A capital stack in business refers to the hierarchy of financing sources used to fund an investment or company. It typically includes senior debt, mezzanine debt, preferred equity, and common equity, each representing different levels of risk and return. Senior debt is prioritized for repayment, usually carrying the lowest interest rate, while common equity sits at the bottom, bearing the highest risk with potential for greater returns. In a typical capital stack structure, senior debt might consist of bank loans or bonds, which provide secured funding with fixed interest payments. Mezzanine debt is often unsecured or subordinated and includes features like warrants or options to enhance returns. Preferred equity holders receive dividends before common shareholders but do not have voting rights, whereas common equity shareholders hold ownership and control but are last in line for payouts during liquidation.

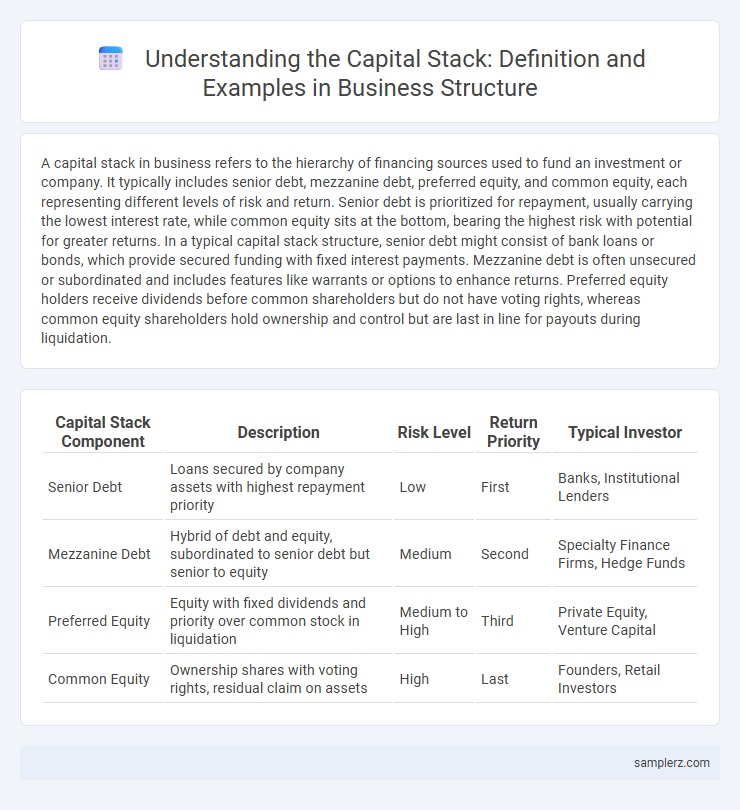

Table of Comparison

| Capital Stack Component | Description | Risk Level | Return Priority | Typical Investor |

|---|---|---|---|---|

| Senior Debt | Loans secured by company assets with highest repayment priority | Low | First | Banks, Institutional Lenders |

| Mezzanine Debt | Hybrid of debt and equity, subordinated to senior debt but senior to equity | Medium | Second | Specialty Finance Firms, Hedge Funds |

| Preferred Equity | Equity with fixed dividends and priority over common stock in liquidation | Medium to High | Third | Private Equity, Venture Capital |

| Common Equity | Ownership shares with voting rights, residual claim on assets | High | Last | Founders, Retail Investors |

Understanding the Capital Stack in Business Finance

The capital stack in business finance typically includes common equity, preferred equity, mezzanine debt, and senior debt, each with distinct risk and return profiles. Senior debt holds the highest claim on assets, followed by mezzanine debt, which blends debt and equity features, while preferred and common equity sit at the bottom, absorbing the most risk but offering higher potential returns. Understanding this hierarchy helps investors and companies assess financing costs, risk exposure, and the optimal mix for capital structure decisions.

Key Components of a Typical Capital Stack

A typical capital stack in business finance includes equity, mezzanine debt, and senior debt, each representing different risk and return profiles. Equity holders have ownership with the highest risk but potential for significant returns, while senior debt holders receive priority in repayment with lower risk and fixed returns. Mezzanine debt bridges the gap, offering subordinated debt with higher interest rates to compensate for increased risk compared to senior debt.

Senior Debt: Foundation of the Capital Stack

Senior debt forms the foundation of the capital stack by providing primary financing secured against assets with the highest repayment priority. Typically, it carries lower interest rates due to reduced risk and is senior to mezzanine debt and equity in the payment hierarchy. Its stability and lower cost make senior debt essential for leveraging business growth and managing capital structure efficiently.

Mezzanine Financing: Bridging Debt and Equity

Mezzanine financing occupies a crucial layer within the capital stack, positioned between senior debt and equity, often structured as subordinated debt with equity warrants. This hybrid instrument provides businesses with flexible capital, enabling growth without immediate dilution of ownership, while offering lenders higher returns compared to traditional loans. In commercial real estate or leveraged buyouts, mezzanine financing effectively bridges funding gaps, supporting projects that exceed senior debt capacity but fall short of full equity financing.

Preferred Equity: Priority Returns Explained

Preferred equity in a capital stack holds a senior position, providing investors with priority returns before common equity holders receive distributions. These returns are often fixed dividends or a pre-agreed percentage, ensuring predictable income with less risk compared to common equity. This structure benefits companies by attracting investors seeking stable cash flow without the full control rights of debt financing.

Common Equity: The Residual Stake

Common equity represents the residual stake in the capital stack after all debts and preferred shares are accounted for, making it the most junior and highest-risk layer in a business's capital structure. Investors holding common equity benefit from unlimited upside potential through dividends and capital appreciation but absorb losses first in case of liquidation. This equity typically captures the residual value of the company, aligning shareholder interests with long-term business growth and profitability.

Real-World Example of a Capital Stack Structure

A real-world example of a capital stack structure can be observed in a commercial real estate development project where the total financing consists of 60% senior debt, 25% mezzanine debt, and 15% equity from the developer and investors. Senior debt is secured against the property and takes priority in repayment, while mezzanine debt acts as a subordinated loan with higher interest rates to bridge the gap between senior debt and equity. Equity holders assume the highest risk but benefit from potential residual profits after debts are serviced, illustrating the layered risk-return profile of the capital stack in business financing.

Capital Stack Hierarchy and Risk Allocation

The capital stack hierarchy typically consists of senior debt, mezzanine debt, preferred equity, and common equity, each with distinct risk and return profiles. Senior debt holds the highest repayment priority and carries the lowest risk, while common equity occupies the lowest priority but offers the highest potential return. Risk allocation favors debt holders with fixed repayments, whereas equity investors absorb residual risk and benefit from upside growth in business value.

Strategies for Optimizing Your Capital Stack

A typical capital stack in business structure includes senior debt, mezzanine debt, preferred equity, and common equity, each carrying different risk and return profiles. Strategies for optimizing your capital stack involve balancing cost of capital, maintaining control, and enhancing financial flexibility to support growth and mitigate risks. Employing a mix of lower-cost debt with strategic equity partnerships can maximize returns while preserving operational autonomy.

How Capital Stack Impacts Business Valuation

The capital stack, composed of senior debt, mezzanine debt, preferred equity, and common equity, directly influences business valuation by determining the cost of capital and risk distribution among investors. A higher proportion of equity can increase valuation due to greater risk absorption, while excessive debt may lower valuation by raising financial risk. Understanding the capital stack structure enables accurate assessment of business worth and investor return potential.

example of capital stack in structure Infographic

samplerz.com

samplerz.com