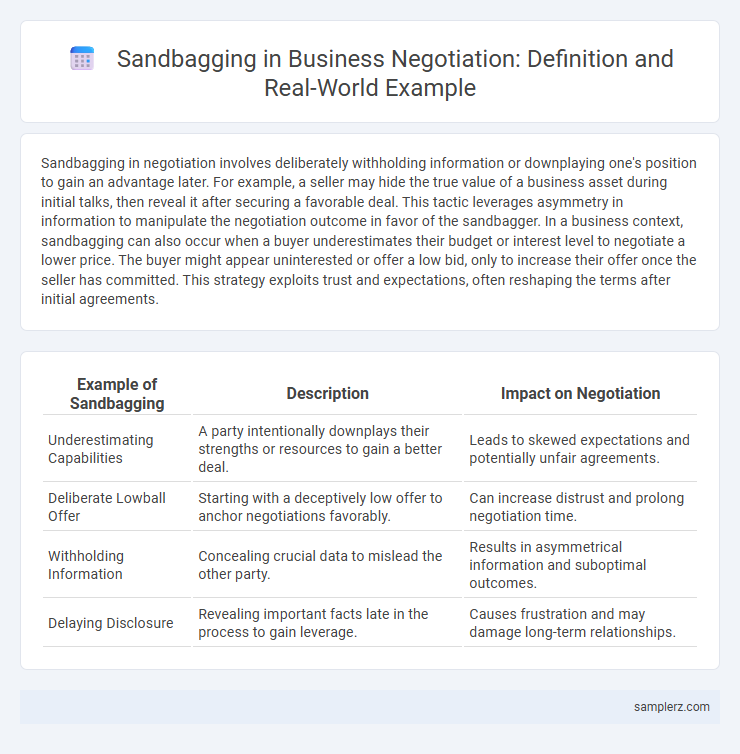

Sandbagging in negotiation involves deliberately withholding information or downplaying one's position to gain an advantage later. For example, a seller may hide the true value of a business asset during initial talks, then reveal it after securing a favorable deal. This tactic leverages asymmetry in information to manipulate the negotiation outcome in favor of the sandbagger. In a business context, sandbagging can also occur when a buyer underestimates their budget or interest level to negotiate a lower price. The buyer might appear uninterested or offer a low bid, only to increase their offer once the seller has committed. This strategy exploits trust and expectations, often reshaping the terms after initial agreements.

Table of Comparison

| Example of Sandbagging | Description | Impact on Negotiation |

|---|---|---|

| Underestimating Capabilities | A party intentionally downplays their strengths or resources to gain a better deal. | Leads to skewed expectations and potentially unfair agreements. |

| Deliberate Lowball Offer | Starting with a deceptively low offer to anchor negotiations favorably. | Can increase distrust and prolong negotiation time. |

| Withholding Information | Concealing crucial data to mislead the other party. | Results in asymmetrical information and suboptimal outcomes. |

| Delaying Disclosure | Revealing important facts late in the process to gain leverage. | Causes frustration and may damage long-term relationships. |

Understanding Sandbagging in Business Negotiations

Sandbagging in business negotiations occurs when one party deliberately understates their capabilities or reserves critical information to gain an advantage later in the deal-making process. For example, a seller might downplay the profitability of a company during valuation discussions only to reveal strong financials after securing a low purchase price. Recognizing sandbagging tactics helps negotiators mitigate risks, maintain trust, and steer conversations toward transparent and equitable agreements.

Classic Examples of Sandbagging Strategies

Classic examples of sandbagging in negotiation include deliberately underrepresenting a company's strengths to lower buyer expectations and then exceeding them post-deal, as seen in mergers and acquisitions. Sales teams often use sandbagging by withholding their full commitment to a deal until key contract terms are secured, maximizing leverage. Another strategy involves intentionally delaying disclosure of crucial information to maintain bargaining power and secure more favorable terms.

Sandbagging Tactics: Buyer’s Perspective

Buyers use sandbagging tactics in negotiation by intentionally underplaying their interest or ability to pay to secure a lower price or better terms. This often involves withholding key information about budget constraints or alternate offers to create a false impression of bargaining power. Strategic patience and controlled disclosure give buyers a competitive edge in acquiring favorable deals.

Sandbagging by Sellers: Real-World Scenarios

Sellers often engage in sandbagging by deliberately understating product defects or financial risks during mergers to secure higher offers. In one real-world scenario, a company concealed pending litigation risks until after deal closure, leveraging buyer oversight to maximize sale price. This tactic undermines trust but creates leverage by exploiting informational asymmetries in negotiation dynamics.

Case Study: Sandbagging in M&A Negotiations

In the landmark M&A negotiation between Company A and Company B, sandbagging occurred when Company A withheld critical financial information until after the deal closed, leveraging hidden liabilities to renegotiate terms post-acquisition. This strategic delay in disclosure, identified during due diligence, led to protracted legal disputes and a significant adjustment in the final purchase price. The case underscores the importance of transparent information exchange and thorough vetting in high-stakes mergers to prevent value erosion and safeguard stakeholder interests.

Subtle Signs of Sandbagging During Deal-Making

During deal-making, subtle signs of sandbagging include deliberately downplaying a company's financial performance to set lower expectations before revealing strong results. Negotiators may also provide vague or incomplete information about key assets, creating uncertainty that can be leveraged later. Another indicator is consistent reluctance to disclose timelines or project milestones, which can mask true progress or intentions.

Legal Implications of Sandbagging in Contracts

Sandbagging in contracts occurs when one party knowingly breaches a representation or warranty while concealing that knowledge during negotiation or closing, raising significant legal implications such as potential claims for fraud or breach of contract. Courts may differ in their treatment, with some allowing the aggrieved party to recover damages despite the sandbagger's pre-closing knowledge, thereby emphasizing the importance of clear contractual provisions addressing sandbagging. Including explicit anti-sandbagging clauses can mitigate litigation risks by defining whether parties waive or preserve their rights to claim breaches based on pre-closing knowledge.

How Sandbagging Affects Negotiation Outcomes

Sandbagging in negotiation occurs when one party deliberately underrepresents their position or resources to gain an advantage later in the deal, often leading to skewed expectations and mistrust. This tactic can result in suboptimal agreement terms, as the other party may concede more than necessary or feel deceived, damaging long-term business relationships. Studies show that sandbagging reduces negotiation efficiency and increases the likelihood of conflict post-agreement, ultimately impacting overall deal value and partnership sustainability.

Strategies to Detect and Counter Sandbagging

Sandbagging in negotiation often occurs when one party intentionally underplays their capabilities or lowers their initial offers to gain leverage later. Strategies to detect sandbagging include closely monitoring inconsistent statements and verifying the authenticity of presented information through third-party data or benchmarks. Countermeasures involve setting clear expectations, demanding transparency through detailed disclosures, and employing conditional agreements to mitigate the risk of unexpected concessions.

Ethical Considerations in Using Sandbagging Techniques

Sandbagging in negotiation involves intentionally underrepresenting information or intentions to gain an advantage, raising significant ethical concerns. Such tactics can undermine trust, damage long-term business relationships, and potentially lead to reputational harm or legal repercussions. Ethical negotiation practices prioritize transparency and fairness to foster sustainable partnerships and uphold corporate integrity.

example of sandbagging in negotiation Infographic

samplerz.com

samplerz.com