Seigniorage refers to the profit made by a government from issuing currency, especially when the face value exceeds the production cost. For example, when the U.S. government prints a $100 bill, the cost of producing the bill is only a few cents, so the difference represents seigniorage revenue. Central banks often use seigniorage as a source of non-tax revenue to finance government spending without raising taxes. In hyperinflationary economies like Zimbabwe, seigniorage can become a significant but problematic revenue source. As the government prints excessive money to cover budget deficits, the value of the currency falls rapidly, reducing real seigniorage gains. This cycle leads to further inflation, showing how seigniorage impacts both currency stability and economic conditions.

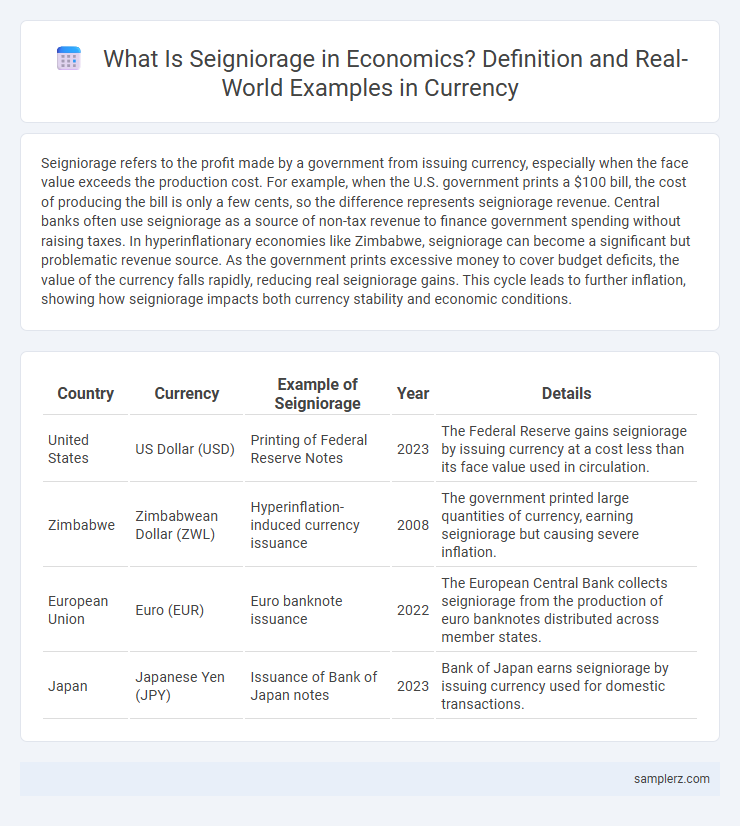

Table of Comparison

| Country | Currency | Example of Seigniorage | Year | Details |

|---|---|---|---|---|

| United States | US Dollar (USD) | Printing of Federal Reserve Notes | 2023 | The Federal Reserve gains seigniorage by issuing currency at a cost less than its face value used in circulation. |

| Zimbabwe | Zimbabwean Dollar (ZWL) | Hyperinflation-induced currency issuance | 2008 | The government printed large quantities of currency, earning seigniorage but causing severe inflation. |

| European Union | Euro (EUR) | Euro banknote issuance | 2022 | The European Central Bank collects seigniorage from the production of euro banknotes distributed across member states. |

| Japan | Japanese Yen (JPY) | Issuance of Bank of Japan notes | 2023 | Bank of Japan earns seigniorage by issuing currency used for domestic transactions. |

Defining Seigniorage: Economic Significance

Seigniorage refers to the profit a government earns from issuing currency, calculated as the difference between the face value of money and its production cost. This economic concept highlights the financial benefits central banks gain by producing currency, which helps fund public expenditures without direct taxation. Understanding seigniorage is crucial for analyzing monetary policy impacts on inflation and currency valuation.

