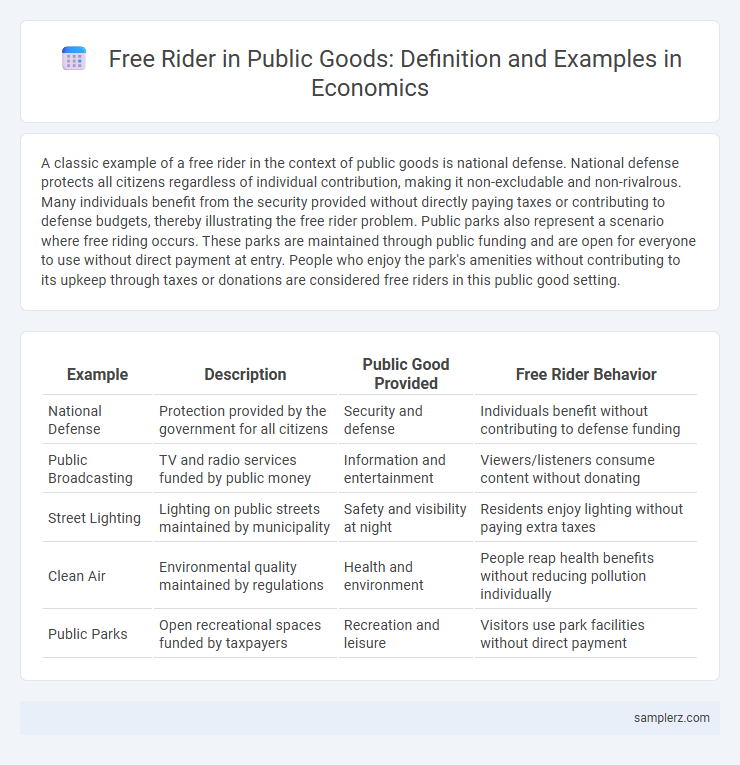

A classic example of a free rider in the context of public goods is national defense. National defense protects all citizens regardless of individual contribution, making it non-excludable and non-rivalrous. Many individuals benefit from the security provided without directly paying taxes or contributing to defense budgets, thereby illustrating the free rider problem. Public parks also represent a scenario where free riding occurs. These parks are maintained through public funding and are open for everyone to use without direct payment at entry. People who enjoy the park's amenities without contributing to its upkeep through taxes or donations are considered free riders in this public good setting.

Table of Comparison

| Example | Description | Public Good Provided | Free Rider Behavior |

|---|---|---|---|

| National Defense | Protection provided by the government for all citizens | Security and defense | Individuals benefit without contributing to defense funding |

| Public Broadcasting | TV and radio services funded by public money | Information and entertainment | Viewers/listeners consume content without donating |

| Street Lighting | Lighting on public streets maintained by municipality | Safety and visibility at night | Residents enjoy lighting without paying extra taxes |

| Clean Air | Environmental quality maintained by regulations | Health and environment | People reap health benefits without reducing pollution individually |

| Public Parks | Open recreational spaces funded by taxpayers | Recreation and leisure | Visitors use park facilities without direct payment |

Understanding the Free Rider Problem in Public Goods

The free rider problem occurs when individuals consume public goods like national defense or clean air without contributing to their cost, leading to underfunding or depletion of these goods. Public goods are non-excludable and non-rivalrous, so people have little incentive to pay voluntarily, causing market failure in their provision. Governments often intervene through taxation or regulation to ensure adequate funding and maintenance of essential public goods, preventing free rider exploitation.

Classic Examples of Free Riders in Public Services

Classic examples of free riders in public services include individuals who benefit from public firefighting without contributing to the fire department's funding, and people who use public parks without paying local taxes that support park maintenance. Another common instance is commuters who rely on public transportation systems but avoid paying fares or contribute less to funding through taxes. These behaviors illustrate how individuals can exploit public goods without directly bearing their costs, leading to challenges in financing and maintaining essential public services.

Public Goods and Non-Excludability: The Core Issue

Public goods, such as national defense and clean air, are characterized by non-excludability, meaning individuals cannot be prevented from benefiting regardless of contribution. This creates the free rider problem, where people consume the good without paying, undermining funding and provision. Governments often intervene to finance public goods through taxation to address this core issue.

Real-World Cases of Free Rider Behavior

Free rider behavior is evident in public goods such as national defense, where individuals benefit without directly contributing to funding. In environmental conservation efforts, people often avoid paying for pollution control but still enjoy cleaner air and water. Public broadcasting services like NPR face free rider challenges as many listen without donating, relying on others to support production costs.

Free Rider Effects on National Defense Funding

Free rider effects significantly impact national defense funding as individuals who benefit from national security often avoid contributing to defense expenditures, expecting others to cover the costs. This underfunding risk can lead to insufficient resources for maintaining military readiness, technology upgrades, and strategic operations. Governments typically address this challenge by implementing mandatory taxation to ensure equitable contribution toward public goods like national defense.

The Free Rider Problem in Environmental Conservation

The Free Rider Problem in environmental conservation occurs when individuals or businesses benefit from clean air and water without contributing to pollution control efforts or funding conservation programs. This leads to underinvestment in public goods like national parks and pollution reduction initiatives, as the incentive to pay diminishes when others bear the costs. Addressing this issue requires policies such as taxes, permits, or regulations to ensure fair contribution and sustainable resource management.

Community Projects and Voluntary Contributions

Community projects often face free rider problems when individuals benefit from public goods without contributing to voluntary financing or labor, leading to underfunding and reduced effectiveness. In neighborhood cleanups or public park maintenance, some residents may enjoy the improved environment without participating or donating, undermining collective efforts. Overcoming free riding requires mechanisms like incentives, social norms, or partial exclusion to ensure sufficient voluntary contributions sustain these community initiatives.

The Role of Free Riders in Public Broadcasting

Free riders in public broadcasting consume content without directly funding it through donations or license fees, relying on others to bear the cost of production. This behavior challenges the sustainability of public media by reducing the available resources needed for high-quality programming and innovation. Addressing free rider problems involves exploring funding models such as voluntary contributions, government subsidies, and hybrid financing.

Mitigation Strategies for Free Rider Issues

Public goods such as national defense and clean air often suffer from free rider problems, where individuals benefit without contributing to the cost. Mitigation strategies include implementing tax-based funding mechanisms, establishing regulatory frameworks, and promoting voluntary contributions through social norms and community engagement. Governments can also introduce exclusionary tactics using technology or membership models to incentivize participation and fair contribution.

Policy Solutions: Encouraging Fair Contribution to Public Goods

Policy solutions to address free rider problems in public goods include implementing taxation systems that ensure equitable funding and creating incentive mechanisms such as matching grants or user fees to encourage voluntary contributions. Governments often adopt regulatory measures and social norms campaigns to promote awareness of individual responsibility in sustaining public resources. Effective enforcement and transparency in fund allocation further reduce free riding by fostering trust and accountability among beneficiaries.

example of free rider in public good Infographic

samplerz.com

samplerz.com