A notable example of a black swan event in the economy is the 2008 global financial crisis. This crisis originated from the collapse of the housing bubble in the United States, leading to widespread mortgage defaults and the failure of major financial institutions. The unforeseen nature of this event caused severe disruption in global financial markets and triggered a deep recession. Another significant black swan event is the COVID-19 pandemic's impact on the global economy in 2020. The rapid spread of the virus and resulting lockdowns caused a sudden halt in economic activity across various sectors, including travel, hospitality, and manufacturing. The pandemic led to unprecedented fiscal stimulus measures and highlighted vulnerabilities in global supply chains.

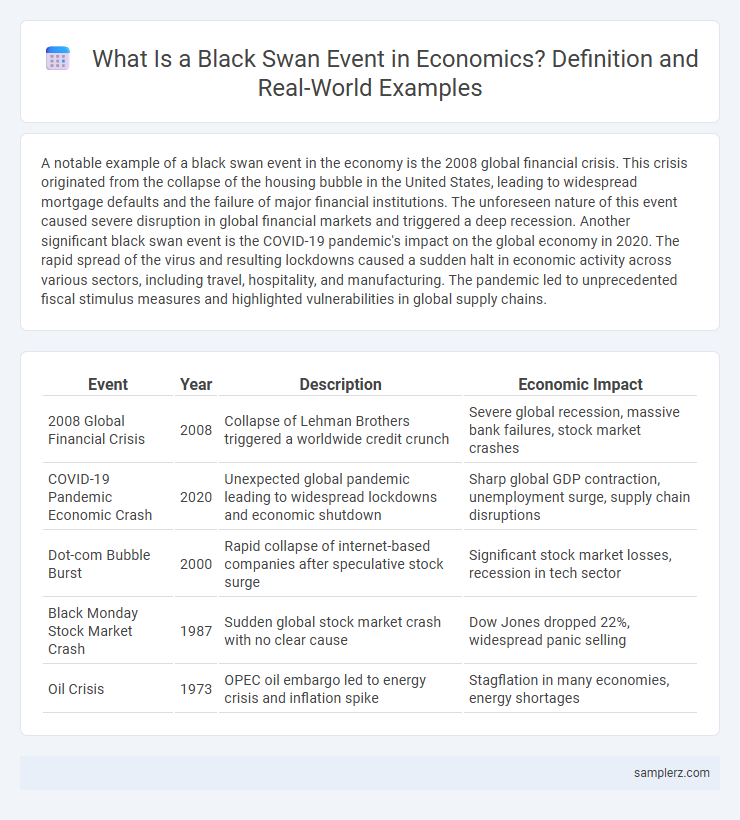

Table of Comparison

| Event | Year | Description | Economic Impact |

|---|---|---|---|

| 2008 Global Financial Crisis | 2008 | Collapse of Lehman Brothers triggered a worldwide credit crunch | Severe global recession, massive bank failures, stock market crashes |

| COVID-19 Pandemic Economic Crash | 2020 | Unexpected global pandemic leading to widespread lockdowns and economic shutdown | Sharp global GDP contraction, unemployment surge, supply chain disruptions |

| Dot-com Bubble Burst | 2000 | Rapid collapse of internet-based companies after speculative stock surge | Significant stock market losses, recession in tech sector |

| Black Monday Stock Market Crash | 1987 | Sudden global stock market crash with no clear cause | Dow Jones dropped 22%, widespread panic selling |

| Oil Crisis | 1973 | OPEC oil embargo led to energy crisis and inflation spike | Stagflation in many economies, energy shortages |

Defining Black Swan Events in Economic Crises

Black Swan events in economic crises are characterized by their extreme rarity, severe impact, and retrospective predictability, such as the 2008 global financial meltdown triggered by the collapse of Lehman Brothers. These events defy traditional economic models and risk assessment tools due to their unforeseen nature and profound consequences on financial markets, institutions, and global economies. Understanding Black Swan events involves recognizing their ability to upend conventional wisdom, necessitating adaptive risk management strategies and robust economic policies.

