The Fisher effect describes the relationship between nominal interest rates, real interest rates, and expected inflation. For example, if the real interest rate is 3% and the expected inflation rate rises from 2% to 5%, the nominal interest rate will adjust from 5% to 8%. This adjustment ensures that lenders maintain their real returns despite changes in inflation expectations. In practical terms, a central bank may raise nominal interest rates in response to increased inflation forecasts to prevent loss of purchasing power. Businesses and consumers react to these changes, influencing borrowing costs and investment decisions. Understanding the Fisher effect helps policymakers and investors anticipate interest rate movements linked to inflation trends.

Table of Comparison

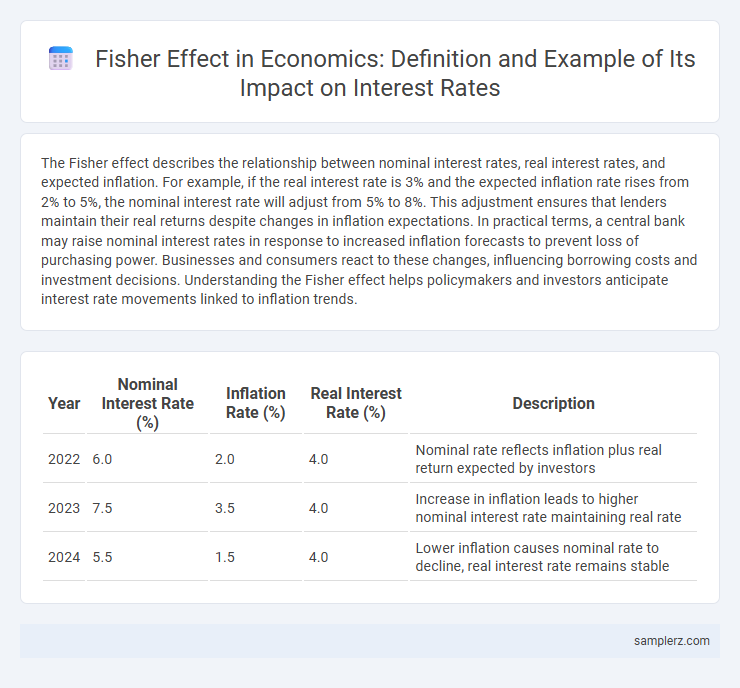

| Year | Nominal Interest Rate (%) | Inflation Rate (%) | Real Interest Rate (%) | Description |

|---|---|---|---|---|

| 2022 | 6.0 | 2.0 | 4.0 | Nominal rate reflects inflation plus real return expected by investors |

| 2023 | 7.5 | 3.5 | 4.0 | Increase in inflation leads to higher nominal interest rate maintaining real rate |

| 2024 | 5.5 | 1.5 | 4.0 | Lower inflation causes nominal rate to decline, real interest rate remains stable |

Understanding the Fisher Effect: A Brief Overview

The Fisher Effect describes the relationship between nominal interest rates, real interest rates, and expected inflation, indicating that nominal rates adjust to expected inflation to maintain a constant real return. For example, if the expected inflation rate rises from 2% to 4%, nominal interest rates typically increase by the same margin, preserving the real interest rate. This principle helps investors and policymakers anticipate how inflation influences interest rates and informs decisions on borrowing and lending.

Real-World Examples of the Fisher Effect in Interest Rates

The Fisher effect can be observed in the relationship between nominal interest rates and expected inflation in countries like the United States, where Treasury bond yields adjust to shifts in inflation expectations. For instance, during periods of rising inflation forecasts, nominal interest rates on long-term government bonds tend to increase while real interest rates remain relatively stable. This phenomenon underscores the Fisher effect's core principle that nominal interest rates reflect the sum of real interest rates and anticipated inflation.

The Fisher Effect and Inflation-Indexed Bonds

The Fisher Effect explains the relationship between nominal interest rates, real interest rates, and inflation expectations, asserting that nominal rates adjust to reflect anticipated inflation, preserving the real interest rate. Inflation-indexed bonds, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., exemplify this principle by adjusting principal and interest payments based on inflation indices, thereby protecting investors from inflation risk. These securities offer real returns that remain stable, illustrating the practical application of the Fisher Effect in monetary policy and investment strategies.

Central Banks’ Policy Responses Demonstrating the Fisher Effect

Central Banks adjust nominal interest rates in response to changes in expected inflation, exemplifying the Fisher Effect where real interest rates remain stable. For instance, the Federal Reserve raises policy rates to counter rising inflation expectations, maintaining the equilibrium in real returns. This alignment between nominal interest rate adjustments and inflation forecasts showcases the Fisher Effect in monetary policy implementation.

Historical Case: Fisher Effect During Hyperinflation

During the hyperinflation period in Zimbabwe from 2007 to 2009, nominal interest rates surged dramatically as a direct response to soaring inflation rates exceeding 79.6 billion percent in November 2008, exemplifying the Fisher effect where real interest rates remained relatively stable despite nominal rate spikes. This historical case highlights how lenders demanded significantly higher nominal returns to compensate for anticipated inflation, aligning with the Fisher hypothesis in an extreme economic environment.

Emerging Markets: The Fisher Effect in Action

Emerging markets frequently demonstrate the Fisher Effect as nominal interest rates adjust to anticipated inflation, maintaining real interest rates relatively stable despite economic volatility. For instance, countries like Brazil and India exhibit increases in nominal rates corresponding to expected inflation surges, reflecting investor expectations and central bank policies. This alignment underscores the Fisher Effect's role in guiding monetary policy and investment decisions in these dynamic economies.

Comparative Analysis: Fisher Effect in Developed vs. Developing Economies

The Fisher Effect illustrates how nominal interest rates adjust to expected inflation, differing significantly between developed and developing economies. In developed economies, stable inflation expectations lead to a more predictable alignment between nominal interest rates and inflation, while developing economies often experience volatile inflation rates that cause nominal interest rates to fluctuate unpredictably. Comparative analysis reveals that the Fisher Effect is more consistently observed in mature markets due to better monetary policy frameworks and inflation targeting mechanisms.

The Impact of Currency Devaluation on the Fisher Effect

Currency devaluation intensifies the Fisher effect by increasing nominal interest rates as inflation expectations rise. Investors demand higher nominal yields to compensate for expected purchasing power losses from currency depreciation. This dynamic amplifies the link between inflation and interest rates in economies undergoing devaluation.

Recent Interest Rate Trends and the Fisher Effect

Recent interest rate trends reflect the Fisher effect, which links nominal interest rates to expected inflation rates. Central banks have raised nominal rates in response to rising inflation expectations, maintaining real interest rates relatively stable. This dynamic illustrates how inflation forecasts directly influence the adjustment of interest rates in financial markets.

Limitations and Critiques of the Fisher Effect in Modern Economies

The Fisher effect, which posits that nominal interest rates adjust to expected inflation, faces limitations in modern economies due to factors like monetary policy interventions and market imperfections. Empirical studies reveal that real interest rates often remain sticky, contradicting the theory's prediction of full adjustment. Critics also highlight that the presence of risk premiums and inflation uncertainty distorts the straightforward relationship between nominal rates and inflation expectations.

example of Fisher effect in interest rate Infographic

samplerz.com

samplerz.com