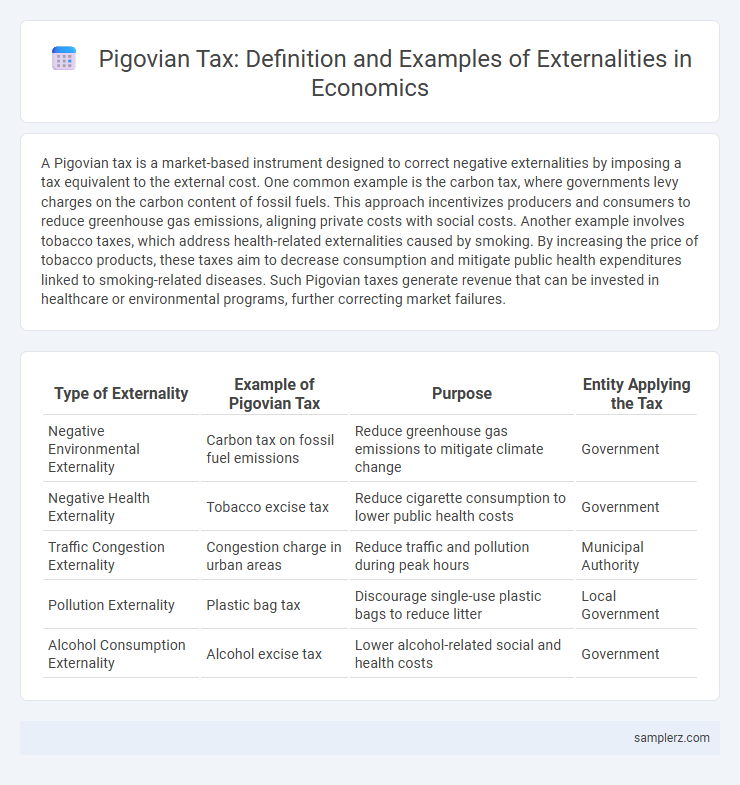

A Pigovian tax is a market-based instrument designed to correct negative externalities by imposing a tax equivalent to the external cost. One common example is the carbon tax, where governments levy charges on the carbon content of fossil fuels. This approach incentivizes producers and consumers to reduce greenhouse gas emissions, aligning private costs with social costs. Another example involves tobacco taxes, which address health-related externalities caused by smoking. By increasing the price of tobacco products, these taxes aim to decrease consumption and mitigate public health expenditures linked to smoking-related diseases. Such Pigovian taxes generate revenue that can be invested in healthcare or environmental programs, further correcting market failures.

Table of Comparison

| Type of Externality | Example of Pigovian Tax | Purpose | Entity Applying the Tax |

|---|---|---|---|

| Negative Environmental Externality | Carbon tax on fossil fuel emissions | Reduce greenhouse gas emissions to mitigate climate change | Government |

| Negative Health Externality | Tobacco excise tax | Reduce cigarette consumption to lower public health costs | Government |

| Traffic Congestion Externality | Congestion charge in urban areas | Reduce traffic and pollution during peak hours | Municipal Authority |

| Pollution Externality | Plastic bag tax | Discourage single-use plastic bags to reduce litter | Local Government |

| Alcohol Consumption Externality | Alcohol excise tax | Lower alcohol-related social and health costs | Government |

Understanding Pigovian Taxes in Addressing Externalities

Pigovian taxes are levied to correct negative externalities by internalizing social costs, such as a carbon tax imposed on industries to reduce greenhouse gas emissions. These taxes incentivize producers and consumers to modify behavior, aligning private costs with true societal costs and promoting more sustainable economic activities. Implementing Pigovian taxes enhances market efficiency by addressing externalities that traditional regulations may overlook.

