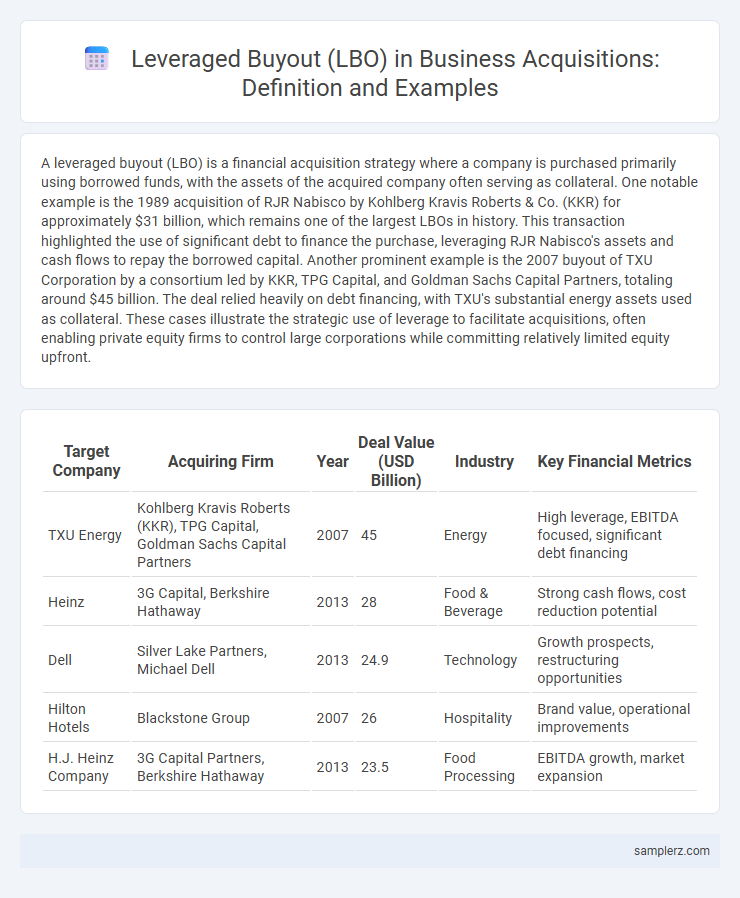

A leveraged buyout (LBO) is a financial acquisition strategy where a company is purchased primarily using borrowed funds, with the assets of the acquired company often serving as collateral. One notable example is the 1989 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) for approximately $31 billion, which remains one of the largest LBOs in history. This transaction highlighted the use of significant debt to finance the purchase, leveraging RJR Nabisco's assets and cash flows to repay the borrowed capital. Another prominent example is the 2007 buyout of TXU Corporation by a consortium led by KKR, TPG Capital, and Goldman Sachs Capital Partners, totaling around $45 billion. The deal relied heavily on debt financing, with TXU's substantial energy assets used as collateral. These cases illustrate the strategic use of leverage to facilitate acquisitions, often enabling private equity firms to control large corporations while committing relatively limited equity upfront.

Table of Comparison

| Target Company | Acquiring Firm | Year | Deal Value (USD Billion) | Industry | Key Financial Metrics |

|---|---|---|---|---|---|

| TXU Energy | Kohlberg Kravis Roberts (KKR), TPG Capital, Goldman Sachs Capital Partners | 2007 | 45 | Energy | High leverage, EBITDA focused, significant debt financing |

| Heinz | 3G Capital, Berkshire Hathaway | 2013 | 28 | Food & Beverage | Strong cash flows, cost reduction potential |

| Dell | Silver Lake Partners, Michael Dell | 2013 | 24.9 | Technology | Growth prospects, restructuring opportunities |

| Hilton Hotels | Blackstone Group | 2007 | 26 | Hospitality | Brand value, operational improvements |

| H.J. Heinz Company | 3G Capital Partners, Berkshire Hathaway | 2013 | 23.5 | Food Processing | EBITDA growth, market expansion |

Introduction to Leveraged Buyouts in Business Acquisitions

Leveraged buyouts (LBOs) involve acquiring a company primarily using borrowed funds, with the acquired company's assets serving as collateral. A notable example is the 2007 acquisition of TXU Corporation by Kohlberg Kravis Roberts (KKR) and TPG Capital, valued at $45 billion, highlighting the scale and financial engineering typical of LBOs. LBOs enable private equity firms to control companies with minimal equity, optimizing returns through strategic management and operational improvements.

