A green swan in economic risk refers to unpredictable and potentially catastrophic events linked to environmental changes and climate instability. For example, a sudden collapse of a major agricultural sector due to prolonged drought driven by climate change can disrupt global food supplies and trigger severe inflation. Such events expose vulnerabilities in financial markets and supply chains, highlighting the interconnected risks posed by environmental factors. Financial institutions are increasingly analyzing green swan risks to improve resilience in investment portfolios and economic planning. Data shows that losses related to climate events, such as floods and wildfires, have surged, emphasizing the need for incorporating climate risk into economic models. Understanding the impact of these rare but high-impact events aids policymakers and investors in developing strategies to mitigate systemic economic shocks.

Table of Comparison

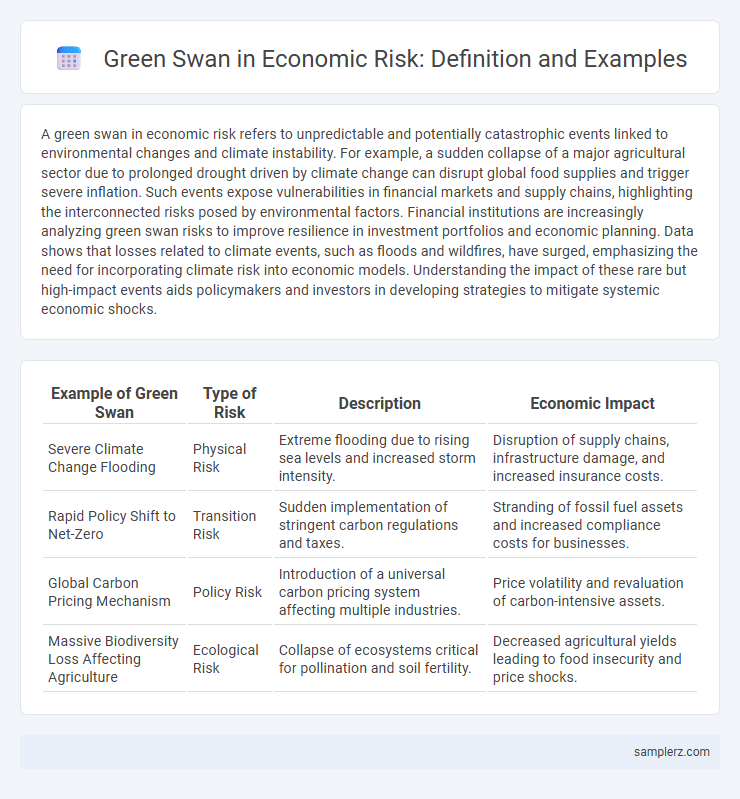

| Example of Green Swan | Type of Risk | Description | Economic Impact |

|---|---|---|---|

| Severe Climate Change Flooding | Physical Risk | Extreme flooding due to rising sea levels and increased storm intensity. | Disruption of supply chains, infrastructure damage, and increased insurance costs. |

| Rapid Policy Shift to Net-Zero | Transition Risk | Sudden implementation of stringent carbon regulations and taxes. | Stranding of fossil fuel assets and increased compliance costs for businesses. |

| Global Carbon Pricing Mechanism | Policy Risk | Introduction of a universal carbon pricing system affecting multiple industries. | Price volatility and revaluation of carbon-intensive assets. |

| Massive Biodiversity Loss Affecting Agriculture | Ecological Risk | Collapse of ecosystems critical for pollination and soil fertility. | Decreased agricultural yields leading to food insecurity and price shocks. |

Understanding Green Swans in Economic Risk

Green swans in economic risk represent unpredictable but potentially catastrophic events linked to climate change, such as sudden financial market collapses triggered by abrupt policy shifts or extreme weather disasters. These events challenge traditional risk models due to their unprecedented nature and complex interconnections between environmental factors and global financial systems. Understanding green swans requires integrating climate science with economic risk analysis to improve resilience and adaptive policymaking.

