The Quantity Theory of Money explains the relationship between the money supply and the general price level in an economy. According to this theory, if the money supply increases while the velocity of money and the volume of transactions remain constant, inflation will occur, causing prices to rise proportionally. This theory is summarized by the equation MV = PQ, where M represents the money supply, V the velocity of money, P the price level, and Q the output of goods and services. A practical example of the Quantity Theory of Money can be observed in hyperinflation scenarios, such as Zimbabwe during the late 2000s. The government rapidly increased the money supply to finance deficits, resulting in a sharp rise in prices and severe inflation. This example highlights how rapid increases in the quantity of money lead to corresponding increases in price levels, validating the theory's core premise within an economic context.

Table of Comparison

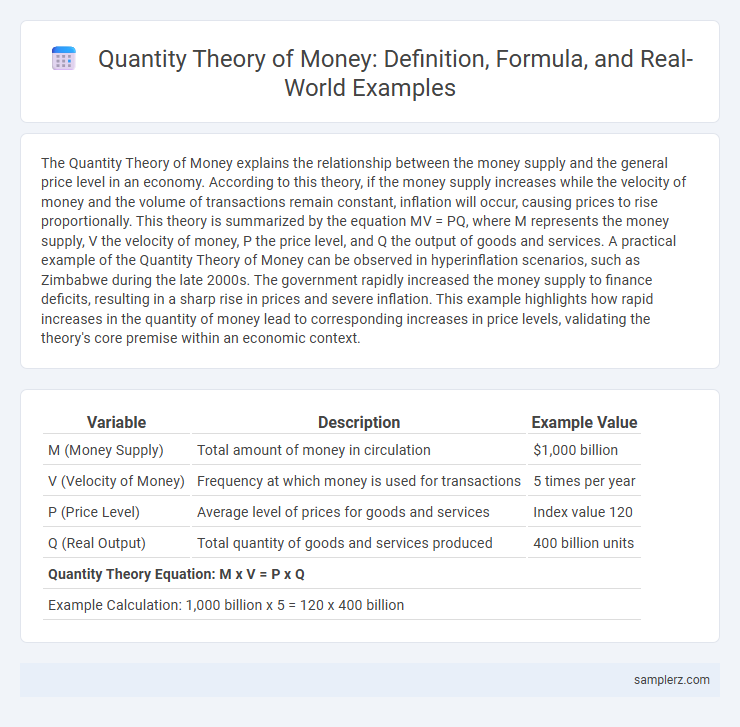

| Variable | Description | Example Value |

|---|---|---|

| M (Money Supply) | Total amount of money in circulation | $1,000 billion |

| V (Velocity of Money) | Frequency at which money is used for transactions | 5 times per year |

| P (Price Level) | Average level of prices for goods and services | Index value 120 |

| Q (Real Output) | Total quantity of goods and services produced | 400 billion units |

| Quantity Theory Equation: M x V = P x Q | ||

| Example Calculation: 1,000 billion x 5 = 120 x 400 billion | ||

Understanding the Quantity Theory of Money

The Quantity Theory of Money explains the relationship between money supply, velocity, price level, and economic output using the equation MV = PQ, where M is money supply, V is velocity, P is the price level, and Q represents real output. An increase in money supply (M) typically leads to proportional inflation (rise in P) if velocity (V) and real output (Q) remain constant, highlighting the direct impact of monetary policy on inflation rates. Central banks use this theoretical framework to manage inflation by controlling money supply growth in relation to the economy's production capacity.

Key Principles Behind the Quantity Theory

The Quantity Theory of Money centers on the equation MV = PY, where M represents money supply, V is velocity of money, P stands for price level, and Y denotes real output. A key principle is that changes in money supply directly influence the price level when velocity and real output are constant. This theory underlines that controlling the money supply is essential for managing inflation and economic stability.

The Equation of Exchange Explained

The Equation of Exchange, expressed as MV = PQ, illustrates the Quantity Theory of Money by linking the money supply (M) and velocity of money (V) to the price level (P) and output (Q) in an economy. This equation emphasizes how changes in the money supply directly influence nominal GDP when velocity and output remain constant. Central banks monitor this relationship to control inflation and stabilize economic growth by adjusting the money supply accordingly.

Classical Examples of Quantity Theory in Action

The Quantity Theory of Money is exemplified classically by the hyperinflation in Weimar Germany in the 1920s, where excessive increases in money supply led to a drastic rise in prices. Another notable example is the United States during the 1970s stagflation, where rapid money supply growth corresponded with inflationary pressures. These cases illustrate the direct relationship between money supply and price levels, a core principle of the Quantity Theory.

Hyperinflation: A Case Study of Weimar Germany

The Quantity Theory of Money explains the hyperinflation in Weimar Germany during the early 1920s, where excessive money supply growth led to a dramatic increase in price levels. The Reichsbank's mass printing of currency to pay war reparations caused the velocity of money to spike, resulting in prices doubling every few days. This historical case vividly illustrates how uncontrolled expansion of money supply relative to economic output can trigger extreme inflationary spirals.

The Role of Money Supply in Modern Economies

The Quantity Theory of Money emphasizes the direct relationship between money supply and price levels, asserting that an increase in money supply typically leads to inflation in modern economies. Central banks manipulate the money supply to control inflation, stabilize currency, and influence economic growth through monetary policy tools such as open market operations and reserve requirements. Empirical data from advanced economies show that excessive growth in money supply without corresponding output increase can erode purchasing power and disrupt economic stability.

US Economic History: The Quantity Theory Perspective

The Quantity Theory of Money explains the relationship between money supply and price levels in the US economy, particularly during the 1970s when rapid money supply growth led to high inflation rates. Historical data shows that the Federal Reserve's expansion of the money supply corresponded with rising Consumer Price Index (CPI), supporting the theory's assertion that excessive money supply growth causes inflation. This perspective highlights the importance of monetary policy control in maintaining price stability and fostering sustainable economic growth in the United States.

Criticisms and Limitations of the Quantity Theory

The Quantity Theory of Money, which links money supply directly to price levels, faces significant criticisms for its oversimplification of economic dynamics and neglect of factors like velocity fluctuations and demand for money. It assumes a stable velocity of money and ignores the role of financial innovation, institutional frameworks, and expectations in influencing inflation and output. Empirical evidence often shows weak correlation between money supply growth and inflation, highlighting limitations in its predictive power and policy applicability.

Comparing Quantity Theory with Other Monetary Theories

Quantity Theory of Money posits a direct relationship between money supply and price levels, emphasizing the equation MV = PT, where M is money supply, V is velocity, P is price level, and T is transaction volume. Unlike Keynesian monetary theory, which highlights interest rates and liquidity preference, Quantity Theory assumes velocity (V) and transaction volume (T) are stable, leading to a proportional impact of money supply changes on inflation. In contrast to Monetarism, while both prioritize money supply control, Quantity Theory treats velocity as constant whereas Monetarists accept its variability, influencing policy implications in managing inflation and economic growth.

Real-World Implications for Monetary Policy

The Quantity Theory of Money highlights the direct relationship between the money supply and price levels, emphasizing that excessive increases in money supply lead to inflation. Central banks use this principle to guide monetary policy by controlling inflation through measures such as adjusting interest rates and regulating money supply growth. Real-world cases, like hyperinflation in Zimbabwe, demonstrate how unchecked money supply expansion can destabilize economies, making adherence to the Quantity Theory critical for maintaining price stability.

example of Quantity Theory in money Infographic

samplerz.com

samplerz.com