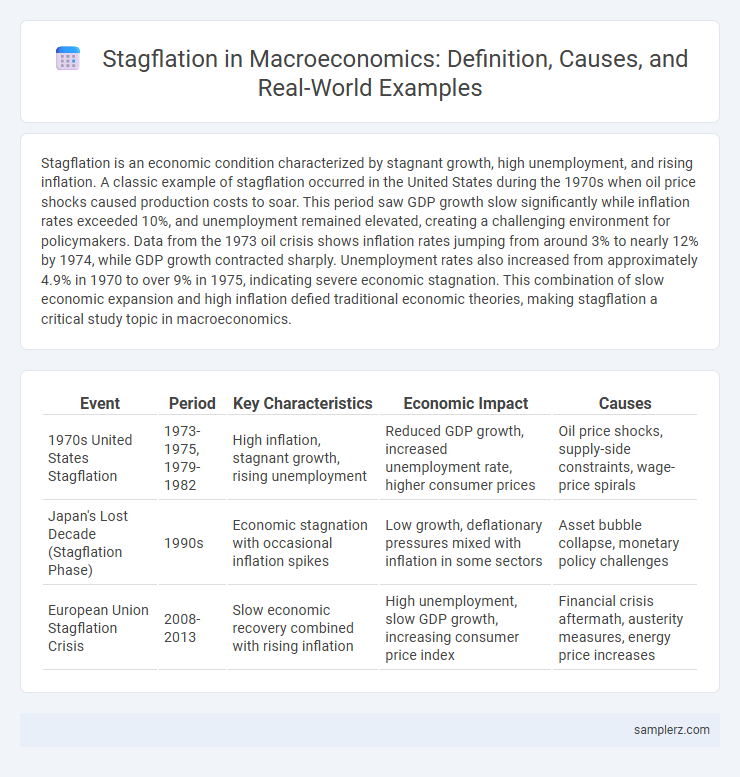

Stagflation is an economic condition characterized by stagnant growth, high unemployment, and rising inflation. A classic example of stagflation occurred in the United States during the 1970s when oil price shocks caused production costs to soar. This period saw GDP growth slow significantly while inflation rates exceeded 10%, and unemployment remained elevated, creating a challenging environment for policymakers. Data from the 1973 oil crisis shows inflation rates jumping from around 3% to nearly 12% by 1974, while GDP growth contracted sharply. Unemployment rates also increased from approximately 4.9% in 1970 to over 9% in 1975, indicating severe economic stagnation. This combination of slow economic expansion and high inflation defied traditional economic theories, making stagflation a critical study topic in macroeconomics.

Table of Comparison

| Event | Period | Key Characteristics | Economic Impact | Causes |

|---|---|---|---|---|

| 1970s United States Stagflation | 1973-1975, 1979-1982 | High inflation, stagnant growth, rising unemployment | Reduced GDP growth, increased unemployment rate, higher consumer prices | Oil price shocks, supply-side constraints, wage-price spirals |

| Japan's Lost Decade (Stagflation Phase) | 1990s | Economic stagnation with occasional inflation spikes | Low growth, deflationary pressures mixed with inflation in some sectors | Asset bubble collapse, monetary policy challenges |

| European Union Stagflation Crisis | 2008-2013 | Slow economic recovery combined with rising inflation | High unemployment, slow GDP growth, increasing consumer price index | Financial crisis aftermath, austerity measures, energy price increases |

Understanding Stagdeflation: Definition and Core Concepts

Stagflation is an economic condition characterized by stagnant growth, high unemployment, and rising inflation occurring simultaneously, defying traditional economic theories that typically associate inflation with economic expansion. This phenomenon challenges policymakers because measures to curb inflation, such as raising interest rates, can exacerbate unemployment and slow growth further. Key examples of stagflation include the 1970s U.S. economy, where oil price shocks and supply constraints led to prolonged inflation combined with economic stagnation and joblessness.

Historical Overview: Instances of Stagdeflation Globally

The 1970s global economy exemplified stagflation, characterized by stagnant growth, soaring inflation rates above 10%, and rising unemployment in the United States, Europe, and Japan. The 1973 oil crisis triggered supply shocks, leading to increased production costs and price levels, while wage controls failed to stabilize labor markets. Similar patterns emerged in the late 1990s in Latin American economies, including Argentina and Brazil, where fiscal deficits and external debt pressures caused simultaneous inflation and economic stagnation.

