Quantitative easing (QE) is a monetary policy used by central banks to stimulate the economy during periods of low inflation and slow growth. An example of QE occurred in the United States during the 2008 financial crisis, when the Federal Reserve purchased large amounts of government bonds and mortgage-backed securities. This injected liquidity into the financial system, lowered interest rates, and encouraged lending and investment. Another significant instance of quantitative easing took place in Japan starting in the early 2000s, led by the Bank of Japan. The central bank bought government bonds and assets aggressively to combat deflation and stagnation in the Japanese economy. Data shows this policy helped maintain low borrowing costs and supported economic activity despite prolonged economic challenges.

Table of Comparison

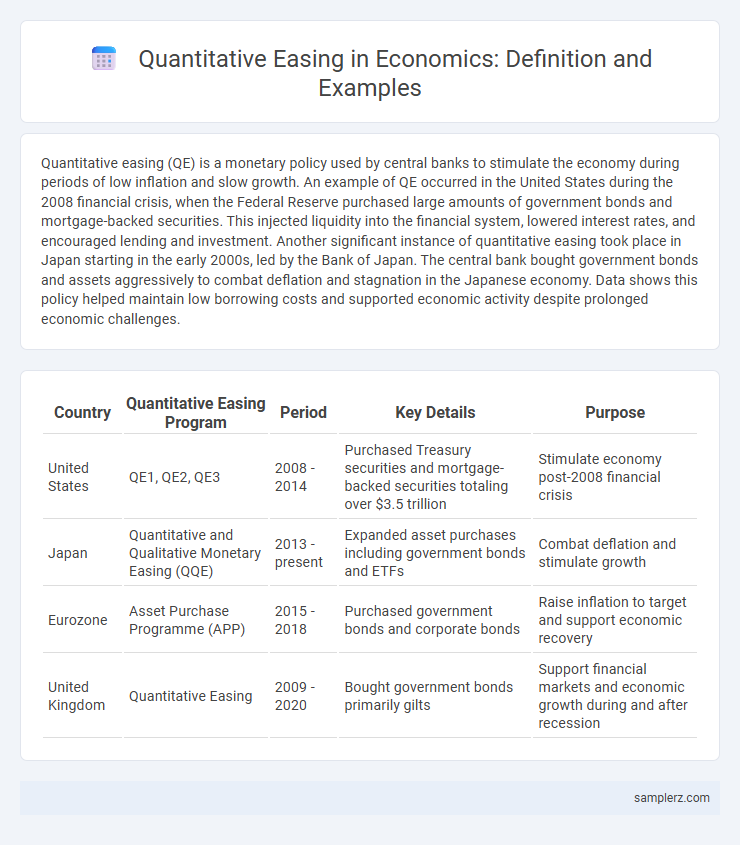

| Country | Quantitative Easing Program | Period | Key Details | Purpose |

|---|---|---|---|---|

| United States | QE1, QE2, QE3 | 2008 - 2014 | Purchased Treasury securities and mortgage-backed securities totaling over $3.5 trillion | Stimulate economy post-2008 financial crisis |

| Japan | Quantitative and Qualitative Monetary Easing (QQE) | 2013 - present | Expanded asset purchases including government bonds and ETFs | Combat deflation and stimulate growth |

| Eurozone | Asset Purchase Programme (APP) | 2015 - 2018 | Purchased government bonds and corporate bonds | Raise inflation to target and support economic recovery |

| United Kingdom | Quantitative Easing | 2009 - 2020 | Bought government bonds primarily gilts | Support financial markets and economic growth during and after recession |

Understanding Quantitative Easing: A Modern Monetary Tool

Quantitative easing (QE) involves central banks purchasing large-scale government securities or financial assets to increase money supply and stimulate economic activity during periods of low inflation and sluggish growth. The U.S. Federal Reserve's response to the 2008 financial crisis, where it bought trillions of dollars in mortgage-backed securities, exemplifies QE's impact on lowering long-term interest rates and encouraging lending. This modern monetary tool aims to boost consumption and investment when traditional monetary policy reaches its limits, effectively preventing deflation and fostering economic recovery.

