The Cobra Effect in tax policy occurs when government actions to increase tax revenue lead to unintended negative consequences that undermine the original goal. One classic example is in colonial India, where the British government imposed a bounty on cobra snakes to reduce their population. Instead of decreasing, cobra numbers increased as people bred them to collect the bounty, ultimately making the problem worse and forcing authorities to abandon the program. In modern economies, similar phenomena can happen when high taxes incentivize tax evasion or avoidance strategies. For instance, excessively high income taxes may encourage individuals to underreport earnings or move to tax havens, reducing overall tax revenue. This demonstrates the importance of carefully balancing tax rates to avoid triggering behaviors that counteract fiscal objectives.

Table of Comparison

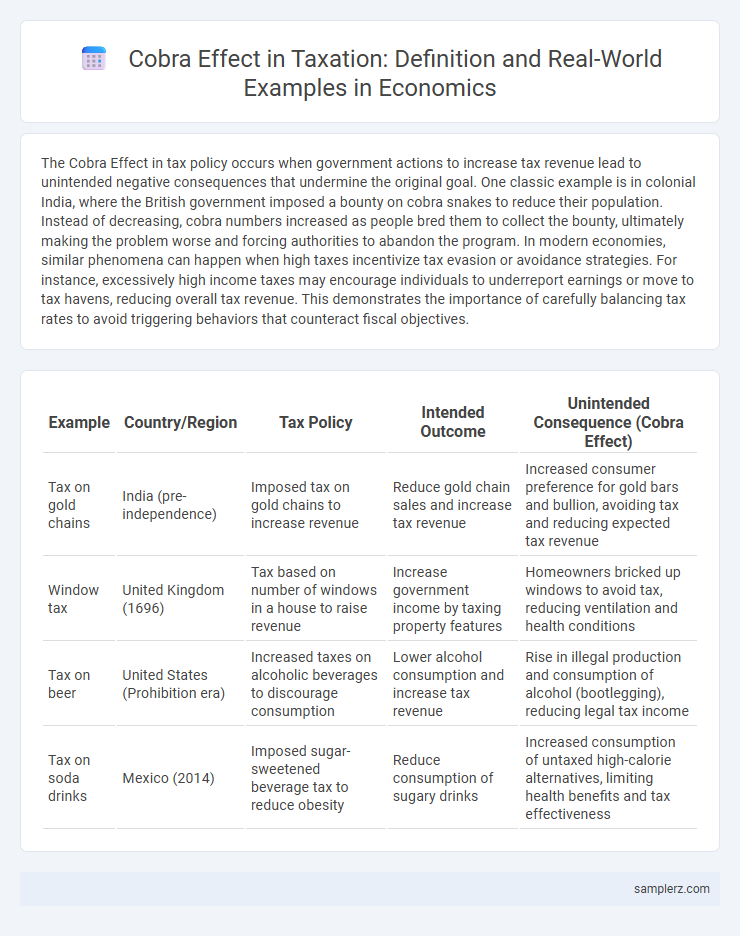

| Example | Country/Region | Tax Policy | Intended Outcome | Unintended Consequence (Cobra Effect) |

|---|---|---|---|---|

| Tax on gold chains | India (pre-independence) | Imposed tax on gold chains to increase revenue | Reduce gold chain sales and increase tax revenue | Increased consumer preference for gold bars and bullion, avoiding tax and reducing expected tax revenue |

| Window tax | United Kingdom (1696) | Tax based on number of windows in a house to raise revenue | Increase government income by taxing property features | Homeowners bricked up windows to avoid tax, reducing ventilation and health conditions |

| Tax on beer | United States (Prohibition era) | Increased taxes on alcoholic beverages to discourage consumption | Lower alcohol consumption and increase tax revenue | Rise in illegal production and consumption of alcohol (bootlegging), reducing legal tax income |

| Tax on soda drinks | Mexico (2014) | Imposed sugar-sweetened beverage tax to reduce obesity | Reduce consumption of sugary drinks | Increased consumption of untaxed high-calorie alternatives, limiting health benefits and tax effectiveness |

Understanding the Cobra Effect in Taxation

The cobra effect in taxation occurs when tax policies unintentionally encourage behaviors that worsen the fiscal problem they aim to solve, such as high taxes on cigarettes leading to an increase in illegal smuggling and black market sales. This phenomenon highlights the complexity of designing tax measures that avoid perverse incentives and unintended economic consequences. Understanding this effect is vital for policymakers to create balanced tax systems that effectively generate revenue without encouraging tax evasion or harmful market distortions.