Key Features of Pigovian Taxation

Pigovian taxation targets negative externalities by imposing a tax equivalent to the external social cost caused by an activity, such as carbon taxes designed to reduce greenhouse gas emissions. The key features include aligning private costs with social costs, incentivizing producers and consumers to reduce harmful behaviors, and promoting overall economic efficiency. This tax mechanism corrects market failures by internalizing external costs, encouraging sustainable practices without outright bans or regulations.

Classic Example: Carbon Taxes and Environmental Protection

Carbon taxes serve as a classic Pigovian tax designed to internalize the negative externality of carbon emissions by assigning a cost proportional to the environmental damage caused. These taxes incentivize businesses and consumers to reduce their carbon footprint, promoting investment in cleaner technologies and renewable energy sources. Empirical studies indicate that regions implementing carbon taxes experience measurable declines in greenhouse gas emissions, contributing to environmental protection and climate change mitigation.

Pigovian Tax in Practice: Tobacco and Alcohol Excise

Pigovian taxes are levied on tobacco and alcohol products to address negative externalities such as public health costs and social harms. These excise taxes increase prices, reducing consumption and generating government revenue allocated for healthcare and prevention programs. Empirical studies demonstrate that higher tobacco and alcohol taxes correlate with decreased usage rates and lower incidence of related diseases.

Congestion Charges: Managing Urban Traffic Externalities

Congestion charges are a prime example of a Pigovian tax aimed at internalizing the negative externalities caused by urban traffic congestion. By imposing fees on vehicles entering high-traffic zones during peak hours, cities like London and Singapore reduce traffic volume, lower pollution levels, and enhance overall urban mobility. This economic instrument incentivizes commuters to shift to public transport or off-peak travel, effectively mitigating the social costs of congestion.

Plastic Bag Levies: Reducing Environmental Waste

Pigovian taxes are designed to correct negative externalities by imposing costs equivalent to the social damage caused by harmful activities. Plastic bag levies exemplify this concept, targeting environmental waste by charging consumers a fee for single-use plastic bags to discourage their use. Studies show that countries implementing plastic bag taxes, such as Ireland and Kenya, have achieved reductions in plastic waste by over 90%, proving the effectiveness of Pigovian taxation in environmental conservation.

Sugar Taxes: Combating Public Health Externalities

Sugar taxes serve as a prime example of a Pigovian tax aimed at addressing negative externalities in public health, targeting the societal costs of excessive sugar consumption such as obesity and diabetes. By imposing levies on sugary drinks and snacks, governments internalize these external costs, incentivizing healthier consumer choices and reducing healthcare expenditures. Studies show countries implementing sugar taxes often experience decreased sugar sales and improved health outcomes, validating their effectiveness in mitigating public health externalities.

Emission Trading Schemes Versus Pigovian Taxes

Emission Trading Schemes (ETS) and Pigovian taxes both address negative externalities like pollution by internalizing external costs. Pigovian taxes impose a fixed price per unit of emissions, providing clear cost signals but uncertain emission reductions. ETS set a cap on total emissions and allow firms to trade permits, ensuring emission limits but causing price variability in carbon markets.

Success Stories of Pigovian Tax Implementation Globally

Sweden's carbon tax, introduced in 1991, successfully reduced greenhouse gas emissions by incentivizing cleaner energy use, leading to a 27% drop in emissions by 2019. British Columbia's carbon tax, implemented in 2008, generated significant revenue while decreasing per capita fuel consumption by 16% over a decade. These Pigovian tax examples demonstrate effective internalization of negative externalities, promoting sustainable environmental outcomes worldwide.

Challenges and Criticisms of Pigovian Taxes

Pigovian taxes, designed to correct negative externalities like pollution, often face challenges such as accurately measuring the social cost of the externality and setting an appropriate tax rate. Critics argue that these taxes can lead to economic inefficiencies, disproportionately impact low-income populations, and may be politically unpopular due to perceived government overreach. Furthermore, administrative costs and difficulties in enforcement can reduce the overall effectiveness of Pigovian taxation in addressing externality problems.

example of Pigovian tax in externality Infographic

samplerz.com

samplerz.com