Helicopter money refers to an unconventional monetary policy where central banks distribute money directly to the public to stimulate economic activity. An example of helicopter money in a stimulus context occurred during the COVID-19 pandemic when several governments issued direct cash payments to citizens. The United States implemented this through Economic Impact Payments, sending trillions of dollars to individuals to boost consumption and support economic recovery. This approach differs from traditional stimulus methods that rely on tax cuts or increased government spending. Helicopter money aims to increase disposable income immediately, leading to higher consumer demand and quicker economic revival. Data from the Federal Reserve shows that these cash transfers significantly increased household spending, contributing to economic stabilization during the crisis.

Table of Comparison

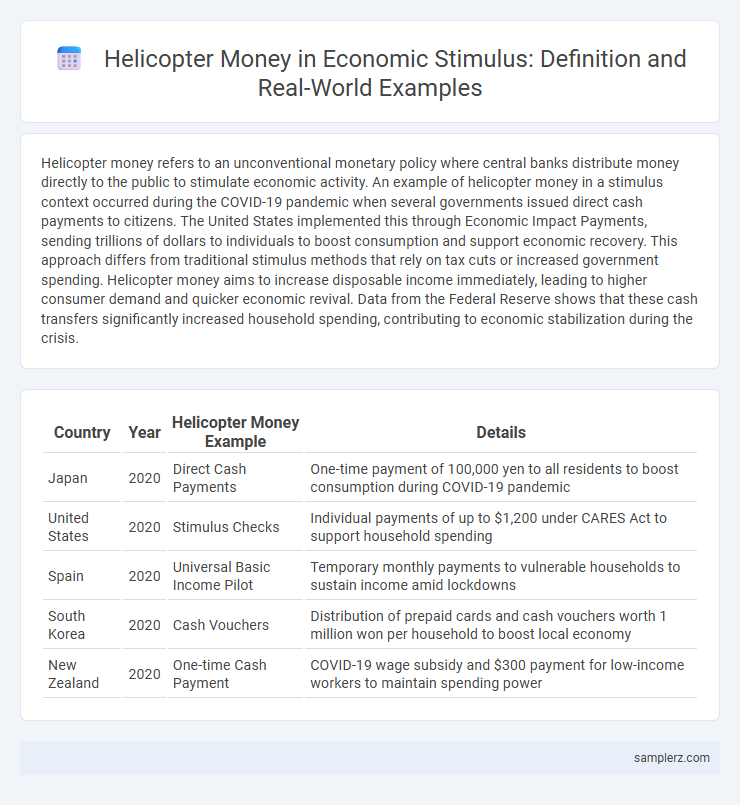

| Country | Year | Helicopter Money Example | Details |

|---|---|---|---|

| Japan | 2020 | Direct Cash Payments | One-time payment of 100,000 yen to all residents to boost consumption during COVID-19 pandemic |

| United States | 2020 | Stimulus Checks | Individual payments of up to $1,200 under CARES Act to support household spending |

| Spain | 2020 | Universal Basic Income Pilot | Temporary monthly payments to vulnerable households to sustain income amid lockdowns |

| South Korea | 2020 | Cash Vouchers | Distribution of prepaid cards and cash vouchers worth 1 million won per household to boost local economy |

| New Zealand | 2020 | One-time Cash Payment | COVID-19 wage subsidy and $300 payment for low-income workers to maintain spending power |

Understanding Helicopter Money in Economic Stimulus

Helicopter money refers to direct cash transfers from the government to residents aimed at boosting consumer spending and stimulating economic growth during downturns. This unconventional monetary policy tool bypasses traditional banking channels, increasing liquidity directly in the hands of consumers to jumpstart demand. Japan's 2020 stimulus package, which included direct payments to households, serves as a prominent example of helicopter money implemented to counter deflation and sluggish growth.