Notable Examples of Quantitative Easing Worldwide

The United States implemented a series of quantitative easing programs between 2008 and 2014, purchasing over $4 trillion in government bonds to stabilize financial markets following the global financial crisis. The Bank of Japan has conducted ongoing quantitative easing since the early 2000s, expanding its balance sheet to more than 100% of GDP to combat deflation and stimulate economic growth. The European Central Bank initiated quantitative easing in 2015, acquiring approximately EUR2.6 trillion in assets to support the Eurozone economy during prolonged periods of low inflation and sluggish growth.

The Federal Reserve's Quantitative Easing Programs

The Federal Reserve's Quantitative Easing (QE) programs involved large-scale asset purchases, primarily U.S. Treasury securities and mortgage-backed securities, aimed at lowering long-term interest rates and stimulating economic growth during and after the 2008 financial crisis. From 2008 to 2014, the Fed implemented three major QE rounds, injecting trillions of dollars into the economy to increase liquidity and encourage lending. These efforts helped stabilize financial markets, support asset prices, and promote job creation amid slow economic recovery.

European Central Bank’s Approach to Quantitative Easing

The European Central Bank (ECB) implemented quantitative easing (QE) starting in March 2015 by purchasing government bonds and private-sector assets totaling over EUR2.6 trillion to stimulate economic growth and prevent deflation in the Eurozone. This large-scale asset purchase program aimed to lower borrowing costs, increase liquidity, and boost inflation toward its target of just below 2%. The ECB's approach to QE significantly influenced interest rates and enhanced credit flow across member states during periods of sluggish economic recovery.

Bank of Japan’s Pioneering Use of Quantitative Easing

The Bank of Japan pioneered quantitative easing (QE) in the early 2000s to combat deflation and stimulate economic growth by purchasing government bonds and increasing the money supply. This approach aimed to lower long-term interest rates and encourage lending and investment amidst prolonged economic stagnation. The BOJ's strategy set a precedent for other central banks, influencing global monetary policy frameworks in response to financial crises.

Bank of England: Implementing Quantitative Easing Measures

The Bank of England implemented quantitative easing by purchasing government bonds to inject liquidity into the economy during the 2008 financial crisis, aiming to lower interest rates and stimulate borrowing. This policy expanded the central bank's balance sheet significantly, bolstering asset prices and supporting economic growth. Quantitative easing helped stabilize financial markets and maintain inflation targets amid sluggish economic recovery.

Economic Impact of Quantitative Easing Initiatives

Quantitative easing initiatives, such as the Federal Reserve's $4.5 trillion asset purchases following the 2008 financial crisis, significantly lowered long-term interest rates and boosted asset prices, stimulating borrowing and investment. These programs helped reduce unemployment rates by supporting economic growth and increasing liquidity in financial markets. However, prolonged quantitative easing also raised concerns about potential inflationary pressures and asset bubbles in sectors like housing and equities.

Quantitative Easing During the COVID-19 Pandemic

Quantitative easing during the COVID-19 pandemic involved central banks injecting trillions of dollars into financial systems to stabilize markets and support economic recovery. The Federal Reserve expanded its balance sheet by purchasing over $3 trillion in government bonds and mortgage-backed securities between March and December 2020. This unprecedented monetary policy action helped lower interest rates, increase liquidity, and mitigate the economic contraction caused by the global health crisis.

Comparing Quantitative Easing Across Major Economies

Quantitative easing (QE) policies differ significantly among major economies, with the U.S. Federal Reserve implementing over $4 trillion in asset purchases since 2008, primarily focusing on Treasury bonds and mortgage-backed securities. The European Central Bank's QE strategy involves buying government and corporate bonds across the Eurozone, totaling more than EUR3.5 trillion, aimed at combating deflation and stimulating growth. Japan's Bank of Japan maintains the largest relative scale of QE, expanding its balance sheet to exceed 130% of GDP by purchasing government bonds and exchange-traded funds to counter persistent deflationary pressures.

Lessons Learned from Quantitative Easing Policies

Quantitative easing (QE) policies, such as those implemented by the Federal Reserve during the 2008 financial crisis, demonstrated that large-scale asset purchases can lower long-term interest rates and support economic recovery. However, QE also revealed risks including asset price bubbles and increased income inequality due to disproportionate wealth gains among asset holders. Policymakers learned the importance of clear communication and exit strategies to prevent market disruptions and maintain financial stability post-QE.

example of quantitative easing in economy Infographic

samplerz.com

samplerz.com