The 1970s Oil Crisis: A Classic Case of Stagdeflation

The 1970s Oil Crisis exemplifies stagflation, a rare economic condition characterized by stagnant growth, high unemployment, and soaring inflation triggered by a sharp increase in oil prices due to OPEC's embargo. This supply shock caused production costs to surge, leading to reduced economic output and persistent inflation despite weak demand. Policymakers faced challenges balancing inflation control with stimulating growth, highlighting stagflation's complexity in macroeconomic management.

Japan’s Lost Decades: Stagnation with Deflationary Pressures

Japan's Lost Decades exemplify stagdeflation characterized by prolonged economic stagnation combined with persistent deflationary pressures. During this period from the 1990s to the 2010s, Japan experienced stagnant GDP growth alongside falling consumer prices, eroding corporate profits and household wealth. The deflationary environment discouraged investment and consumption, deepening the economic malaise and challenging policymakers with a unique macroeconomic dilemma.

Eurozone After the Global Financial Crisis: Signs of Stagdeflation

The Eurozone experienced signs of stagflation following the Global Financial Crisis, characterized by stagnant economic growth, soaring unemployment rates exceeding 12%, and rising inflation that breached the European Central Bank's 2% target. High sovereign debt levels, particularly in countries like Greece, Spain, and Italy, exacerbated fiscal challenges, limiting policy responses and fueling persistent economic malaise. Structural rigidities in labor markets and sluggish productivity growth further entrenched the Eurozone's stagflationary pressures during this period.

Emerging Markets: Recent Stagdeflationary Episodes

Emerging markets such as Argentina and Turkey have experienced stagdeflation, characterized by stagnant economic growth, soaring inflation, and high unemployment rates. These episodes are often triggered by currency depreciation, external debt pressures, and political instability, exacerbating macroeconomic imbalances. Central banks in these countries struggle to balance inflation control with economic stimulation, complicating monetary policy decisions.

Key Macroeconomic Indicators of Stagdeflation

Stagflation is characterized by a combination of stagnant economic growth, high unemployment rates, and accelerating inflation, often measured by rising Consumer Price Index (CPI) figures alongside declining Gross Domestic Product (GDP) growth rates. Key macroeconomic indicators include persistent inflation above target levels, unemployment rates exceeding natural levels, and slowed industrial production reflecting reduced demand. The 1970s oil crisis exemplifies stagflation, where rising energy prices led to supply shocks that impaired economic output while fueling inflation and joblessness simultaneously.

Policy Responses to Stagdeflation: Case Studies

Japan's lost decade in the 1990s exemplifies stagflation, where stagnant growth combined with deflationary pressures challenged policymakers. The Bank of Japan implemented aggressive monetary easing, including near-zero interest rates and quantitative easing, while the government pursued fiscal stimulus to revive demand. Despite these efforts, prolonged deflation and sluggish growth highlighted the complexity of balancing inflation control with economic revitalization during stagdeflation.

Impact of Stagdeflation on Unemployment and Consumer Behavior

Stagflation, combining stagnant economic growth with high inflation, significantly increases unemployment rates as businesses face higher costs and reduced consumer demand, leading to layoffs and hiring freezes. Consumers respond by cutting back on discretionary spending and prioritizing essential goods, which further suppresses economic activity and reinforces the downward economic spiral. The persistent uncertainty and declining real incomes during stagflation create a challenging environment for both labor markets and consumer confidence.

Lessons Learned: Preventing Future Stagdeflationary Cycles

Stagflation, characterized by stagnant economic growth, high inflation, and rising unemployment, was notably exemplified in the 1970s U.S. economy during oil price shocks. Lessons learned emphasize the importance of timely monetary policy adjustments and proactive fiscal measures to balance inflation control without stifling growth. Central banks must prioritize credible inflation targeting and supply-side reforms to enhance productivity and prevent chronic stagflation scenarios.

example of stagdeflation in macroeconomy Infographic

samplerz.com

samplerz.com