Historical Black Swan Events That Shook Economies

The 2008 global financial crisis stands as a prime example of a black swan event, triggered by the collapse of Lehman Brothers and the bursting of the U.S. housing bubble, which led to widespread economic turmoil worldwide. The 1929 Wall Street Crash, which initiated the Great Depression, represents another historical black swan that caused massive unemployment and a prolonged economic downturn across multiple nations. More recently, the COVID-19 pandemic disrupted global supply chains and financial markets unexpectedly, causing severe recessions that highlighted the fragility of interconnected economies.

The 2008 Global Financial Crisis: A Modern Black Swan

The 2008 Global Financial Crisis exemplifies a modern Black Swan event, triggered by the collapse of Lehman Brothers and widespread failures in mortgage-backed securities. This economic meltdown led to a severe global recession, massive unemployment, and unprecedented government bailouts. The crisis exposed critical vulnerabilities in financial regulation and risk management, reshaping economic policies worldwide.

COVID-19 Pandemic: Unprecedented Economic Disruption

The COVID-19 pandemic triggered a black swan event causing unprecedented economic disruption worldwide, with global GDP contracting by 3.3% in 2020. Supply chain breakdowns and widespread lockdowns led to massive unemployment spikes, while markets experienced extreme volatility, exemplified by the S&P 500's swift 34% plunge in March 2020. Governments and central banks implemented historic stimulus packages exceeding $12 trillion to stabilize economies and support recovery efforts.

The Asian Financial Crisis: Unexpected Contagion

The Asian Financial Crisis of 1997 exemplifies a black swan event marked by sudden and unexpected contagion that devastated economies across East Asia. Triggered by the collapse of the Thai baht after speculative attacks, the crisis rapidly spread to South Korea, Indonesia, and Malaysia, exposing vulnerabilities in currency pegs, excessive corporate debt, and weak financial regulations. The event led to severe currency devaluations, plummeting stock markets, and deep recessions, highlighting the systemic risks inherent in interconnected emerging markets.

Oil Price Shocks as Economic Black Swans

The 1973 oil crisis exemplifies an economic black swan event, where an unexpected embargo by OPEC led to a quadrupling of global oil prices, triggering widespread inflation and recession. This supply shock disrupted energy markets, intensified geopolitical tensions, and caused significant declines in industrial output worldwide. Such oil price shocks highlight the vulnerability of economies heavily dependent on fossil fuels to sudden, unpredictable disruptions in energy supply.

Brexit: A Political Black Swan with Economic Fallout

The Brexit referendum in 2016 represented a political black swan event that triggered significant economic uncertainty and market volatility across the United Kingdom and Europe. The unexpected decision to leave the EU disrupted trade agreements, supply chains, and investment flows, resulting in fluctuations in the British pound and reduced business confidence. Long-term economic fallout includes shifts in labor markets, altered foreign direct investment patterns, and increased costs for cross-border commerce.

Technological Failures Sparking Economic Crises

Technological failures such as the 2016 Dyn DNS cyberattack triggered widespread internet outages, severely disrupting e-commerce and digital financial services, illustrating a black swan event with substantial economic repercussions. Similarly, the 2010 Flash Crash exposed vulnerabilities in automated trading algorithms, causing a sudden $1 trillion market value drop within minutes. These incidents underscore how unforeseen technological failures can cascade into critical economic crises, impacting global markets and investor confidence.

Sovereign Debt Defaults: Rare, Yet Devastating

Sovereign debt defaults represent a classic example of a black swan event in economic crises due to their rarity and severe impact on global markets. Instances like Argentina's 2001 default triggered widespread financial contagion, undermining investor confidence and destabilizing international credit systems. The unpredictability and devastating consequences of these defaults emphasize the critical need for robust risk assessment in sovereign debt management.

Lessons Learned from Black Swan Events in Economics

The 2008 financial crisis serves as a prime example of a black swan event that revealed vulnerabilities within global financial systems and risk models. Lessons learned emphasize the importance of improving regulatory frameworks, enhancing transparency, and diversifying portfolios to mitigate systemic risks. Economists also highlight the necessity for adaptive risk management strategies to better anticipate and respond to unpredictable, high-impact economic shocks.

example of black swan in crisis Infographic

samplerz.com

samplerz.com