The prisoner's dilemma in cartel formation illustrates the challenge of cooperation among competing firms to maintain high prices. Each firm faces the temptation to cheat by secretly lowering prices to increase market share, even though mutual cooperation would maximize collective profits. This situation results in unstable cartels as distrust and incentives to defect lead to price wars and reduced overall gains. Economic data shows that cartels often disband shortly after formation due to the prisoner's dilemma. Empirical studies reveal higher profits during cartel enforcement periods, followed by a collapse in prices when members defect. Regulatory bodies monitor and penalize such behavior to protect market competition and prevent consumer harm.

Table of Comparison

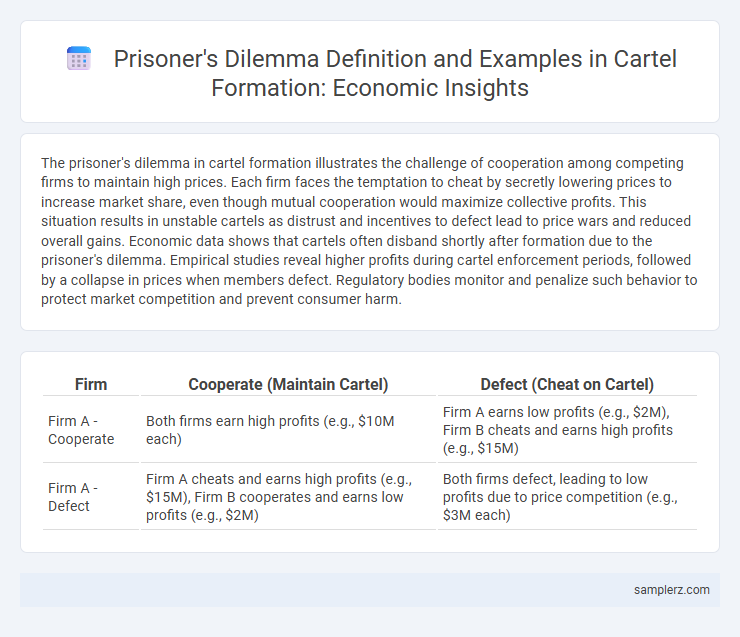

| Firm | Cooperate (Maintain Cartel) | Defect (Cheat on Cartel) |

|---|---|---|

| Firm A - Cooperate | Both firms earn high profits (e.g., $10M each) | Firm A earns low profits (e.g., $2M), Firm B cheats and earns high profits (e.g., $15M) |

| Firm A - Defect | Firm A cheats and earns high profits (e.g., $15M), Firm B cooperates and earns low profits (e.g., $2M) | Both firms defect, leading to low profits due to price competition (e.g., $3M each) |

Understanding the Prisoner's Dilemma in Cartel Agreements

Cartel members face a Prisoner's Dilemma when deciding whether to maintain collusion or cheat for short-term gains, risking the collapse of the cartel. Each firm's incentive to undercut prices leads to a Nash equilibrium where all firms defect, resulting in lower profits than if they cooperated. Understanding this dilemma explains why cartel stability is fragile and why enforcement mechanisms are critical for sustaining collusive agreements.

Real-World Cartel Examples: Applying Game Theory

Real-world cartel examples such as the OPEC oil cartel illustrate the prisoner's dilemma in cartel formation, where member countries face incentives to cheat by exceeding production quotas to maximize individual profits. Game theory models show that the temptation to defect undermines collective agreements, leading to unstable cooperation and market price volatility. Understanding these dynamics helps policymakers design regulations that deter cheating and promote collusion stability.

Incentives to Cheat: Cartel Instability Explained

Cartel formation in economic markets often faces instability due to the prisoner's dilemma, where each firm has strong incentives to cheat by undercutting agreed-upon prices or output quotas to increase individual profits. The temptation to deviate arises from the short-term gain a single firm can achieve if others stick to the cartel agreement, leading to mistrust and eventual collapse of the cartel. This inherent incentive to cheat undermines long-term cooperation, explaining why many cartels fail to maintain stability over time.

OPEC and Oil Markets: A Case Study of Coordination

OPEC's cartel formation exemplifies the prisoner's dilemma as member countries face incentives to cheat by exceeding production quotas to maximize individual profits, undermining collective output restrictions. Despite agreements to stabilize oil prices, distrust among members often leads to overproduction, causing price volatility in global oil markets. Effective coordination mechanisms and monitoring are essential to mitigate this dilemma and sustain cartel discipline.

Antitrust Laws and Deterring Cartel Formations

Cartel formations exemplify the prisoner's dilemma where firms face incentives to cheat despite mutual gains from cooperation, leading to market inefficiencies. Antitrust laws, enforced by agencies like the U.S. Federal Trade Commission and the European Commission, impose heavy fines and legal penalties to deter collusion and promote competition. Effective detection and stringent enforcement reduce the stability of cartels by increasing the risk and cost of coordination among firms.

Price Fixing: Cartel Tactics under the Prisoner’s Dilemma

Price fixing in cartel formation exemplifies the Prisoner's Dilemma as each firm benefits from secretly lowering prices to gain market share, despite agreeing to maintain high prices collectively. The incentive to cheat undermines trust among cartel members, leading to unstable agreements and eventual cartel breakdown. Economic models show that without enforceable contracts, rational firms prioritize individual gains over collective profits, illustrating the difficulty in sustaining cooperative price-fixing strategies.

Trust and Enforcement Mechanisms within Cartels

Cartel formation often exemplifies the prisoner's dilemma, where firms face incentives to cheat despite mutual benefits from cooperation. Trust is crucial as firms must believe others will adhere to agreements, yet this trust is fragile without credible enforcement mechanisms such as monitoring, penalty clauses, or legal sanctions. Effective enforcement ensures compliance, reduces the temptation to defect, and sustains cartel stability in oligopolistic markets.

Consequences of Betrayal: Collapse of Cartel Agreements

Betrayal in cartel agreements often triggers a rapid breakdown of collusive pricing, as defecting members undercut agreed-upon prices to capture greater market share. This collapse leads to intensified competition, pushing prices closer to marginal cost and significantly reducing collective profits for all cartel participants. The instability caused by distrust undermines long-term cooperation, ultimately resulting in market volatility and diminished cartel effectiveness.

Repeated Games: Sustaining Cooperation in Cartels

In the context of cartel formation, repeated games enable firms to sustain cooperation by leveraging the threat of future punishment for defection, helping maintain collusive pricing strategies over time. The shadow of the future incentivizes cartel members to adhere to agreed-upon output restrictions, as the long-term benefits of cooperation outweigh short-term gains from cheating. This dynamic underscores the importance of monitoring mechanisms and credible threats in stabilizing cartel agreements within oligopolistic markets.

Economic Welfare Losses from Cartel Behavior

Cartel formation exemplifies the prisoner's dilemma as firms collectively restrict output to raise prices, resulting in higher profits for members but causing economic welfare losses through reduced consumer surplus and allocative inefficiency. The misallocation of resources leads to deadweight loss, harming overall social welfare by limiting market competition and innovation. Persistent cartel behavior distorts market equilibrium, undermining the benefits of perfect competition essential for maximizing economic efficiency.

example of prisoner's dilemma in cartel formation Infographic

samplerz.com

samplerz.com