Agflation refers to the rapid increase in agricultural commodity prices due to supply constraints, rising production costs, or demand surges. An example of agflation can be observed in the global wheat market, where adverse weather conditions in major producing regions like the U.S. and Russia have tightened supply. This supply disruption drove wheat prices up by nearly 50% within a single year, affecting food inflation worldwide. Another instance occurs in the corn market, where increased demand from biofuel production and livestock feed combined with drought impacts reduced yields. As a result, corn prices surged, contributing to higher costs for food and animal products. These price hikes illustrate how agflation influences inflation trends in commodity-driven economies.

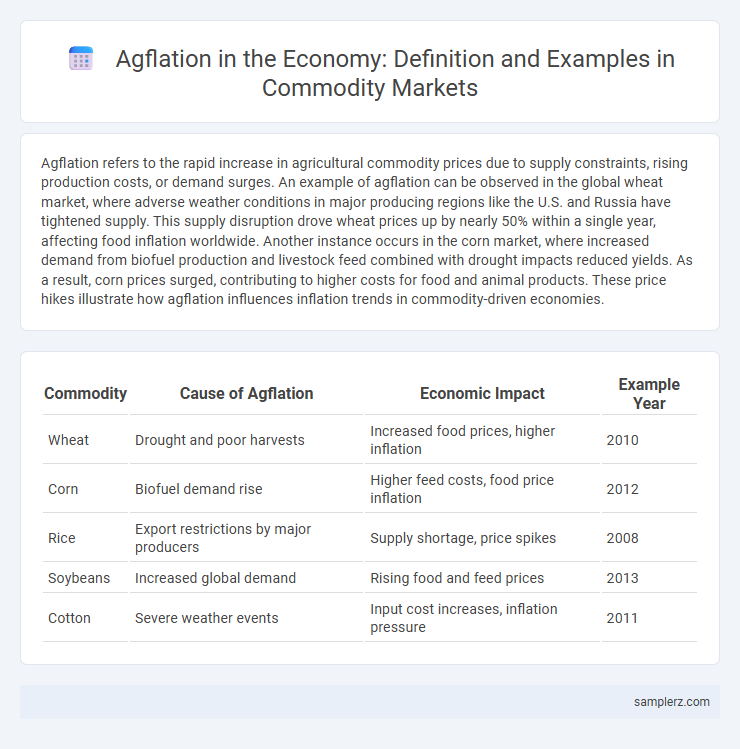

Table of Comparison

| Commodity | Cause of Agflation | Economic Impact | Example Year |

|---|---|---|---|

| Wheat | Drought and poor harvests | Increased food prices, higher inflation | 2010 |

| Corn | Biofuel demand rise | Higher feed costs, food price inflation | 2012 |

| Rice | Export restrictions by major producers | Supply shortage, price spikes | 2008 |

| Soybeans | Increased global demand | Rising food and feed prices | 2013 |

| Cotton | Severe weather events | Input cost increases, inflation pressure | 2011 |

Defining Agflation: Understanding the Phenomenon

Agflation refers to the rapid increase in agricultural commodity prices driven by factors such as supply chain disruptions, adverse weather conditions, and rising input costs like fertilizers and fuel. This phenomenon directly impacts staple commodities including wheat, corn, and soybeans, leading to inflationary pressures across food markets globally. Understanding agflation involves analyzing how these price surges affect consumer prices, food security, and overall economic stability.

Historical Overview of Agflation in Commodities

Agflation historically surged during the 1970s when oil price shocks triggered widespread increases in agricultural commodity costs, notably in wheat and corn. The 2007-2008 global food crisis exemplified agflation, driven by biofuel demand, adverse weather, and rising energy prices, causing staple crop prices to spike sharply. Such episodes underline the intricate link between energy markets and agricultural commodity prices, emphasizing the role of supply shocks and policy decisions in agflation dynamics.

Key Drivers Behind Agflation Events

Rising input costs such as fertilizers, fuel, and labor significantly drive agflation in commodity markets by increasing production expenses. Supply chain disruptions caused by extreme weather events or geopolitical tensions further restrict agricultural output, intensifying price pressures. Elevated global demand for food and biofuels exacerbates scarcity, pushing commodity prices higher and fueling persistent agflation trends.

Notable Global Examples of Agflation

Rising food prices in 2022 exemplified agflation, where wheat and corn prices surged due to supply chain disruptions and adverse weather conditions, impacting global markets like Russia, Ukraine, and the U.S. The 2007-2008 food crisis highlighted agflation with rice and soybean prices doubling amid increased biofuel demand and export restrictions from major producers such as India and Thailand. These notable global instances demonstrate how commodity-specific inflation pressures can trigger broad economic challenges.

Agflation and Its Impact on Food Staples

Agflation, characterized by rising agricultural commodity prices, directly drives up the cost of essential food staples such as wheat, corn, and rice. Factors like adverse weather, supply chain disruptions, and increased demand for biofuels intensify price volatility, impacting food security and inflation rates globally. This price surge strains household budgets, especially in low-income regions, leading to higher food inflation and increased socioeconomic challenges.

Case Study: Agflation in the Wheat Market

Rising global demand, adverse weather conditions, and supply chain disruptions have driven wheat prices upward, exemplifying agflation in the commodity market. In 2023, wheat futures surged by over 25%, intensifying food inflation and impacting global food security. This case highlights how agflation in wheat supply can trigger broader economic challenges, including increased costs for consumers and strain on agricultural economies.

Agflation Effects on Oilseed Commodities

Agflation significantly impacts oilseed commodities such as soybeans and canola by driving up production costs due to rising prices of fertilizers, fuel, and labor. Higher input costs lead to reduced crop yields and increased market prices, exacerbating food inflation and supply chain disruptions. This dynamic ultimately pressures both producers and consumers, fueling volatility in global oilseed markets.

Developing Economies and the Burden of Agflation

Developing economies face significant challenges due to agflation, as rising food commodity prices disproportionately impact low-income populations and strain government resources. Staple crops like rice, maize, and wheat often experience price surges driven by supply chain disruptions, climate change, and increased demand, exacerbating poverty and food insecurity. This burden limits economic growth and diverts funds from essential development programs, trapping vulnerable communities in cycles of inflation and instability.

Policy Responses to Agflation Scenarios

In response to agflation, governments often implement targeted fiscal policies such as subsidies on essential commodities like wheat and rice to stabilize prices and ensure affordability for low-income households. Central banks may adjust interest rates cautiously to avoid exacerbating supply-side inflation while supporting economic growth. Strategic reserves and import tariffs are also calibrated to balance domestic supply constraints and international market volatility.

Future Outlook: Mitigating Agflation Risks in Commodities

Rising demand for food and energy commodities driven by global population growth intensifies agflation risks in agricultural markets. Strategic investment in sustainable farming technologies and diversification of supply chains are critical to stabilizing prices and ensuring long-term resilience. Governments and private sectors must enhance data analytics and market transparency to anticipate supply shocks and implement timely interventions.

example of agflation in commodity Infographic

samplerz.com

samplerz.com