The Origins of Helicopter Money Policy

Helicopter money traces back to economist Milton Friedman's 1969 thought experiment suggesting direct cash drops to stimulate spending during deflationary periods. The term gained prominence in the aftermath of the 2008 financial crisis as policymakers explored unconventional monetary tools beyond quantitative easing. Japan and the Eurozone considered helicopter money to bypass zero interest rate policies, aiming to boost demand and inflation by distributing funds directly to households.

Historical Instances of Helicopter Money Implementation

Historical instances of helicopter money implementation include Japan's 2020 stimulus, where the government directly transferred cash to households to combat deflation and economic stagnation. Another example is the United States during the COVID-19 pandemic, with direct stimulus checks distributed to citizens to boost consumer spending and support economic recovery. These direct cash transfers exemplify helicopter money aimed at increasing liquidity without increasing government debt burden.

Helicopter Money vs. Traditional Fiscal Stimulus

Helicopter money involves direct cash transfers to citizens without the need for repayment, aiming to boost demand more immediately compared to traditional fiscal stimulus that often relies on government spending or tax cuts subject to legislative delays and potential debt accumulation. Unlike conventional fiscal measures, helicopter money bypasses financial intermediaries, reducing implementation lag and increasing the likelihood of cash being spent rather than saved. Economic studies show helicopter money can more effectively counteract deflation and stimulate consumption during severe downturns.

Case Study: Japan’s Discussions on Helicopter Drops

Japan's discussions on helicopter money gained prominence during its prolonged economic stagnation, with the Bank of Japan considering direct cash transfers to stimulate consumer spending and combat deflation. This unconventional monetary policy aimed to increase inflation expectations and boost aggregate demand without raising government debt through traditional fiscal stimulus. The debate highlighted concerns over potential long-term impacts on monetary credibility and the effectiveness of such direct monetary-financed transfers in revitalizing Japan's sluggish economy.

The 2020 U.S. Stimulus Checks: A Modern Helicopter Drop?

The 2020 U.S. stimulus checks represent a contemporary example of helicopter money, where direct cash payments were sent to millions of Americans to stimulate economic demand amidst the COVID-19 pandemic. These payments, totaling over $800 billion across multiple rounds, aimed to increase household spending and stabilize consumer confidence during a sharp economic downturn. This approach illustrated a large-scale, government-led cash infusion designed to quickly boost liquidity and counteract recessionary pressures.

European Central Bank and Helicopter Money Debates

The European Central Bank has explored helicopter money as a stimulus method during economic downturns, debating direct cash transfers to households to boost demand. This unconventional monetary tool aims to bypass traditional interest rate channels, addressing deflation risks and sluggish growth in the Eurozone. Critics emphasize inflation control and fiscal discipline, fueling ongoing debates on the feasibility and long-term impacts of helicopter money policies.

Effects of Helicopter Money on Inflation Rates

Helicopter money, as an unconventional monetary policy tool, directly increases consumer spending by distributing cash to the public, leading to a rapid surge in demand for goods and services. This immediate boost in demand often surpasses supply capacity, driving up prices and resulting in higher inflation rates. Historical examples, such as Japan's stimulus during the COVID-19 pandemic, demonstrated that helicopter money can fuel inflationary pressures when combined with supply chain constraints and low interest rates.

Criticisms and Risks of Helicopter Money in Practice

Helicopter money as a stimulus tool faces criticisms including the risk of triggering runaway inflation due to sudden increases in money supply without corresponding economic output growth. Critics highlight potential erosion of central bank independence and challenges in unwinding such policies without destabilizing financial markets. Empirical evidence from trials like Japan's direct cash transfers indicates limited effectiveness in sustained economic stimulation and raises concerns about increased public debt burdens.

Future Prospects for Helicopter Money in Global Economies

Future prospects for helicopter money in global economies hinge on its potential to stimulate demand during prolonged recessions without increasing public debt burdens. Economists highlight Japan and the United States as key examples where direct cash transfers to households could boost consumption and offset deflationary pressures. Emerging markets consider helicopter money a viable option, especially when conventional monetary policies face limitations and central banks struggle with near-zero interest rates.

example of helicopter money in stimulus Infographic

samplerz.com

samplerz.com