Capital flight refers to the large-scale exodus of financial assets and capital from a country due to economic or political instability. One notable example is the 1997 Asian Financial Crisis, where countries like Thailand and South Korea experienced massive outflows of foreign investments. Investors withdrew money rapidly, causing currency devaluations and severe economic downturns in the affected regions. Another example of capital flight occurred in Venezuela during the 2010s amid hyperinflation and political turmoil. Wealthy individuals and corporations transferred funds abroad to protect their assets from the collapsing local economy and stringent government controls. This outflow further weakened the national economy, exacerbating currency depreciation and reducing investment in domestic industries.

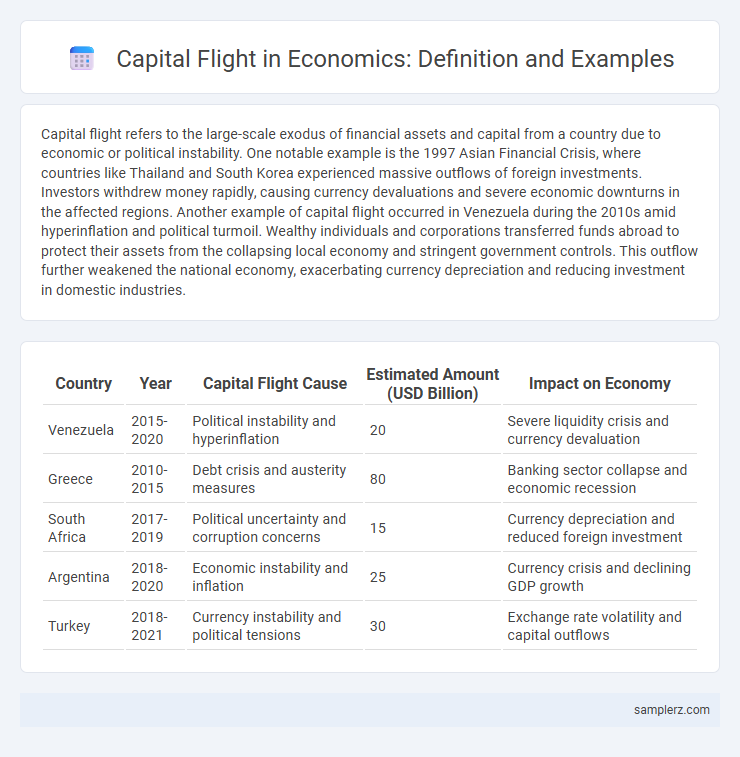

Table of Comparison

| Country | Year | Capital Flight Cause | Estimated Amount (USD Billion) | Impact on Economy |

|---|---|---|---|---|

| Venezuela | 2015-2020 | Political instability and hyperinflation | 20 | Severe liquidity crisis and currency devaluation |

| Greece | 2010-2015 | Debt crisis and austerity measures | 80 | Banking sector collapse and economic recession |

| South Africa | 2017-2019 | Political uncertainty and corruption concerns | 15 | Currency depreciation and reduced foreign investment |

| Argentina | 2018-2020 | Economic instability and inflation | 25 | Currency crisis and declining GDP growth |

| Turkey | 2018-2021 | Currency instability and political tensions | 30 | Exchange rate volatility and capital outflows |

Understanding Capital Flight: Definition and Key Drivers

Capital flight refers to the rapid outflow of financial assets and capital from a country due to economic instability, political turmoil, or sudden changes in market conditions. Key drivers include high inflation rates, currency devaluation, restrictive government policies, and lack of investor confidence. Examples such as the 1994 Mexican Peso Crisis and the 2015 Greek debt crisis illustrate how capital flight can exacerbate economic downturns and destabilize national economies.