Real-world Examples of Green Swan Events

The collapse of carbon-intensive industries following sudden regulatory shifts exemplifies a Green Swan event by triggering widespread financial risks linked to climate transition. Extreme weather disasters, such as Hurricane Katrina, demonstrate how climate-induced shocks can disrupt global supply chains and asset values, intensifying systemic economic vulnerabilities. Central banks' growing concerns about the interplay between climate change and financial stability further highlight real-world manifestations of Green Swan risks.

The Financial Impact of Climate-related Green Swans

Climate-related green swans represent unpredictable and severe financial risks triggered by abrupt climate shifts, such as sudden policy changes, natural disasters, or technological breakthroughs. The financial impact includes drastic asset devaluations, increased insurance claims, and disruptions in global supply chains, ultimately threatening financial stability. Central banks and financial institutions are increasingly incorporating climate stress testing to mitigate exposure and enhance resilience against these systemic risks.

Comparing Black Swan and Green Swan Risks

Black Swan risks represent rare, unpredictable economic shocks with severe consequences, such as the 2008 financial crisis. Green Swan risks, emerging from climate change and ecological disruptions, pose systemic threats to global financial stability through long-term environmental degradation and sudden climate events. Unlike Black Swan events, Green Swan risks are increasingly foreseeable and require integrative risk management frameworks that address both environmental and economic vulnerabilities.

Case Study: Green Swan Disruptions in Global Markets

The Green Swan disruptions in global markets highlight severe climate-related financial risks that can trigger systemic economic instability, as seen in cases like the 2021 European energy crisis driven by extreme weather patterns and supply chain disruptions. Central banks and financial institutions face mounting challenges in integrating climate risk into stress testing models, exposing vulnerabilities in asset valuations and liquidity. This case study underscores the urgent need for enhanced resilience strategies and regulatory frameworks to mitigate the cascading impacts of climate-induced market shocks.

Green Swans and Systemic Financial Vulnerabilities

Green Swans represent extreme climate-related risks that can trigger systemic financial vulnerabilities, destabilizing global markets through sudden asset repricing and credit losses. The integration of climate stress testing in financial regulations highlights how unexpected environmental disasters expose banking systems to abrupt liquidity shortages and insolvency risks. Identifying Green Swan events is crucial for developing resilient economic policies that mitigate cascading financial shocks in the transition to a low-carbon economy.

Policy Responses to Green Swan Economic Risks

Policy responses to green swan economic risks include implementing carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, to internalize environmental costs and incentivize low-carbon investments. Central banks and financial regulators are integrating climate-related risk assessments into monetary policy frameworks and stress testing to enhance financial system resilience. Governments are also advancing large-scale investments in renewable energy infrastructure and sustainable technologies to mitigate systemic risks associated with climate change-induced economic shocks.

Investor Strategies for Green Swan Event Preparedness

Investor strategies for Green Swan event preparedness emphasize integrating climate risk assessments into portfolio management, prioritizing investments in sustainable and resilient infrastructure, and adopting scenario analysis to anticipate extreme environmental disruptions. Allocating capital towards renewable energy projects, green bonds, and climate-resilient assets enhances long-term portfolio stability amid unpredictable ecological crises. Risk diversification across sectors vulnerable to climate shocks further mitigates potential financial losses associated with Green Swan events.

Green Swans: Lessons from Recent Economic Shocks

Green swans represent unpredictable, high-impact environmental risks that challenge traditional economic models, such as the 2020 COVID-19 pandemic combined with extreme climate events that disrupted global supply chains. Recent economic shocks highlight how climate-driven disasters like wildfires and floods amplify financial instability, revealing vulnerabilities in markets and investment portfolios exposed to ecological degradation. Integrating green swan scenarios into risk assessment frameworks is crucial for building resilience and safeguarding sustainable economic growth.

Future Green Swan Scenarios in the Global Economy

Future green swan scenarios in the global economy highlight extreme climate-related risks that could trigger sudden financial crises, such as widespread asset devaluation linked to fossil fuel stranded assets and abrupt shifts in energy policy. These scenarios emphasize the systemic impact of environmental shocks on supply chains, insurance markets, and sovereign debt, underscoring the critical need for adaptive risk management strategies. Central banks and financial institutions are increasingly integrating these potential disruptions into stress testing to enhance economic resilience against climate-induced financial instability.

example of green swan in risk Infographic

samplerz.com

samplerz.com