A notable example of a microcap stock is Plug Power Inc., which operates within the alternative energy sector. Microcap stocks are typically defined by having a market capitalization between $50 million and $300 million. Plug Power's valuation places it in this category, making it a target for investors interested in small-cap equities with growth potential. Microcap companies like Plug Power often exhibit higher volatility compared to larger firms. These stocks are listed on exchanges such as the Nasdaq or OTC Markets, providing liquidity despite their smaller size. The data around microcap stocks include lower trading volumes and higher risk, but they can also offer significant returns when the company succeeds.

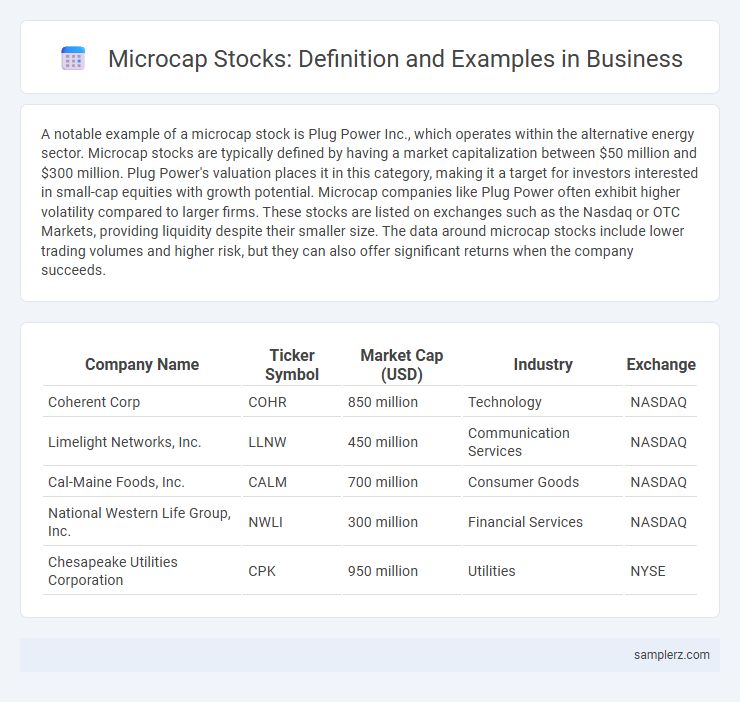

Table of Comparison

| Company Name | Ticker Symbol | Market Cap (USD) | Industry | Exchange |

|---|---|---|---|---|

| Coherent Corp | COHR | 850 million | Technology | NASDAQ |

| Limelight Networks, Inc. | LLNW | 450 million | Communication Services | NASDAQ |

| Cal-Maine Foods, Inc. | CALM | 700 million | Consumer Goods | NASDAQ |

| National Western Life Group, Inc. | NWLI | 300 million | Financial Services | NASDAQ |

| Chesapeake Utilities Corporation | CPK | 950 million | Utilities | NYSE |

Introduction to Microcap Stocks in Business

Microcap stocks typically represent companies with a market capitalization between $50 million and $300 million, often characterized by lower liquidity and higher volatility than larger firms. Examples include niche technology startups or emerging biotechnology firms, which attract investors seeking substantial growth potential despite increased risk. Understanding the dynamics of microcap stocks is essential for investors aiming to diversify portfolios with high-reward opportunities in the market.

Defining Microcap Stocks: Key Characteristics

Microcap stocks typically have a market capitalization ranging from $50 million to $300 million, representing small companies with limited liquidity and higher volatility compared to larger firms. These stocks often exhibit lower trading volumes and less analyst coverage, making them riskier but potential candidates for significant growth. Investing in microcaps requires careful analysis of financial health and market position due to their susceptibility to price manipulation and economic shifts.

Criteria for Identifying Microcap Companies

Microcap companies typically have a market capitalization between $50 million and $300 million, distinguishing them from small-cap and nano-cap stocks. Key criteria for identifying microcap stocks include low liquidity, limited analyst coverage, and higher volatility compared to larger firms. Investors often evaluate financial ratios such as price-to-earnings (P/E), debt-to-equity, and revenue growth to assess the potential risks and opportunities within this segment.

Advantages of Investing in Microcap Stocks

Microcap stocks, typically defined as companies with a market capitalization below $300 million, offer investors unique advantages such as high growth potential and the opportunity to discover undervalued companies before they gain mainstream attention. These stocks often experience greater price volatility, which skilled investors can leverage for significant returns. Early investment in microcap stocks can result in substantial capital appreciation as these companies expand and attract institutional interest.

Risks Associated with Microcap Investments

Microcap stocks, such as those of companies with market capitalizations under $300 million like Tupperware Brands Corporation (ticker: TUP), often face significant risks including low liquidity, high volatility, and limited financial disclosure. These factors increase the potential for price manipulation and make it difficult for investors to execute trades without affecting market prices significantly. Due to their smaller size and less established business models, microcap investments carry a higher risk of insolvency and unpredictable financial performance compared to larger, more stable companies.

Notable Examples of Microcap Stocks

Notable examples of microcap stocks include companies like Plug Power Inc. (PLUG), a leader in hydrogen fuel cell technology, and Sundial Growers Inc. (SNDL), a prominent cannabis producer. These stocks typically have market capitalizations ranging from $50 million to $300 million, often characterized by higher volatility and growth potential. Investors targeting microcap stocks should analyze financial health, market trends, and sector-specific catalysts to make informed decisions.

Industry Sectors Popular Among Microcap Companies

Microcap stocks frequently emerge within the healthcare, technology, and consumer discretionary sectors, reflecting their growth-oriented and innovation-driven nature. Industries such as biotechnology, software development, and specialty retail offer fertile ground for microcap companies to capitalize on niche markets and emerging trends. Investors often target these sectors for their potential high returns despite increased volatility compared to larger-cap counterparts.

How to Research and Evaluate Microcap Stocks

Microcap stocks, typically valued under $300 million in market capitalization, require thorough research due to their higher volatility and limited liquidity. Evaluating these stocks involves analyzing financial statements for consistent revenue growth, scrutinizing management's track record, and assessing industry position through competitive analysis. Utilizing tools like SEC filings, analyst reports, and market sentiment indicators helps investors identify promising microcap opportunities while managing risks effectively.

Regulatory Considerations for Microcap Stocks

Microcap stocks, such as those traded on the OTC Markets or Pink Sheets, often face stringent regulatory considerations due to their smaller market capitalizations, typically under $300 million. The SEC requires heightened disclosure and anti-fraud measures to protect investors from risks including limited liquidity and potential price manipulation. Investors should be aware of the ongoing compliance burdens and risks inherent in microcap securities when considering such investments.

Future Trends for Microcap Stocks in Business

Microcap stocks like Axion Technologies and BioNano Innovations often exhibit high volatility but possess significant growth potential driven by emerging sectors such as clean energy and biotechnology. Increasing investor interest in microcap stocks is fueled by advancements in AI integration, renewable energy adoption, and digital healthcare solutions, positioning these companies as pivotal players in future market expansions. Strategic investments in microcaps focusing on disruptive technologies can yield substantial returns as these businesses capitalize on evolving consumer demands and regulatory shifts.

example of microcap in stock Infographic

samplerz.com

samplerz.com