sector for limited funds, decreasing the capital available for businesses. This displacement effect constrains economic growth by limiting the resources that private enterprises can access for expansion and innovation.

Historical Cases of Crowding-Out in Fiscal Policy

Historical cases of crowding-out in fiscal policy often highlight the U.S. during the 1980s when significant increases in government spending on defense led to higher interest rates, reducing private investment. Japan's experience in the 1990s also illustrates crowding-out, as extensive public works spending coincided with stagnant private sector growth and increased public debt. These examples underscore the impact of expansive fiscal deficits on capital markets and private sector activity.

Infrastructure Investment and Private Sector Displacement

Government infrastructure investment often leads to crowding-out by absorbing financial resources that the private sector would otherwise use for capital projects. When public spending increases on large-scale infrastructure, interest rates can rise, making it more expensive for private companies to borrow and invest. This displacement reduces private sector activity, potentially slowing economic growth despite the increase in government expenditure.

Military Spending Versus Private Investment: A Comparative Example

Military spending often leads to crowding-out effects by absorbing significant government resources, which could otherwise stimulate private investment. For instance, a 2022 study by the Congressional Budget Office found that every $1 billion increase in military expenditure reduces private sector investment by approximately $600 million due to higher interest rates and limited capital availability. This substitution effect highlights how large-scale defense budgets can constrain economic growth by diverting funds away from innovation-driven private enterprises.

Crowding-Out in Developing Economies

Crowding-out in developing economies occurs when increased government spending, often financed by borrowing, leads to higher interest rates that reduce private investment capacity. This phenomenon is particularly pronounced in countries with less developed financial markets, where limited credit availability forces private firms to compete with the government for funds. The resulting decline in private sector investment can hinder economic growth and innovation, compromising the overall development agenda.

The Role of Interest Rates in Amplifying Crowding-Out

Rising government spending often leads to higher interest rates as increased borrowing demands more credit from financial markets. Elevated interest rates discourage private investment by raising the cost of capital, amplifying the crowding-out effect. This dynamic reduces capital accumulation and slows economic growth, highlighting the critical role interest rates play in mediating government expenditure impacts on the private sector.

Social Welfare Programs and Their Market Impact

Government spending on social welfare programs such as unemployment benefits and public housing can lead to crowding-out by reducing private sector investment and consumption. When increased social welfare expenditures are financed through higher taxes or borrowing, disposable income for private individuals and businesses declines, suppressing demand for private goods and services. This shift can distort market signals, prompting resource allocation away from potentially more productive private investments.

Monetary Policy Interaction with Fiscal Crowding-Out

Monetary policy can influence fiscal crowding-out when government borrowing drives up interest rates, reducing private investment. Central banks may counteract this by lowering interest rates or purchasing government bonds, mitigating the crowding-out effect. Effective coordination between fiscal and monetary authorities is crucial to balance public spending without stifling private sector growth.

Lessons Learned: Mitigating Crowding-Out Effects in Future Policies

Government borrowing to finance large infrastructure projects often leads to crowding-out by increasing interest rates and reducing private investment. Lessons learned emphasize implementing targeted fiscal policies that balance public expenditure with incentives for private sector growth to minimize adverse effects. Strategic coordination between monetary and fiscal authorities further enhances effectiveness in mitigating crowding-out in future economic planning.

example of crowding-out in government spending Infographic

samplerz.com

samplerz.com