Historical Examples of Seigniorage in Currency

During the Roman Empire, seigniorage was prominently experienced through the debasement of silver coins, which allowed the government to cover expenses by reducing the precious metal content while maintaining nominal values. Similarly, in 16th-century Spain, excessive minting of silver reales led to inflation, exemplifying how seigniorage impacted currency value amid vast inflows of New World silver. These historical instances illustrate how sovereign powers leveraged coinage production to finance expenditures at the expense of monetary stability.

Seigniorage in Modern Fiat Currency Systems

Seigniorage in modern fiat currency systems occurs when central banks issue currency that costs less to produce than its face value, generating profit for the government. This profit effectively acts as an interest-free loan to the government, enabling financing of public expenditures without immediate taxation or borrowing. The Federal Reserve's issuance of U.S. dollars exemplifies how seigniorage supports fiscal policy in developed economies.

Case Study: U.S. Dollar Seigniorage

The U.S. dollar generates significant seigniorage revenue due to its status as the world's primary reserve currency, allowing the Federal Reserve to issue currency beyond domestic demand. This global demand for dollars enables the U.S. government to finance budget deficits at lower costs, effectively profiting from the difference between the face value of currency issued and production costs. Studies estimate U.S. seigniorage earnings in the tens of billions of dollars annually, highlighting the economic advantage derived from dollar dominance in international trade and finance.

Eurozone Seigniorage Distribution Examples

Seigniorage in the Eurozone arises from the European Central Bank's issuance of euro banknotes, generating profits that are allocated among national central banks based on their capital key. For example, Germany and France receive larger shares of seigniorage due to their higher capital contributions, reflecting their economic weight in the Eurozone. This distribution mechanism ensures that seigniorage revenue supports national economies while maintaining monetary stability across member states.

Developing Countries and Seigniorage Practices

Developing countries often rely on seigniorage as a critical source of revenue by printing currency to finance budget deficits without increasing taxes, which can temporarily boost government funds. This practice can lead to higher inflation rates, reducing the currency's purchasing power and negatively impacting economic stability in nations like Zimbabwe and Venezuela. Despite risks, seigniorage remains a vital tool for countries with limited access to international credit markets.

Central Bank Digital Currencies and Seigniorage

Seigniorage in currency creation is exemplified by Central Bank Digital Currencies (CBDCs), where central banks generate revenue through issuing digital money without physical backing costs. The margin between the digital currency's face value and production costs forms a new revenue stream, enhancing financial sovereignty and reducing reliance on traditional fiat notes. CBDCs amplify seigniorage benefits by enabling instant, secure transactions while minimizing counterfeiting risks and operational expenses.

Hyperinflation and Excessive Seigniorage

Hyperinflation occurs when governments excessively finance deficits by printing money, generating high seigniorage that drastically erodes currency value. Excessive seigniorage during hyperinflation leads to runaway price increases, collapsing purchasing power and destabilizing economic activity. Zimbabwe's 2008 crisis exemplifies how uncontrolled money creation for seigniorage can trigger hyperinflation and monetary collapse.

Seigniorage Revenue and Government Budgets

Seigniorage revenue represents the profit a government earns from issuing currency, calculated as the difference between the face value of money and its production cost. This source of revenue can significantly impact government budgets by providing non-tax income that helps finance public expenditures and reduce the need for borrowing. Central banks in countries with high inflation often experience increased seigniorage, which can temporarily boost fiscal capacity but risk long-term economic stability.

Risks and Controversies of Seigniorage in Currency

Seigniorage, the profit made by issuing currency, carries risks such as inflationary pressure when excessive money supply devalues purchasing power. Central banks relying heavily on seigniorage risk undermining monetary stability, which can trigger hyperinflation and erode investor confidence, as witnessed in Zimbabwe during the late 2000s. Controversies arise over ethical concerns and fiscal discipline, with critics arguing that excessive seigniorage serves as a hidden tax on citizens through currency debasement.

example of seigniorage in currency Infographic

samplerz.com

samplerz.com