Keiretsu is a Japanese business network characterized by interlocking relationships among companies, often involving cross-shareholding and long-term partnerships. One prominent example is the Mitsubishi Group, which consists of diverse firms such as Mitsubishi Motors, Mitsubishi Electric, and Mitsubishi Heavy Industries, all connected through shared ownership and collaborative strategies. This structure fosters mutual support, resource sharing, and stability among member companies, enhancing their competitive advantage. Another significant example of keiretsu is the Sumitomo Group, which includes entities like Sumitomo Mitsui Banking Corporation, Sumitomo Chemical, and Sumitomo Metal Mining. These companies maintain close ties through financial links and cooperative business ventures across various industries. The keiretsu model promotes resilience by enabling member firms to coordinate efforts, reduce risks, and sustain growth despite market fluctuations.

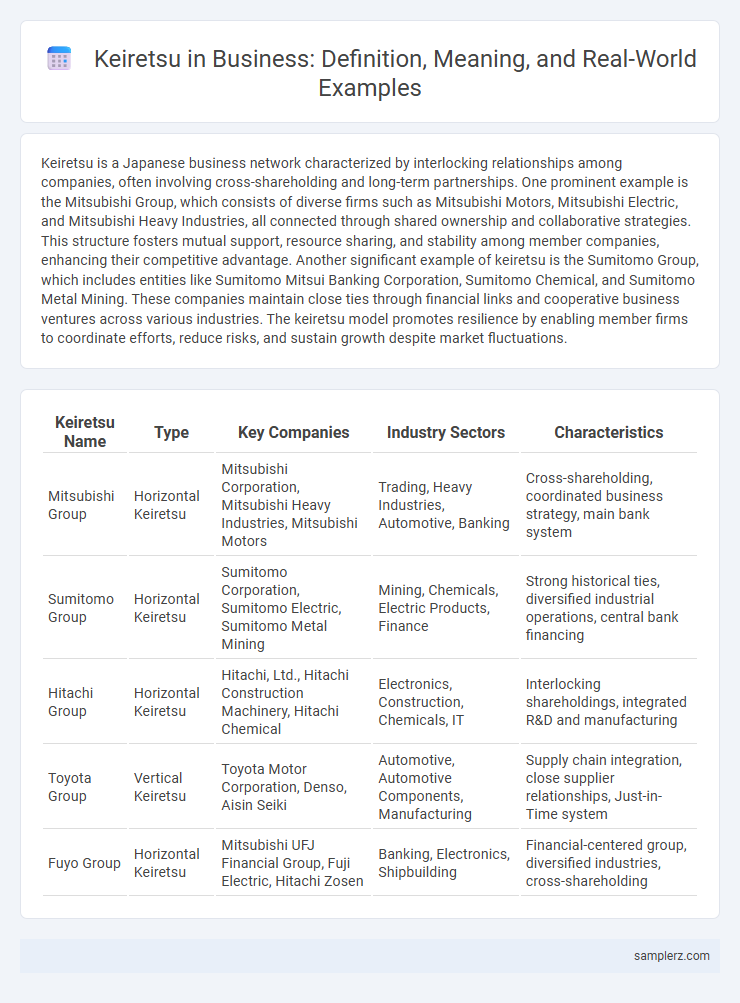

Table of Comparison

| Keiretsu Name | Type | Key Companies | Industry Sectors | Characteristics |

|---|---|---|---|---|

| Mitsubishi Group | Horizontal Keiretsu | Mitsubishi Corporation, Mitsubishi Heavy Industries, Mitsubishi Motors | Trading, Heavy Industries, Automotive, Banking | Cross-shareholding, coordinated business strategy, main bank system |

| Sumitomo Group | Horizontal Keiretsu | Sumitomo Corporation, Sumitomo Electric, Sumitomo Metal Mining | Mining, Chemicals, Electric Products, Finance | Strong historical ties, diversified industrial operations, central bank financing |

| Hitachi Group | Horizontal Keiretsu | Hitachi, Ltd., Hitachi Construction Machinery, Hitachi Chemical | Electronics, Construction, Chemicals, IT | Interlocking shareholdings, integrated R&D and manufacturing |

| Toyota Group | Vertical Keiretsu | Toyota Motor Corporation, Denso, Aisin Seiki | Automotive, Automotive Components, Manufacturing | Supply chain integration, close supplier relationships, Just-in-Time system |

| Fuyo Group | Horizontal Keiretsu | Mitsubishi UFJ Financial Group, Fuji Electric, Hitachi Zosen | Banking, Electronics, Shipbuilding | Financial-centered group, diversified industries, cross-shareholding |

Understanding Keiretsu: Definition and Significance in Business

Keiretsu, a Japanese business network model, consists of interconnected companies with cross-shareholdings and long-term partnerships that foster stability and collaborative growth. This system enhances supply chain efficiency, risk sharing, and mutual trust among manufacturers, suppliers, and financial institutions. Prominent examples include the Toyota Group, with its keiretsu structure enabling integrated production and innovation across automotive suppliers and affiliates.