Key Characteristics of Leveraged Buyouts

Leveraged buyouts (LBOs) involve acquiring a company primarily through debt financing, using the target's assets as collateral to secure loans. Key characteristics include high leverage ratios, management or private equity firms driving the acquisition, and an emphasis on improving operational efficiency to generate cash flow for debt repayment. Successful LBOs often feature a clear exit strategy, such as a public offering or sale, to realize returns on equity investment.

Classic Leveraged Buyout Example: The RJR Nabisco Deal

The RJR Nabisco leveraged buyout in 1989, valued at $25 billion, remains a quintessential example of a classic leveraged buyout (LBO) in business history. Kohlberg Kravis Roberts & Co. (KKR) orchestrated the acquisition using significant debt financing to purchase the conglomerate, leveraging future cash flows to service the debt. This deal highlighted the risks and rewards of LBOs, setting a precedent for large-scale acquisitions driven by financial leverage.

Notable LBO: The Hilton Hotels Acquisition by Blackstone

The Hilton Hotels acquisition by Blackstone in 2007 represents a notable leveraged buyout, valued at approximately $26 billion. Blackstone employed significant debt financing, leveraging Hilton's assets to optimize capital structure and drive operational improvements. This LBO exemplifies strategic use of leverage to enhance value in the hospitality industry through targeted management and financial restructuring.

Leveraged Buyout of Dell Technologies

The Leveraged Buyout (LBO) of Dell Technologies in 2013 stands as a landmark acquisition, orchestrated by Michael Dell in partnership with private equity firm Silver Lake Partners. This $24.4 billion transaction involved substantial debt financing, allowing the company to transition from public to private ownership and restructure operations away from shareholder pressures. The deal exemplifies strategic use of leverage to enable company turnaround and long-term value creation in the tech industry.

Famous LBO: Buyout of Kraft by Heinz and 3G Capital

The leveraged buyout of Kraft by Heinz and 3G Capital in 2015 exemplifies a high-profile acquisition where significant debt financing was utilized to acquire Kraft Foods Group for $45 billion. 3G Capital's aggressive cost-cutting strategies combined with Kraft Heinz's strong brand portfolio created substantial shareholder value post-LBO. This transaction showcased how private equity firms deploy leverage to drive operational efficiency and increase returns in large-scale consumer goods mergers.

Successful LBO: The Toys “R” Us Case Study

The successful leveraged buyout of Toys "R" Us in 2005, valued at approximately $6.6 billion, involved private equity firms Kohlberg Kravis Roberts (KKR), Bain Capital, and Vornado Realty Trust. By using significant debt financing exceeding 70% of the purchase price, the acquisition leveraged Toys "R" Us's assets to maximize return on equity. Despite initial operational improvements, the company's heavy debt burden and evolving retail landscape eventually led to bankruptcy in 2017, highlighting both the potential and risks of leveraged buyouts.

Recent LBO: Refinitiv Acquisition by Blackstone and Partners

The recent leveraged buyout of Refinitiv by Blackstone and its partners represents a landmark acquisition valued at approximately $20 billion. This deal showcases the strategic use of debt financing to amplify equity returns while enabling Blackstone to expand its footprint in financial data services. The transaction underscores the increasing trend of private equity firms leveraging LBOs to acquire technology-driven companies with strong cash flows.

Private Equity Influence in Leveraged Buyouts

Private equity firms play a critical role in leveraged buyouts (LBOs) by using significant amounts of debt to acquire companies, aiming to enhance value through strategic management and operational improvements. A notable example is the 2007 acquisition of TXU Energy by Kohlberg Kravis Roberts (KKR), which became one of the largest LBOs in history, valued at approximately $45 billion. This deal highlights private equity's influence in structuring complex financial arrangements to optimize returns while managing risk in high-stakes acquisitions.

Lessons Learned from Historic Leveraged Buyouts

The 1989 RJR Nabisco leveraged buyout, led by Kohlberg Kravis Roberts & Co., exemplifies critical lessons in acquisition strategy, particularly the importance of thorough due diligence and realistic debt management. Overleveraging can strain cash flow and limit operational flexibility, emphasizing the need for balanced financial structuring. Strategic post-acquisition integration and value creation remain essential to realizing returns in high-stakes LBO transactions.

example of leveraged buyout in acquisition Infographic

samplerz.com

samplerz.com