Greenmail in investment occurs when an investor acquires a significant stake in a company and threatens a hostile takeover. The targeted company responds by buying back the shares at a premium price to prevent the takeover. This strategy allows the greenmailer to profit from selling their shares at an inflated value. An example of greenmail is the case of T. Boone Pickens and Gulf Oil in the 1980s. Pickens purchased a large portion of Gulf Oil's stock and pressured the company to repurchase his shares at a higher price. Gulf Oil agreed to the buyback, resulting in substantial profits for Pickens and protecting the company from a takeover.

Table of Comparison

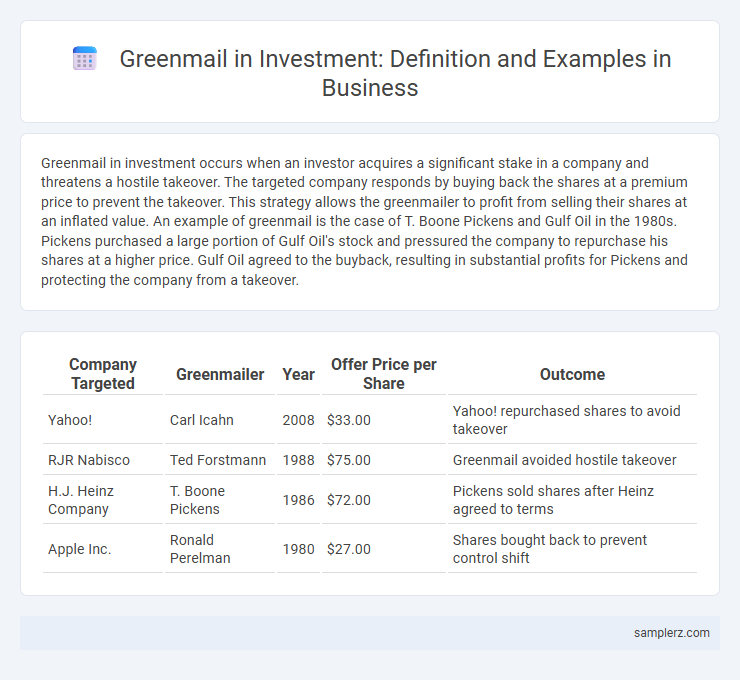

| Company Targeted | Greenmailer | Year | Offer Price per Share | Outcome |

|---|---|---|---|---|

| Yahoo! | Carl Icahn | 2008 | $33.00 | Yahoo! repurchased shares to avoid takeover |

| RJR Nabisco | Ted Forstmann | 1988 | $75.00 | Greenmail avoided hostile takeover |

| H.J. Heinz Company | T. Boone Pickens | 1986 | $72.00 | Pickens sold shares after Heinz agreed to terms |

| Apple Inc. | Ronald Perelman | 1980 | $27.00 | Shares bought back to prevent control shift |

Understanding Greenmail: Definition and Business Context

Greenmail involves an investor purchasing a significant stake in a company and threatening a hostile takeover to force the target company to buy back the shares at a premium. This tactic is often used as a defensive strategy or a form of corporate blackmail in mergers and acquisitions. Understanding greenmail highlights risks for companies concerning shareholder activism and governance vulnerabilities.

Historical Overview: Notable Greenmail Cases in Investment

Greenmail became notorious in the 1980s when investors like Sir James Goldsmith and T. Boone Pickens purchased significant shares in companies to force buybacks at premium prices, exemplifying aggressive takeover defenses. One of the most cited cases involved Goodyear Tire & Rubber Company, where investor Carl Icahn acquired shares and pressured the company for a lucrative buyback to avoid a hostile takeover. These historical greenmail episodes significantly influenced corporate governance reforms and regulatory measures to limit such practices in investment strategies.

Corporate Tactics: How Companies Respond to Greenmail

Companies facing greenmail often implement poison pills, granting shareholders rights to buy additional stock at a discount, diluting the potential greenmailer's holdings and making hostile takeovers more expensive. Firms also may negotiate directly with the greenmailer to repurchase shares at a premium, avoiding prolonged shareholder disputes and preserving corporate control. Legal defenses such as staggered board structures further impede greenmail attempts by limiting the speed at which greenmailers can gain influence.

Iconic Greenmail Example: The T. Boone Pickens Case

T. Boone Pickens' aggressive acquisition of shares in Gulf Oil during the 1980s exemplifies iconic greenmail, where he amassed a significant stake to pressure the company into buying back his shares at a premium. His strategy leveraged the threat of a hostile takeover to extract a lucrative buyout, highlighting the manipulative potential of greenmail in investment. This case underscores the impact of greenmail on corporate governance and shareholder value during that era.

Greenmail in the Tech Sector: Real-world Instances

Greenmail in the tech sector occurred when Microsoft repurchased millions of shares from activist investor Carl Icahn in the 1980s to prevent a hostile takeover. Another notable instance involved Yahoo! in 2008, where Microsoft bought back shares to avoid a proxy battle. These cases highlight strategic buybacks aimed at deterring takeover attempts by influential shareholders.

Legal and Regulatory Aspects Surrounding Greenmail

Greenmail involves an investor purchasing a large block of a company's stock and threatening a hostile takeover unless the company buys back the shares at a premium. Legal frameworks, including the Williams Act of 1968, regulate disclosure requirements and tender offer procedures to protect shareholders and maintain market fairness. Regulatory bodies like the SEC enforce anti-greenmail policies, ensuring transparency and deterring coercive buybacks in investment strategies.

Greenmail and Shareholder Value: A Double-Edged Sword

Greenmail, a tactic where investors buy enough shares to threaten a takeover and then force the target company to repurchase those shares at a premium, can significantly impact shareholder value by providing immediate gains for the greenmailer but often at the expense of long-term company prospects. While this practice may increase short-term stock prices, it frequently drains corporate resources and undermines investor confidence, ultimately eroding overall shareholder value. Firms facing greenmail must balance defending against hostile bids with protecting sustainable growth and maintaining shareholder trust.

Greenmail Strategies: Methods Investors Use

Greenmail strategies involve investors acquiring a significant stake in a target company to pressure management for a premium buyback of their shares, often above market value. Common methods include purchasing stock quietly to avoid price spikes and threatening a hostile takeover to push the company towards greenmail payments. This tactic leverages the potential for a costly battle, compelling companies to settle promptly and minimize disruption.

Impact of Greenmail on Corporate Governance

Greenmail occurs when a company buys back its own shares at a premium from a hostile bidder to prevent a takeover, often leading to significant financial costs for the firm. This practice undermines corporate governance by prioritizing short-term management protection over shareholder value and strategic growth. Consequently, greenmail can erode investor confidence and weaken the board's accountability and oversight functions.

Lessons Learned: Greenmail’s Influence on Modern Investment Practices

Greenmail, where investors purchase a substantial stake in a company to pressure it into buying back shares at a premium, highlights the risks of hostile takeovers and the importance of shareholder rights. Modern investment practices emphasize transparent communication and robust corporate governance to prevent such exploitative tactics. Lessons from greenmail incidents have led to regulatory reforms that protect companies from coercive buybacks and encourage long-term value creation for all stakeholders.

example of greenmail in investment Infographic

samplerz.com

samplerz.com