Sweat equity in a business partnership refers to the non-monetary contribution made by partners through their time, effort, and expertise instead of financial investment. For example, a co-founder who takes on the role of business development and client acquisition without drawing a salary initially builds sweat equity. This type of contribution increases the partner's ownership stake based on their active involvement in growing the company. An example of sweat equity can be seen when a technical partner develops the company's core product, dedicating months of work before any capital is raised. The value of their work is often calculated based on comparable market salaries or project costs, converted into an equity share. This arrangement ensures that sweat equity holders are rewarded proportionally to their input, aligning their interests with the company's long-term success.

Table of Comparison

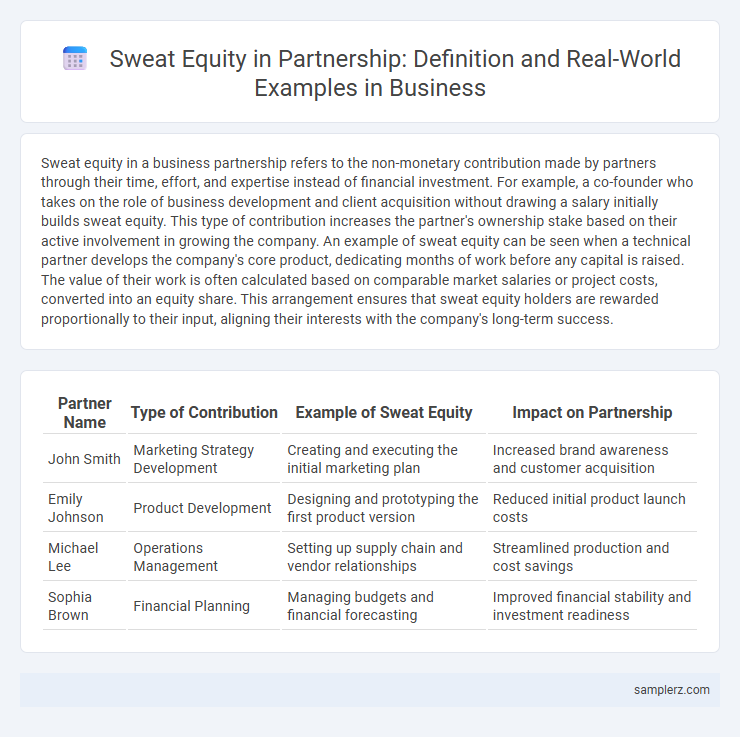

| Partner Name | Type of Contribution | Example of Sweat Equity | Impact on Partnership |

|---|---|---|---|

| John Smith | Marketing Strategy Development | Creating and executing the initial marketing plan | Increased brand awareness and customer acquisition |

| Emily Johnson | Product Development | Designing and prototyping the first product version | Reduced initial product launch costs |

| Michael Lee | Operations Management | Setting up supply chain and vendor relationships | Streamlined production and cost savings |

| Sophia Brown | Financial Planning | Managing budgets and financial forecasting | Improved financial stability and investment readiness |

Understanding Sweat Equity in Business Partnerships

Sweat equity in business partnerships refers to the non-monetary investment of time, effort, and expertise contributed by a partner to build and grow the business, often in exchange for ownership shares or profit participation. An example includes a co-founder who develops the company's product or manages operations without drawing a salary initially, thereby increasing the partnership's overall value. This approach aligns incentives and recognizes the critical role of active involvement beyond financial capital in business success.

Key Roles of Sweat Equity in Collaborative Ventures

Sweat equity plays a crucial role in collaborative ventures by enabling partners to contribute time, expertise, and effort instead of capital, thereby securing ownership stakes. In business partnerships, key roles of sweat equity include driving innovation, managing operations, and fostering client relationships to create value. This approach aligns incentives, promotes commitment, and balances resource contributions among partners.

Real-World Examples of Sweat Equity Arrangements

Sweat equity in business partnerships often involves one partner contributing labor, expertise, or time instead of capital investment, such as a co-founder managing operations while another provides funding. A notable example is tech startups where engineers develop the product in exchange for equity shares, aligning their work with ownership stakes. In real estate, partners might contribute sweat equity by handling renovations, increasing property value without monetary input, and earning a larger share of future profits.

Sweat Equity vs. Capital Investment: A Comparative Overview

Sweat equity in partnerships refers to the non-monetary investment contributed by a partner through labor, expertise, and time, often resulting in ownership stakes proportional to their input. Unlike capital investment, which involves direct financial contributions to business assets or operations, sweat equity emphasizes value creation through active participation and skill application. This distinction highlights how sweat equity partners gain equity based on effort rather than cash, impacting profit sharing and decision-making rights differently from traditional investors.

Legal Considerations for Sweat Equity in Partnerships

Sweat equity in partnerships involves allocating ownership shares based on non-monetary contributions such as time, skills, and effort, which must be clearly defined in the partnership agreement to avoid future disputes. Legal considerations include outlining the valuation method for sweat equity, vesting schedules, and the rights and responsibilities of partners contributing sweat equity. Proper documentation and compliance with local partnership laws ensure enforceability and protect all parties' interests.

Evaluating Sweat Equity Contributions: Metrics and Methods

Evaluating sweat equity contributions in partnerships involves quantifying non-monetary inputs such as time, expertise, and effort using metrics like hours worked, milestone achievements, and impact on business growth. Common methods include assigning fair market value to services rendered, benchmarking against industry standards, and utilizing performance-based valuation models. Accurate assessment ensures equitable ownership distribution and aligns partner incentives with company success.

Success Stories: Entrepreneurs Who Leveraged Sweat Equity

Entrepreneurs like Ben Silbermann, co-founder of Pinterest, exemplify sweat equity by investing time and expertise instead of capital during the company's early stages, ultimately securing substantial ownership. Another notable example is Sara Blakely, founder of Spanx, who contributed her innovative product development and marketing efforts as sweat equity, leading to a multibillion-dollar brand. These success stories highlight how founders leverage sweat equity to build significant value and attract investors in competitive markets.

Structuring Sweat Equity Agreements in Partnerships

Structuring sweat equity agreements in partnerships involves clearly defining the contributions, such as time, skills, and expertise, that partners provide instead of capital investment. Assigning a specific percentage of ownership based on the agreed value of sweat equity ensures fairness and aligns incentives for business growth. Legal frameworks should include vesting schedules and exit clauses to protect all parties and maintain partnership stability.

Common Challenges with Sweat Equity Distribution

In business partnerships, sweat equity is often granted based on time, effort, or expertise contributed rather than capital investment, but challenges arise in quantifying these non-monetary inputs accurately. Disputes frequently emerge over the valuation of sweat equity shares, especially when founders disagree on the relative importance of skills or hours dedicated. Establishing clear agreements, using measurable performance benchmarks, and regularly reassessing contributions can help mitigate conflicts in sweat equity distribution.

Best Practices for Managing Sweat Equity Partnerships

Sweat equity in business partnerships often involves one partner contributing time, skills, and expertise instead of capital, such as developing a product prototype or managing operations. Best practices for managing sweat equity partnerships include clearly defining roles and responsibilities, documenting contribution valuations, and establishing transparent communication channels to prevent conflicts. Formal agreements outlining equity distribution based on measurable milestones ensure fair recognition and maintain long-term collaboration trust.

example of sweat equity in partnership Infographic

samplerz.com

samplerz.com