In economics, a Nash equilibrium occurs when no player can improve their payoff by unilaterally changing their strategy while the other players' strategies remain constant. One classic example involves two competing firms deciding whether to set high or low prices. If both firms choose low prices, neither firm can increase profit by switching to a high price alone, establishing a Nash equilibrium. Another example arises in oligopoly markets where firms choose quantities to produce. Suppose two companies simultaneously decide production levels to maximize profits based on expected output of the other. When both firms settle on output levels where neither benefits from changing their decision alone, they reach a Nash equilibrium, reflecting stable strategic behavior in the market.

Table of Comparison

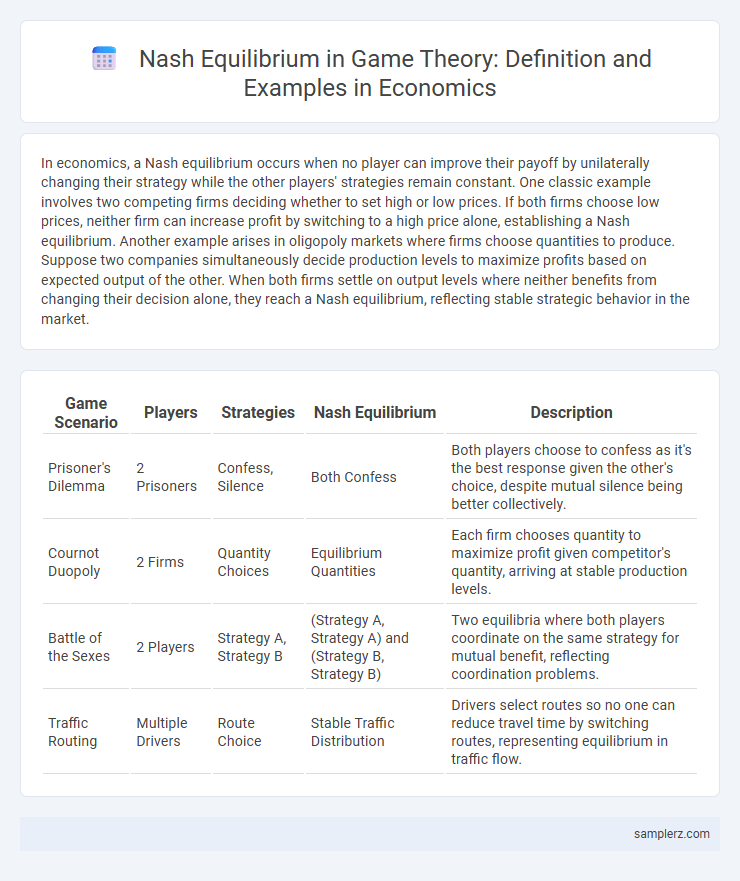

| Game Scenario | Players | Strategies | Nash Equilibrium | Description |

|---|---|---|---|---|

| Prisoner's Dilemma | 2 Prisoners | Confess, Silence | Both Confess | Both players choose to confess as it's the best response given the other's choice, despite mutual silence being better collectively. |

| Cournot Duopoly | 2 Firms | Quantity Choices | Equilibrium Quantities | Each firm chooses quantity to maximize profit given competitor's quantity, arriving at stable production levels. |

| Battle of the Sexes | 2 Players | Strategy A, Strategy B | (Strategy A, Strategy A) and (Strategy B, Strategy B) | Two equilibria where both players coordinate on the same strategy for mutual benefit, reflecting coordination problems. |

| Traffic Routing | Multiple Drivers | Route Choice | Stable Traffic Distribution | Drivers select routes so no one can reduce travel time by switching routes, representing equilibrium in traffic flow. |

Understanding Nash Equilibrium in Economic Games

Nash equilibrium in economic games occurs when no player can improve their payoff by unilaterally changing their strategy, given the strategies of others. For example, in a duopoly market, two firms deciding on production quantities reach a Nash equilibrium when neither firm can increase profits by altering output alone. This concept illustrates stable outcomes in competitive markets, guiding firms in strategic decision-making and predicting market behavior.