Historical Examples of the Cobra Effect in Tax Policies

Historical examples of the cobra effect in tax policies include the 18th-century Bengal tax imposed by the British East India Company, which inadvertently encouraged farmers to cultivate more indigo plants to evade taxes, worsening the economic landscape. Another instance occurred in 17th-century France, where a tax on windows led homeowners to brick up their windows, reducing natural light and harming public health. These examples illustrate how poorly designed tax policies can trigger unintended economic behaviors that counteract their original goals.

How Tax Evasion Increases Due to Poorly Designed Taxes

Poorly designed taxes often create strong incentives for tax evasion by increasing compliance costs and reducing perceived fairness in the tax system. High tax rates on specific goods or income brackets can drive individuals and businesses to conceal earnings or engage in informal economic activities. This unintended outcome, known as the cobra effect, highlights how aggressive taxation policies can backfire by expanding the underground economy and lowering overall tax revenue.

Tax Incentives Leading to Unintended Economic Outcomes

Tax incentives designed to stimulate investment sometimes trigger the cobra effect, where businesses exploit loopholes to maximize benefits without genuine economic contribution. For instance, grants intended to boost manufacturing might lead companies to artificially inflate production figures or shift profits offshore, resulting in negligible job creation. Such unintended consequences erode tax revenues and distort market efficiency, undermining the policy's original economic goals.

Case Study: The Window Tax and Housing Modifications

The Window Tax, introduced in 17th-century England, exemplifies the cobra effect where homeowners bricked up windows to avoid higher taxes, ironically reducing natural light and ventilation. This tax policy led to unhealthy living conditions and a decline in property values, undermining its fiscal intent. The unintended consequence highlights how poorly designed taxes can incentivize counterproductive modifications that harm both citizens and economic welfare.

Fuel Taxes and the Rise of Black Market Trading

Fuel taxes intended to reduce consumption often trigger a cobra effect, where higher prices encourage the rise of black market trading in untaxed or smuggled fuel. This illicit activity undermines government revenue and disrupts legitimate markets, leading to increased enforcement costs and loss of public trust. The unintended economic distortions highlight the challenges of designing effective tax policies without creating incentives for illegal behavior.

Sugar Taxes and Changes in Consumer Behavior

Sugar taxes intended to reduce soda consumption have sometimes led to unintended consequences, illustrating the Cobra Effect in tax policy. Consumers may switch to untaxed sugary alternatives or purchase larger quantities before price hikes take effect, undermining public health goals. This shift in consumer behavior demonstrates how poorly designed taxes can inadvertently increase sugar intake rather than decrease it.

Property Taxes Encouraging Urban Decay

Property taxes intended to fund public services can inadvertently accelerate urban decay by incentivizing property owners to neglect maintenance or abandon buildings to reduce taxable value. This tax-driven disinvestment often leads to lower property values and a deteriorating neighborhood environment, exacerbating economic decline. The resulting downward spiral reflects a classic example of the Cobra Effect, where well-meaning tax policies produce unintended consequences that harm urban communities.

Import Tariffs Sparking Smuggling and Revenue Loss

Imposing high import tariffs often triggers the cobra effect, where intended revenue increases backfire as smuggling surges to bypass taxes, leading to significant government revenue losses. In countries with steep tariffs on electronics and luxury goods, black market activities flourish, undermining official trade statistics and reducing taxable imports. This unintended consequence distorts the economy, eroding customs enforcement effectiveness and fueling illegal trade networks.

Lessons for Policymakers: Avoiding Cobra Effects in Tax Reforms

Policymakers must carefully design tax reforms to prevent unintended consequences, exemplified by the cobra effect where poor incentives lead to counterproductive behaviors such as tax evasion or black-market growth. Implementing comprehensive impact assessments and feedback mechanisms can identify potential loopholes before policy rollout. Ensuring transparency and stakeholder engagement helps align tax objectives with economic realities, minimizing distortions and fostering sustainable revenue generation.

example of cobra effect in tax Infographic

samplerz.com

samplerz.com