Historical Roots of Keiretsu in Japan’s Economy

Keiretsu originated from pre-World War II zaibatsu conglomerates, which were dismantled during the Allied occupation of Japan to decentralize economic power. Post-war, keiretsu re-emerged as networks of interlocking shareholder relationships and business alliances among major corporations like Mitsubishi, Sumitomo, and Mitsui. These keiretsu played a crucial role in Japan's rapid economic growth by promoting long-term partnerships, stable supply chains, and collaborative innovation.

Toyota Group: The Classic Example of Keiretsu

The Toyota Group exemplifies a classic keiretsu structure, where interconnected companies maintain long-term relationships, share stakes, and collaborate closely to enhance competitiveness. Key members include Toyota Motor Corporation, Denso Corporation, Aisin Seiki, and Toyota Tsusho, which collectively ensure efficient supply chains and innovation. This intricate network fosters mutual stability, reduces risks, and drives sustained growth within Japan's industrial landscape.

Mitsubishi Keiretsu: Structure and Business Impact

Mitsubishi Keiretsu consists of a network of interlinked companies, including Mitsubishi Corporation, Mitsubishi Motors, and Mitsubishi Heavy Industries, connected through cross-shareholding and long-term business relationships. This structure fosters collaboration, resource sharing, and risk reduction, enabling Mitsubishi to maintain market stability and competitive advantage in diverse sectors such as automotive, finance, and heavy industry. The keiretsu model's impact includes enhanced operational efficiency, increased innovation capacity, and resilience against economic fluctuations.

Sumitomo Group: A Model of Collaborative Networks

The Sumitomo Group exemplifies a keiretsu, showcasing a tightly-knit network of interrelated companies collaborating strategically across industries like banking, manufacturing, and trading. This group structure enhances stability, resource sharing, and long-term business planning, exemplifying Japan's unique corporate governance model. Sumitomo's enduring partnerships and cross-shareholding practices drive innovation and competitive advantage within the global marketplace.

The Role of Financial Institutions in Keiretsu Systems

Financial institutions play a pivotal role in keiretsu systems by providing stable financing and facilitating close collaboration among member companies. Banks such as Mitsubishi UFJ Financial Group engage in cross-shareholding arrangements, enhancing trust and reducing financial risks across the network. This integrated financial support fosters long-term business growth and resilient intercompany relationships within the keiretsu structure.

Cross-Shareholding and Risk Reduction in Keiretsu

Keiretsu exemplifies cross-shareholding where member companies hold stakes in each other to foster long-term partnerships and stabilize business operations. This interconnected shareholding minimizes market volatility and financial risks by aligning corporate interests and ensuring mutual support across industries. Such risk reduction mechanisms promote resilience and sustained growth within the keiretsu network, enhancing competitive advantage in global markets.

Keiretsu Influence on Global Supply Chain Management

Keiretsu networks, such as those formed by Toyota, significantly influence global supply chain management by fostering long-term, trust-based relationships between manufacturers and suppliers. These intertwined business groups enhance coordination, reduce transaction costs, and promote joint innovation across international markets. Their integrated approach leads to improved supply chain resilience and efficiency, enabling firms to better navigate global disruptions.

Keiretsu vs. Western Business Alliances: Key Differences

Keiretsu in business, exemplified by Japanese conglomerates like Mitsubishi and Toyota, involves tightly-knit networks of companies with cross-shareholdings and long-term relationships, fostering mutual trust and coordinated strategies. In contrast, Western business alliances typically prioritize contractual agreements and shorter-term partnerships driven by market competition and individual shareholder value. The keiretsu model emphasizes stability and collective success, whereas Western alliances focus on flexibility and maximizing immediate financial returns.

Challenges and Evolution of Keiretsu in Modern Business

The traditional keiretsu system, characterized by interlinked Japanese corporations through cross-shareholding and coordinated business strategies, faces challenges such as increased global competition and regulatory scrutiny. Evolving from rigid hierarchies, modern keiretsu adapt by incorporating more flexible partnerships and embracing digital transformation to maintain competitiveness. These changes highlight the shift from tightly controlled alliances to dynamic networks responding to rapid market and technological shifts.

example of keiretsu in business Infographic

samplerz.com

samplerz.com