Japan experienced a liquidity trap during the 1990s and early 2000s, following the burst of its asset price bubble. The Bank of Japan lowered interest rates to near zero in an attempt to stimulate borrowing and spending, yet economic stagnation persisted. Consumers and businesses preferred to hold cash rather than invest, limiting the effectiveness of monetary policy. This phenomenon led to prolonged deflation and sluggish economic growth, characterized by low demand despite abundant liquidity. The government implemented various fiscal stimulus packages, but private sector investment remained subdued. Japan's liquidity trap highlights the challenges central banks face when conventional tools fail to revive economic momentum.

Table of Comparison

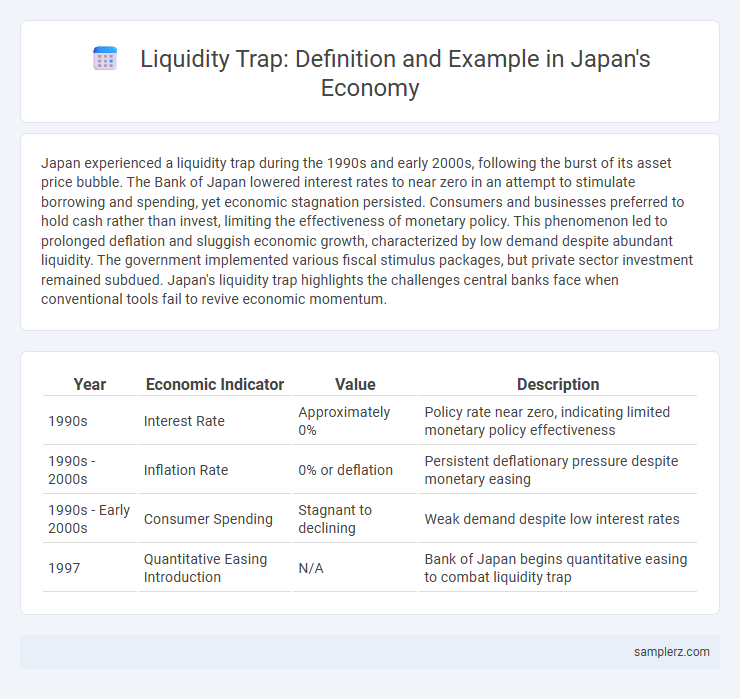

| Year | Economic Indicator | Value | Description |

|---|---|---|---|

| 1990s | Interest Rate | Approximately 0% | Policy rate near zero, indicating limited monetary policy effectiveness |

| 1990s - 2000s | Inflation Rate | 0% or deflation | Persistent deflationary pressure despite monetary easing |

| 1990s - Early 2000s | Consumer Spending | Stagnant to declining | Weak demand despite low interest rates |

| 1997 | Quantitative Easing Introduction | N/A | Bank of Japan begins quantitative easing to combat liquidity trap |

Overview of Japan's Liquidity Trap

Japan's liquidity trap emerged in the 1990s following the burst of its asset price bubble, leading to prolonged deflation and near-zero interest rates despite aggressive monetary easing by the Bank of Japan. The economy faced stagnation as consumers and businesses hoarded cash instead of increasing spending or investment, rendering conventional monetary policy ineffective. Japan's experience highlights the challenges of escaping a liquidity trap without significant fiscal stimulus and structural reforms.

Historical Background: Japan's Lost Decades

Japan's Lost Decades, spanning from the early 1990s to the 2010s, exemplify a prolonged liquidity trap where persistent deflation and near-zero interest rates failed to stimulate economic growth. The burst of the asset price bubble in 1991 triggered a collapse in real estate and stock market values, severely weakening consumer and business confidence. Despite aggressive monetary easing by the Bank of Japan, demand remained stagnant, leading to decades of sluggish economic performance and deflationary pressure.

Causes of the Liquidity Trap in Japan

Japan's liquidity trap in the 1990s resulted from prolonged deflation, stagnant economic growth, and persistent low interest rates that failed to stimulate consumer spending and investment. A combination of excessive debt burdens from the asset price bubble burst and demographic challenges such as an aging population exacerbated the reluctance to spend despite abundant liquidity. Monetary policy became ineffective as expectations of further economic decline led households and businesses to hoard cash rather than invest or consume.

Bank of Japan’s Response to Deflation

The Bank of Japan responded to the persistent deflation and liquidity trap by implementing aggressive quantitative easing policies, including purchasing long-term government bonds to increase money supply. This monetary stimulus aimed to lower interest rates near zero and encourage lending, yet the economy remained stagnant due to weak consumer demand and deflationary expectations. The prolonged liquidity trap in Japan highlights the challenges central banks face when traditional tools fail to revive inflation and stimulate economic growth.

Zero Interest Rate Policy and Its Effects

Japan's liquidity trap emerged prominently during the 1990s when the Bank of Japan implemented the Zero Interest Rate Policy (ZIRP) to stimulate economic growth. Despite near-zero interest rates, consumer spending and investment remained stagnant, limiting the policy's effectiveness. This situation constrained monetary policy tools and prolonged economic deflation and stagnation.

Quantitative Easing in Japan

Japan's prolonged liquidity trap has been characterized by persistent deflation and near-zero interest rates despite aggressive monetary stimulus. The Bank of Japan implemented extensive Quantitative Easing (QE) programs, purchasing massive amounts of government bonds and other assets to inject liquidity and stimulate economic activity. These QE efforts, however, struggled to generate robust inflation or economic growth, highlighting the challenges of overcoming a liquidity trap in a mature economy.

Consumer Behavior During the Liquidity Trap

During Japan's liquidity trap in the 1990s and 2000s, consumer behavior shifted dramatically toward increased savings and reduced spending despite near-zero interest rates. This paradox occurred as households feared deflation and economic uncertainty, leading to a preference for liquidity over consumption or investment. The resulting stagnation in demand further prolonged Japan's economic stagnation and deflationary pressures.

Impact on Japanese Banking Sector

Japan's prolonged liquidity trap since the 1990s severely constrained the Japanese banking sector's profitability as ultra-low interest rates eroded net interest margins. Banks faced mounting non-performing loans due to stagnant economic growth and deflationary pressures, leading to reduced lending capacity and increased capital adequacy concerns. The liquidity trap also intensified reliance on government support and unconventional monetary policies, hindering the banking sector's traditional role in credit intermediation.

Lessons from Japan for Global Economies

Japan's prolonged liquidity trap, characterized by near-zero interest rates and stagnant demand despite aggressive monetary easing, highlights critical lessons for global economies facing similar deflationary pressures. The Bank of Japan's experience demonstrates that conventional monetary policy may be insufficient without complementary fiscal stimulus and structural reforms to boost productivity and consumer confidence. Global economies can learn from Japan's emphasis on sustainable economic growth, targeted government spending, and proactive policy coordination to escape long-term stagnation.

Policy Recommendations for Overcoming Liquidity Traps

Japan's prolonged liquidity trap, characterized by near-zero interest rates and deflation since the 1990s, highlights the challenges of conventional monetary policy ineffectiveness. Policy recommendations for overcoming liquidity traps include implementing aggressive fiscal stimulus measures to boost aggregate demand, adopting unconventional monetary policies such as quantitative easing, and committing to a higher inflation target to influence expectations. Structural reforms to enhance productivity and labor market flexibility also play a crucial role in restoring economic dynamism and escaping deflationary stagnation.

example of liquidity trap in Japan Infographic

samplerz.com

samplerz.com