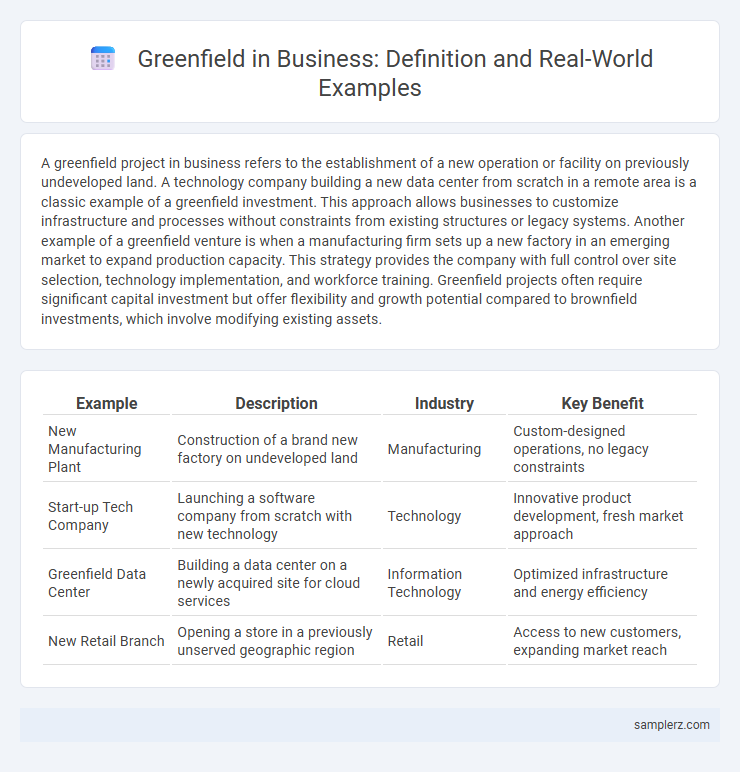

A greenfield project in business refers to the establishment of a new operation or facility on previously undeveloped land. A technology company building a new data center from scratch in a remote area is a classic example of a greenfield investment. This approach allows businesses to customize infrastructure and processes without constraints from existing structures or legacy systems. Another example of a greenfield venture is when a manufacturing firm sets up a new factory in an emerging market to expand production capacity. This strategy provides the company with full control over site selection, technology implementation, and workforce training. Greenfield projects often require significant capital investment but offer flexibility and growth potential compared to brownfield investments, which involve modifying existing assets.

Table of Comparison

| Example | Description | Industry | Key Benefit |

|---|---|---|---|

| New Manufacturing Plant | Construction of a brand new factory on undeveloped land | Manufacturing | Custom-designed operations, no legacy constraints |

| Start-up Tech Company | Launching a software company from scratch with new technology | Technology | Innovative product development, fresh market approach |

| Greenfield Data Center | Building a data center on a newly acquired site for cloud services | Information Technology | Optimized infrastructure and energy efficiency |

| New Retail Branch | Opening a store in a previously unserved geographic region | Retail | Access to new customers, expanding market reach |

Defining Greenfield Projects in Business

Greenfield projects in business refer to ventures initiated from scratch on undeveloped land or markets, allowing complete control over design and operations without constraints from existing infrastructure. Examples include constructing a new manufacturing plant in a foreign country or launching a tech startup in an emerging industry where no prior operations exist. These projects offer opportunities for innovation and market entry but require significant investment and risk management.

Key Characteristics of Greenfield Ventures

Greenfield ventures involve establishing new operations from scratch, allowing full control over business processes, infrastructure, and culture. Key characteristics include high capital investment, complete ownership, and the ability to tailor facilities to specific operational needs without legacy constraints. These ventures often lead to innovative product development and strategic market entry in untapped regions.

Benefits of Greenfield Investments

Greenfield investments enable businesses to establish operations from the ground up, allowing full control over the design, technology, and organizational culture, which promotes innovation and efficiency. These investments often lead to job creation, infrastructure development, and long-term economic growth in the host country, enhancing the company's market presence and local goodwill. Greenfield projects minimize integration challenges compared to mergers or acquisitions, providing tailored solutions aligned with corporate goals and regulatory compliance.

Greenfield vs. Brownfield: Core Differences

Greenfield projects involve starting a business or facility from scratch on undeveloped land, allowing complete control over design, technology, and infrastructure implementation. In contrast, brownfield projects focus on modifying or upgrading existing assets, often requiring remediation of environmental issues and adapting to pre-existing constraints. The core difference lies in the level of customization and risk: greenfield ventures offer high flexibility but greater initial investment, while brownfield developments typically benefit from existing structures but face regulatory and structural challenges.

Notable Greenfield Project Examples Globally

Notable greenfield projects globally include the Tesla Gigafactory in Nevada, which was built from scratch to accelerate electric vehicle production and battery technology innovation. The Shenzhen Bao'an International Airport in China represents a strategic investment in infrastructure development, facilitating increased trade and tourism growth. Meanwhile, Amazon Web Services' data centers constructed in multiple regions exemplify greenfield projects driving cloud computing expansion and digital transformation worldwide.

Greenfield Strategies in Emerging Markets

Greenfield strategies in emerging markets involve establishing new operations from scratch, allowing businesses to tailor facilities and processes to local demands and resources. Companies like Toyota in India and Samsung in Vietnam have successfully used greenfield investments to capitalize on market growth and build brand presence. These strategies enable firms to avoid legacy constraints and customize supply chains for competitive advantage.

Challenges in Greenfield Business Expansion

Greenfield business expansion involves establishing new operations from scratch in a foreign market, which presents significant challenges such as navigating unfamiliar regulatory environments, securing local talent, and managing high initial capital expenditure. Companies face risks related to cultural differences, infrastructure development, and market entry barriers that require substantial strategic planning and local market research. Limited local partnerships and uncertain demand forecasts further complicate operational scalability and profitability timelines.

Greenfield Investments by Multinational Corporations

Greenfield investments by multinational corporations involve establishing new operations or facilities from scratch in foreign markets, such as building manufacturing plants or research centers in emerging economies. These investments enable full control over assets and provide opportunities for customized infrastructure that aligns with corporate strategy and local regulations. Companies like Toyota and Samsung have successfully employed greenfield investments to expand their global presence while fostering local employment and technology transfer.

Factors Influencing Greenfield Success

Greenfield success in business heavily depends on strategic location selection, availability of skilled labor, and access to essential infrastructure such as transportation and utilities. Market demand analysis and regulatory environment including tax incentives and ease of doing business significantly impact operational feasibility. Financial resources and strong project management practices ensure timely execution and alignment with business objectives.

Future Trends in Greenfield Business Developments

Greenfield business developments are increasingly focused on sustainable infrastructure, integrating renewable energy sources and smart technologies to meet future market demands. Emerging sectors such as electric vehicle manufacturing and green data centers exemplify this trend by emphasizing environmental impact reductions and technological innovation. Companies investing in greenfield projects prioritize adaptability, ensuring facilities can evolve with advancements in AI, IoT, and clean energy solutions to maintain competitiveness.

example of greenfield in business Infographic

samplerz.com

samplerz.com