Classic Prisoner's Dilemma: A Nash Equilibrium Analysis

The Classic Prisoner's Dilemma illustrates a Nash equilibrium where both players choose to defect despite mutual cooperation yielding a better collective outcome. In this scenario, each player's optimal strategy, considering the other's choice, leads to a stable yet suboptimal equilibrium. This exemplifies how individual rationality in game theory results in outcomes that are not Pareto efficient.

Oligopoly Pricing: Nash Equilibrium among Competitors

In oligopoly pricing, Nash equilibrium occurs when competing firms choose their optimal prices simultaneously, resulting in no firm benefiting from unilaterally changing its price. For example, if two dominant firms in a market set prices where each firm's price maximizes its profit given the competitor's price, these prices constitute the Nash equilibrium. This strategic interdependence stabilizes market prices, preventing price wars and leading to predictable outcomes in oligopolistic markets.

Auction Strategies and Nash Equilibria Explained

In auction strategies, a Nash equilibrium occurs when each bidder's strategy is optimal given the strategies of others, such that no participant can increase their payoff by changing their bid independently. For example, in a first-price sealed-bid auction, bidders balance bid shading against the probability of winning, resulting in equilibrium bids below their true valuations. This strategic interaction ensures that each bidder's optimal choice depends on their beliefs about opponents' valuation distributions, highlighting the equilibrium's role in predicting bidding behavior.

Nash Equilibrium in Public Goods Provision

Nash Equilibrium in public goods provision occurs when individuals contribute to a public good at levels where no one can increase their benefit by unilaterally changing their contribution, given others' contributions. This equilibrium often results in under-provision of the public good since each participant balances personal cost against collective benefit. The classic example involves taxpayers deciding how much to contribute to public infrastructure, where free-riding leads to inefficiencies despite the collectively optimal investment.

Coordination Games: Reaching Equilibrium in Economics

In coordination games, Nash equilibrium occurs when all economic agents choose strategies that maximize mutual benefit, such as firms adopting compatible technology standards to capture network effects. A classic example is the battle of the sexes, where players coordinate their choices to avoid suboptimal outcomes, illustrating how equilibrium emerges from mutual expectations. These equilibria guide market behaviors in sectors with interdependent decisions, facilitating stable outcomes in pricing, production, and innovation strategies.

Nash Equilibrium in Labor Market Negotiations

In labor market negotiations, a Nash equilibrium occurs when both employers and employees settle on wage rates and work conditions where neither party benefits from changing their strategy unilaterally. For example, employers set wages low enough to control costs, while workers accept these wages to maintain employment, resulting in a stable outcome despite possible dissatisfaction. This equilibrium reflects strategic interdependence, balancing labor supply, demand, and bargaining power within competitive markets.

Trade War Strategies as Nash Equilibria

In trade war strategies, a Nash equilibrium occurs when competing countries choose tariff levels that maximize their own economic benefits given the other's decision, resulting in stable but suboptimal outcomes for both. For example, if both countries impose high tariffs, neither gains by unilaterally reducing tariffs, leading to mutual economic losses but strategic stability. This equilibrium highlights the challenges of cooperation in international trade negotiations where trust and communication are limited.

Real-world Case: Nash Equilibrium in Airline Scheduling

In airline scheduling, Nash equilibrium occurs when competing airlines select flight times and frequencies that prevent any single carrier from unilaterally improving its market share or profitability, leading to stable yet suboptimal slot allocations. For example, major airlines often match rivals' schedules to maintain capacity and avoid price wars, balancing passenger demand with operational costs. This strategic interdependence underscores how Nash equilibrium shapes competitive behaviors and efficiency in the aviation industry.

Nash Equilibrium’s Role in Environmental Policy Games

Nash equilibrium plays a critical role in environmental policy games by modeling strategic interactions among countries aiming to reduce pollution without unilateral disadvantages. For example, in international climate agreements, each nation's optimal strategy depends on others' commitments, creating a stable outcome where no country benefits from changing its emission reduction independently. This equilibrium concept helps economists design policies encouraging cooperation and preventing free-riding in global environmental efforts.

example of Nash equilibrium in game theory Infographic

samplerz.com

samplerz.com