Seigniorage in fiat currency occurs when a government issues new money and benefits from the difference between the currency's face value and its production cost. For instance, the U.S. government prints Federal Reserve notes that cost only a few cents to produce but have a denomination value of one hundred dollars. This difference allows the government to finance spending without raising taxes or borrowing, effectively generating revenue through money creation. Central banks exploit seigniorage by increasing the money supply, which can influence inflation rates and economic growth. When the Federal Reserve buys government bonds using newly created money, it earns seigniorage by converting these bonds into liquid currency. This practice impacts monetary policy, affecting overall economic stability and purchasing power within the fiat currency system.

Table of Comparison

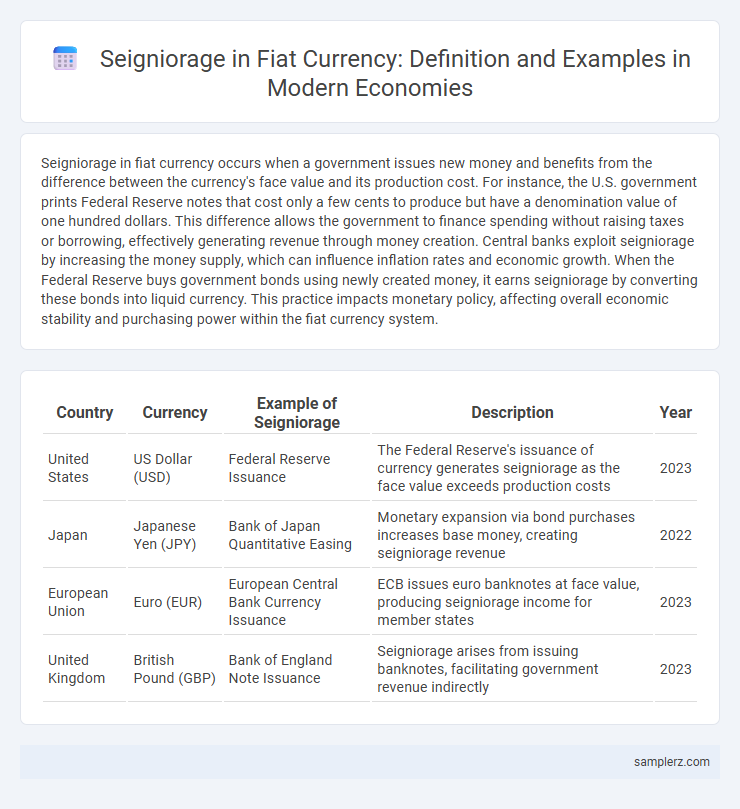

| Country | Currency | Example of Seigniorage | Description | Year |

|---|---|---|---|---|

| United States | US Dollar (USD) | Federal Reserve Issuance | The Federal Reserve's issuance of currency generates seigniorage as the face value exceeds production costs | 2023 |

| Japan | Japanese Yen (JPY) | Bank of Japan Quantitative Easing | Monetary expansion via bond purchases increases base money, creating seigniorage revenue | 2022 |

| European Union | Euro (EUR) | European Central Bank Currency Issuance | ECB issues euro banknotes at face value, producing seigniorage income for member states | 2023 |

| United Kingdom | British Pound (GBP) | Bank of England Note Issuance | Seigniorage arises from issuing banknotes, facilitating government revenue indirectly | 2023 |

Understanding Seigniorage in Modern Fiat Economies

Seigniorage in modern fiat economies refers to the profit governments earn by issuing currency, specifically the difference between the face value of money and the production costs. Central banks, such as the Federal Reserve in the United States or the European Central Bank, create new money to finance public spending without directly raising taxes. This process can influence inflation rates and government debt levels, making seigniorage a crucial factor in monetary policy and economic stability.

How Governments Profit: Seigniorage Explained

Governments profit from seigniorage by issuing fiat currency at a lower production cost than its face value, effectively creating revenue through money creation. This process allows central banks to finance public spending without immediate taxation or borrowing, although excessive issuance can lead to inflationary pressures. The balance between currency supply and economic stability is crucial for maximizing seigniorage benefits while maintaining price stability.

Practical Examples of Seigniorage with Fiat Money

Central banks generate seigniorage by issuing fiat currency, such as the U.S. Federal Reserve creating dollars that cost pennies to produce but hold full face value. During quantitative easing, governments expand the money supply, increasing seigniorage revenues as more currency enters circulation without corresponding physical backing. This practice allows states to finance deficits and public spending by effectively profiting from the difference between currency production costs and its nominal worth.

Seigniorage Revenues: Real-World Case Studies

Seigniorage revenues from fiat currency are notably illustrated by the United States, where the Federal Reserve generates substantial income by issuing the U.S. dollar, the world's primary reserve currency. This process allows the government to finance deficits at lower borrowing costs, as the difference between the face value of currency and its production cost contributes to public revenue. Similarly, Japan's Bank of Japan has leveraged seigniorage through extensive quantitative easing policies, expanding the monetary base to support economic growth while managing inflation risks.

The Process of Currency Creation and Seigniorage

Seigniorage in fiat currency is generated through the central bank's authority to issue new money, converting government debt into liquidity without direct taxation. When the central bank purchases government bonds with newly created money, it effectively earns revenue as the difference between the face value of bonds and the cost of printing currency. This process increases the money supply, enabling governments to finance expenditures while influencing inflation and economic growth.

Seigniorage in Central Bank Operations

Seigniorage in central bank operations occurs when the central bank issues fiat currency at a production cost significantly lower than its face value, generating revenue from the difference. This process finances government deficits without raising taxes by expanding the monetary base through open market operations or direct currency issuance. The resulting inflation risk requires careful monetary policy management to maintain price stability and public trust in the currency.

Seigniorage Gains During Economic Crises

Seigniorage gains occur when governments increase fiat currency issuance during economic crises, effectively financing deficits by expanding the monetary base. For example, during the 2008 financial crisis, central banks in the United States and Eurozone significantly raised currency supply, generating substantial seigniorage revenues that helped stabilize economies. These seigniorage gains provide governments with non-tax revenue, but excessive reliance risks inflationary pressures and currency devaluation.

Seigniorage and Inflation: Fiat Currency Dynamics

Seigniorage represents the profit a government earns from issuing fiat currency, calculated as the difference between the face value of money and its production cost. When central banks increase money supply without corresponding economic growth, seigniorage can lead to inflation by reducing the currency's purchasing power. This dynamic illustrates the delicate balance between utilizing seigniorage for fiscal financing and maintaining stable inflation rates in fiat currency economies.

Global Examples: Countries Benefiting from Seigniorage

Countries such as the United States and Japan benefit significantly from seigniorage by issuing fiat currencies like the US dollar and yen, which are widely accepted as global reserve currencies. The eurozone also gains seigniorage through the euro, facilitating transactions across multiple member states and generating revenue from currency issuance. Emerging economies like China increasingly leverage the yuan's growing international use to extract seigniorage revenue, supporting fiscal stability and economic growth.

The Economic Impact of Seigniorage in Fiat Systems

Seigniorage in fiat currency systems occurs when governments generate revenue by issuing currency beyond their reserves, leading to increased money supply and potential inflation. This process can finance public spending without immediate taxation but risks eroding purchasing power if overused. Central banks' control over seigniorage plays a critical role in maintaining economic stability and managing inflation expectations.

example of seigniorage in fiat currency Infographic

samplerz.com

samplerz.com