The Heckscher-Ohlin model in trade explains how countries export goods that use their abundant factors of production intensively and import goods that use their scarce factors intensively. For example, the United States, abundant in capital and technology, exports machinery and electronics, while importing labor-intensive textiles from countries like Bangladesh. This model emphasizes factor endowments such as capital, labor, and land as key determinants of comparative advantage. A historical instance of the Heckscher-Ohlin model is post-World War II Japan, which, rich in labor but scarce in natural resources, focused on exporting labor-intensive manufacturing products like textiles and consumer electronics. Meanwhile, resource-rich countries like Australia exported minerals and agricultural products. Data from international trade flows supports the pattern where countries specialize according to their factor abundance, validating the Heckscher-Ohlin trade theory.

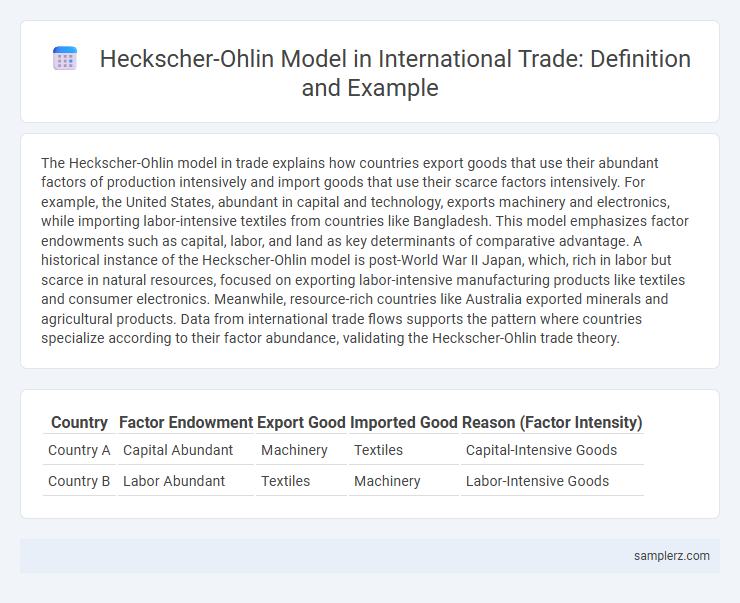

Table of Comparison

| Country | Factor Endowment | Export Good | Imported Good | Reason (Factor Intensity) |

|---|---|---|---|---|

| Country A | Capital Abundant | Machinery | Textiles | Capital-Intensive Goods |

| Country B | Labor Abundant | Textiles | Machinery | Labor-Intensive Goods |

Key Principles of the Heckscher-Ohlin Model

The Heckscher-Ohlin model emphasizes that countries export goods requiring abundant local factors of production while importing goods needing scarce factors. Its key principles include factor endowment differences, factor intensity of goods, and factor-price equalization across countries through trade. This model predicts that nations rich in capital will export capital-intensive products, whereas labor-abundant countries focus on labor-intensive exports.

Real-World Examples of Heckscher-Ohlin in Action

The Heckscher-Ohlin model explains trade patterns by emphasizing countries' factor endowments, such as capital and labor. For example, the United States, abundant in capital, exports capital-intensive goods like machinery, while China, rich in labor, exports labor-intensive products such as textiles. These trade flows illustrate how nations specialize based on relative factor abundance, driving global comparative advantage.

Comparative Advantage Explained by Factor Endowments

The Heckscher-Ohlin model explains comparative advantage by emphasizing differences in factor endowments between countries, such as capital and labor abundance. Countries export goods that intensively use their abundant factors, like capital-rich nations specializing in machinery and labor-rich nations focusing on textiles. This trade pattern reflects the efficient allocation of resources, maximizing overall economic welfare and productivity.

Case Study: Textile Trade Between China and the United States

The Heckscher-Ohlin model explains the textile trade between China and the United States by highlighting China's abundance of labor as a key factor in its comparative advantage. China exports labor-intensive textiles to the U.S., where capital is more abundant and labor costs are higher. This trade pattern reflects the model's prediction that countries specialize in goods utilizing their abundant production factors.

Resource Abundance and Export Patterns: Saudi Oil Exports

Saudi Arabia's abundant oil reserves exemplify the Heckscher-Ohlin model by demonstrating resource-based comparative advantage in international trade. The country's vast natural resource endowment leads to a specialization in oil exports, aligning with the model's prediction that nations export goods utilizing their abundant factors intensively. This pattern underscores how resource abundance shapes export composition and trade flows in global markets.

Developing vs. Developed Countries and Factor Proportions

The Heckscher-Ohlin model explains that developing countries, abundant in labor but scarce in capital, specialize in labor-intensive goods, while developed countries, rich in capital and technology, focus on capital-intensive products. This factor proportions theory predicts comparative advantage based on differences in resource endowments, driving trade patterns between nations at different development stages. Empirical evidence shows that nations export goods utilizing their abundant factors, reinforcing economic specialization and global trade dynamics.

Trade in Agricultural Goods: Australia and Wheat Exports

Australia's abundant land and favorable climate create a comparative advantage in wheat production, driving significant exports in global agricultural markets. The Heckscher-Ohlin model explains this trade pattern by highlighting Australia's factor endowments of capital and land, which are intensively used in wheat farming. Consequently, Australia specializes in wheat exports while importing manufactured goods that require more capital and labor-intensive production.

Technology-Intensive Exports: Germany’s Machinery Industry

Germany's machinery industry exemplifies the Heckscher-Ohlin model through its specialization in technology-intensive exports due to abundant skilled labor and advanced capital equipment. The country's comparative advantage is rooted in high human capital and innovative manufacturing processes, enabling it to dominate global markets in precision machinery and industrial automation. This aligns with the model's prediction that nations export goods requiring factors they possess in relative abundance, such as Germany's capital and skilled labor in technology-driven sectors.

Labor-Intensive vs. Capital-Intensive Exports: India and Japan

India, abundant in labor, specializes in labor-intensive exports such as textiles and garments, while Japan, rich in capital, focuses on capital-intensive exports like automobiles and electronics. The Heckscher-Ohlin model explains this trade pattern by highlighting comparative advantage derived from factor endowments. These differing factor intensities drive specialization and bilateral trade, exemplifying how countries export goods aligned with their abundant inputs.

Contemporary Applications and Criticisms of Heckscher-Ohlin

The Heckscher-Ohlin model explains contemporary trade patterns by highlighting how countries export goods that intensively use their abundant factors, such as capital in developed nations and labor in developing countries. Empirical studies reveal limitations of the model in accounting for technological differences and intra-industry trade prevalent in modern economies. Critics argue that factor endowments alone cannot fully explain trade flows, emphasizing the role of innovation, economies of scale, and global value chains in shaping current international commerce.

example of Heckscher-Ohlin model in trade Infographic

samplerz.com

samplerz.com