Historic Examples of Capital Flight in Emerging Markets

Historic examples of capital flight in emerging markets include the 1997 Asian Financial Crisis, where countries like Thailand, Indonesia, and South Korea experienced massive outflows of foreign investment and domestic capital due to currency devaluation and investor panic. Another significant instance occurred during Argentina's 2001 economic crisis, marked by widespread capital withdrawal triggered by sovereign debt default fears and currency controls. Venezuela's ongoing economic turmoil since the 2010s has also led to extensive capital flight, driven by hyperinflation, political instability, and strict government regulations on currency exchange.

Case Study: Capital Flight During the Asian Financial Crisis

The Asian Financial Crisis of 1997-1998 exemplifies capital flight as investors rapidly withdrew billions of dollars from Southeast Asian markets, particularly in Indonesia, Thailand, and South Korea. Exchange rate volatility and plunging asset prices intensified capital outflows, destabilizing regional economies and triggering recessions. This crisis underscored the risks of sudden capital withdrawal on financial stability and economic growth in emerging markets.

The Venezuelan Economic Crisis and Capital Flight

The Venezuelan economic crisis triggered massive capital flight as investors and citizens moved assets abroad to escape hyperinflation and currency devaluation. Between 2014 and 2019, capital flight from Venezuela exceeded $60 billion, severely weakening domestic financial institutions and exacerbating the ongoing recession. This exodus of capital undermined investment and liquidity, intensifying the economic collapse and prolonging recovery efforts.

Impact of Capital Flight on Local Economies

Capital flight, such as the mass withdrawal of investments from Venezuela during its economic crisis, significantly depletes local financial resources, leading to a contraction in domestic investment and job losses. This outflow of capital undermines currency stability, often causing severe inflation and reducing the purchasing power of local consumers. As a result, essential public services face budget cuts, exacerbating poverty and slowing economic growth within affected regions.

Capital Flight in Russia: Causes and Consequences

Capital flight in Russia surged significantly after 2014 due to economic sanctions, political instability, and declining oil prices, prompting wealthy individuals and businesses to transfer assets abroad. The withdrawal of approximately $40 billion annually between 2014 and 2018 strained the ruble, increased inflation, and limited domestic investment. This persistent outflow of capital undermined Russia's economic growth, weakened investor confidence, and exacerbated financial vulnerabilities in the national economy.

The Role of Tax Havens in Capital Flight

Tax havens play a critical role in capital flight by providing individuals and corporations with low or zero-tax jurisdictions to relocate profits and assets, thereby reducing their tax liabilities in home countries. The use of offshore accounts and shell companies in these havens facilitates the concealment of wealth, undermining domestic tax revenues and economic stability. Countries like the Cayman Islands, Bermuda, and Luxembourg are among the most prominent tax havens contributing significantly to global capital flight dynamics.

Policy Failures and Capital Flight in Sub-Saharan Africa

Policy failures in Sub-Saharan Africa, such as inconsistent regulatory frameworks and rampant corruption, have significantly contributed to capital flight, undermining economic growth and development. Countries like Nigeria and South Africa have experienced substantial outflows of domestic wealth due to lack of investor confidence and inadequate financial governance. Addressing these policy inefficiencies is crucial to stem the tide of capital flight and promote sustainable economic stability in the region.

How Capital Flight Affects Developing Versus Developed Economies

Capital flight severely disrupts developing economies by draining much-needed financial resources, weakening local currencies, and limiting investments in infrastructure and social programs. In contrast, developed economies typically possess stronger financial institutions and diversified markets that help mitigate the immediate economic turmoil caused by capital outflows. Both contexts experience reduced investor confidence, but the long-term impact is disproportionately harsher on developing countries due to their reliance on foreign capital for growth.

Strategies to Prevent and Mitigate Capital Flight

Implementing strict capital controls and enhancing regulatory frameworks helps monitor and restrict large, unauthorized financial outflows, effectively mitigating capital flight. Strengthening economic fundamentals through stable macroeconomic policies, transparent governance, and investor confidence reduces incentives for investors to move assets abroad. Promoting domestic investment opportunities alongside international cooperation on tax evasion and money laundering addresses the root causes of capital flight and supports sustained economic stability.

example of capital flight in economy Infographic

samplerz.com

samplerz.com