Japan's economy experienced a notable liquidity trap during the 1990s and early 2000s, following the burst of its asset price bubble. Despite the Bank of Japan lowering interest rates to near zero, consumer spending and investment remained stagnant, signaling a failure of monetary policy to stimulate demand. This prolonged period of economic stagnation highlighted the challenges faced when liquidity traps render traditional interest rate adjustments ineffective. The zero-interest-rate policy (ZIRP) and quantitative easing measures were implemented extensively in Japan to combat deflation and revive economic growth. Data from the period show persistently low inflation rates alongside high levels of public debt, underscoring the trap's impact on fiscal policy options. Japan's case remains a key study in understanding liquidity traps and their implications for economies experiencing prolonged deflationary pressures.

Table of Comparison

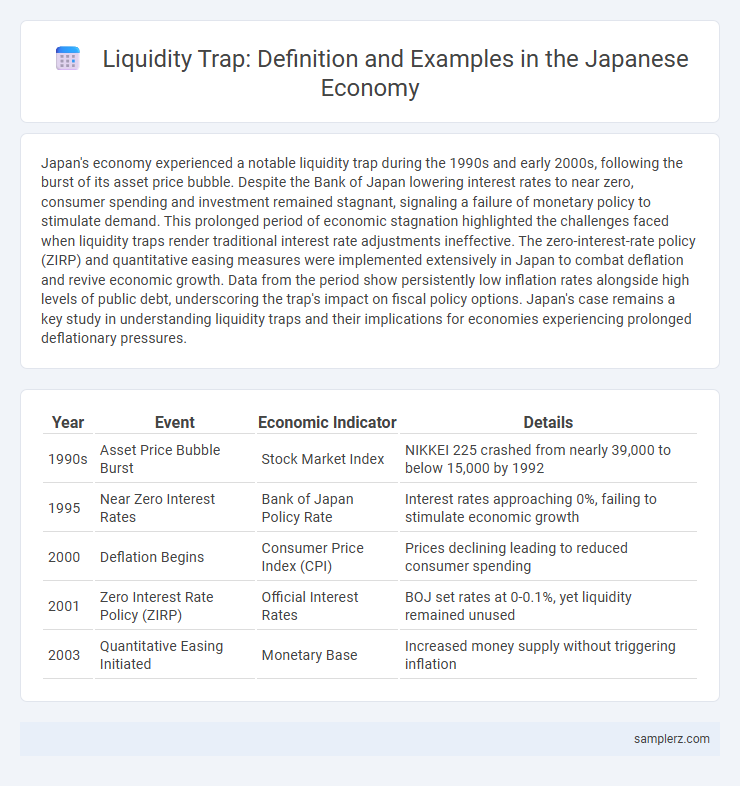

| Year | Event | Economic Indicator | Details |

|---|---|---|---|

| 1990s | Asset Price Bubble Burst | Stock Market Index | NIKKEI 225 crashed from nearly 39,000 to below 15,000 by 1992 |

| 1995 | Near Zero Interest Rates | Bank of Japan Policy Rate | Interest rates approaching 0%, failing to stimulate economic growth |

| 2000 | Deflation Begins | Consumer Price Index (CPI) | Prices declining leading to reduced consumer spending |

| 2001 | Zero Interest Rate Policy (ZIRP) | Official Interest Rates | BOJ set rates at 0-0.1%, yet liquidity remained unused |

| 2003 | Quantitative Easing Initiated | Monetary Base | Increased money supply without triggering inflation |

Overview of Japan’s Liquidity Trap

Japan's liquidity trap emerged prominently during the 1990s when deflationary pressures and prolonged economic stagnation rendered monetary policy ineffective despite near-zero interest rates. Banks accumulated excess reserves, while consumers and businesses hoarded cash rather than invest or spend, stalling economic growth. Persistent deflation and weak demand exemplified challenges in escaping the liquidity trap, highlighting structural issues within Japan's financial system and policy framework.

Historical Background: Japan’s Lost Decades

Japan's Lost Decades refer to the prolonged period of economic stagnation following the asset price bubble burst in the early 1990s, resulting in a liquidity trap where nominal interest rates approached zero but investment and consumption remained sluggish. The Bank of Japan implemented near-zero interest rates and quantitative easing policies, yet inflation stayed below the target, illustrating the inefficacy of traditional monetary tools in overcoming deflationary pressures. This period exemplifies how a liquidity trap can impede economic growth despite extensive monetary stimulus efforts.

Causes of the Liquidity Trap in Japan

Japan's liquidity trap during the 1990s was primarily caused by deflationary pressures and stagnant economic growth following the burst of the asset price bubble. Persistent low interest rates failed to stimulate demand as consumer confidence eroded and expectations of falling prices led to deferred consumption and investment. Structural factors such as an aging population and excessive corporate debt further constrained monetary policy effectiveness, reinforcing the trap.

Impact of Deflation on Japanese Economy

Japan's prolonged liquidity trap exemplifies severe deflation's impact, where persistent price declines discouraged consumer spending and business investment, stalling economic growth. The Bank of Japan's ultra-low interest rates failed to stimulate demand, as households and firms hoarded cash anticipating further deflation. This deflationary spiral suppressed wages and corporate profits, leading to stagnant GDP growth and long-term economic stagnation.

Monetary Policy Responses by Bank of Japan

The Bank of Japan's response to the liquidity trap involved pioneering extensive quantitative easing measures, including large-scale asset purchases and near-zero interest rates to stimulate economic activity. Despite these efforts, persistent deflation and sluggish demand limited the effectiveness of conventional monetary policy tools, highlighting the complexity of overcoming entrenched liquidity traps. The BOJ's adaptive strategies, such as forward guidance and yield curve control, aimed to anchor inflation expectations and encourage lending in an environment of prolonged economic stagnation.

Effectiveness of Quantitative Easing in Japan

Japan's liquidity trap during the 1990s and 2000s illustrated the limited effectiveness of Quantitative Easing (QE) despite massive asset purchases by the Bank of Japan. Prolonged low interest rates and deflationary pressures diminished QE's ability to stimulate consumption and investment, resulting in stagnant economic growth. The persistent liquidity trap highlighted challenges in monetary policy transmission when traditional tools fail to boost aggregate demand.

Low Interest Rates and Savings Behavior

Japan's prolonged liquidity trap is characterized by near-zero interest rates that have failed to stimulate consumption, as households prioritize high savings despite available credit. Persistent deflationary expectations compel consumers to save rather than spend, diminishing the effectiveness of monetary policy in boosting economic activity. This dynamic suppresses demand and constrains inflation, reinforcing stagnation within the economy.

Comparison with Other Global Liquidity Traps

Japan's liquidity trap in the 1990s and 2000s is characterized by near-zero interest rates and ineffective monetary policy despite aggressive quantitative easing, similar to the experiences of the Eurozone during its sovereign debt crisis. Unlike the U.S. liquidity trap post-2008 financial crisis, Japan's prolonged deflationary period created more persistent challenges in stimulating demand. The Bank of Japan's struggle contrasts with emerging markets, where liquidity constraints are often linked to structural and fiscal issues rather than purely monetary stagnation.

Lessons Learned from Japan’s Experience

Japan's prolonged liquidity trap in the 1990s and 2000s revealed the challenges of zero interest rate policies and excessive reliance on monetary easing without accompanying fiscal stimulus. Deflationary expectations entrenched consumer and business behaviors that depressed demand, highlighting the importance of coordinated policy measures to restore confidence. Japan's experience emphasizes that addressing liquidity traps requires proactive fiscal intervention alongside accommodative monetary policies to escape stagnation.

Future Prospects for Overcoming the Trap in Japan

Japan's economy faces ongoing challenges from a liquidity trap characterized by near-zero interest rates and stagnant demand despite aggressive monetary easing by the Bank of Japan. Future prospects for overcoming this trap hinge on innovative fiscal policies, structural reforms such as labor market flexibility, and leveraging technological advancements to boost productivity and consumer confidence. Addressing demographic issues through immigration and incentivizing private investment could further stimulate economic growth and escape the liquidity trap.

example of liquidity trap in Japan economy Infographic

samplerz.com

samplerz.com