Greenmail in business negotiation occurs when an investor acquires a significant stake in a company and threatens a hostile takeover. The targeted company then buys back the shares at a premium to prevent the takeover, resulting in a profitable exit for the investor. This tactic pressures management to pay more than the market value to maintain control. A classic example of greenmail took place in the 1980s when investor Sir James Goldsmith purchased a large portion of Crown Zellerbach Corporation. The company responded by repurchasing the shares at a premium, allowing Goldsmith to profit without pursuing an actual takeover. This case highlights how greenmail leverages threat and financial pressure to extract gains from corporate negotiations.

Table of Comparison

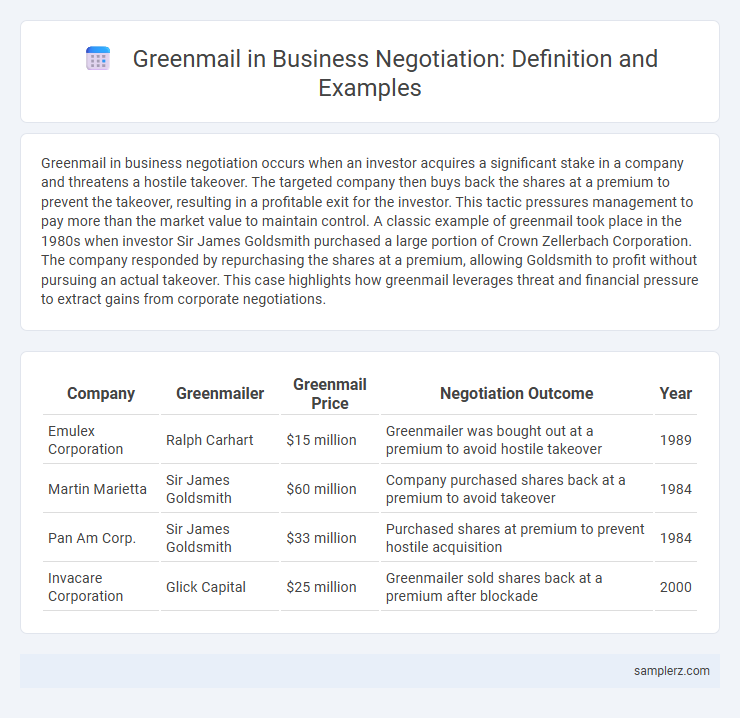

| Company | Greenmailer | Greenmail Price | Negotiation Outcome | Year |

|---|---|---|---|---|

| Emulex Corporation | Ralph Carhart | $15 million | Greenmailer was bought out at a premium to avoid hostile takeover | 1989 |

| Martin Marietta | Sir James Goldsmith | $60 million | Company purchased shares back at a premium to avoid takeover | 1984 |

| Pan Am Corp. | Sir James Goldsmith | $33 million | Purchased shares at premium to prevent hostile acquisition | 1984 |

| Invacare Corporation | Glick Capital | $25 million | Greenmailer sold shares back at a premium after blockade | 2000 |

Understanding Greenmail in Business Negotiations

Greenmail in business negotiations occurs when a party acquires a substantial stake in a company to pressure management into buying back shares at a premium, often to prevent hostile takeovers. This tactic can disrupt shareholder value and create leverage for the greenmailer, forcing companies to allocate funds to repurchase shares rather than invest in growth. Understanding greenmail is crucial for corporate boards to develop defensive strategies like poison pills or staggered boards to protect shareholder interests.

Historical Examples of Greenmail Tactics

In 1980, corporate raider Sir James Goldsmith used greenmail tactics by accumulating a significant share in Bendix Corporation, prompting the company to repurchase his stock at premium prices to avoid a hostile takeover. Another notable case occurred in 1985 when T. Boone Pickens targeted Gulf Oil, pressuring the company to buy back shares at inflated rates, exemplifying greenmail's role in 1980s corporate battles. These historical examples highlight how greenmail leverages share accumulation to extract financial concessions during takeover negotiations.

Famous Greenmail Negotiation Case Studies

In 1984, Saul Steinberg orchestrated a greenmail deal by acquiring a substantial stake in Reliance Group, then forcing the company to repurchase his shares at a premium, securing a $40 million profit. Another notable case involved T. Boone Pickens' bid for Gulf Oil in 1984, where Pickens amassed a large stock position and successfully demanded a lucrative buyback to avoid a takeover. These cases exemplify how greenmail leverages stock accumulation to pressure companies into paying premiums, often at shareholders' expense.

Key Players Involved in Greenmail Deals

Key players involved in greenmail deals typically include corporate raiders, who purchase a significant stake in a company to threaten a hostile takeover. Target company management often responds by buying back shares at a premium to prevent the takeover, while investment banks and legal advisors facilitate the negotiations. Shareholders also play a critical role, as their stock transactions influence the power dynamics within these deals.

Typical Strategies Used in Greenmail Negotiations

Greenmail negotiations typically involve a hostile bidder purchasing a significant stake in a target company to pressure the board into buying back shares at a premium, often above market value. Common strategies include the greenmailer leveraging the threat of a takeover to coerce management, using confidential information for negotiation advantage, and structuring incremental stock acquisitions to avoid triggering regulatory scrutiny. Target companies may respond by adopting poison pill defenses or negotiating buyouts that restrict future greenmail attempts.

Financial Impact of Greenmail on Target Companies

Greenmail imposes significant financial burdens on target companies, often forcing them to repurchase shares at a premium, which can deplete cash reserves and reduce shareholder value. The cost of meeting greenmail demands diverts funds from productive investments and strategic initiatives, weakening the company's long-term competitive position. Additionally, the threat of greenmail can inflate stock prices artificially, complicating future financing efforts and mergers.

Legal and Ethical Implications of Greenmail

Greenmail involves purchasing a significant stake in a target company to threaten a hostile takeover, then forcing the target to buy back the shares at a premium. This practice raises substantial legal concerns, including potential violations of securities laws and regulations designed to prevent market manipulation. Ethically, greenmail is criticized for undermining shareholder value and corporate governance by prioritizing short-term gains over long-term company health.

Preventing Greenmail in Corporate Negotiations

Preventing greenmail in corporate negotiations involves implementing strategies such as poison pills, staggered board terms, and shareholder rights plans to deter hostile takeover attempts. Companies often conduct thorough due diligence to identify potential greenmail threats early and establish clear communication channels with shareholders to maintain trust. Effective governance policies and legal frameworks enhance protection against opportunistic buyouts, maintaining corporate stability and shareholder value.

Analysis of Greenmail in Modern M&A Scenarios

Greenmail in modern M&A scenarios involves a target company buying back its shares at a premium from a hostile bidder to thwart an unwanted takeover. This strategy often results in significant financial costs for the target firm but can provide temporary relief and leverage in negotiations. Analyzing recent cases reveals that greenmail remains a controversial tactic, impacting shareholder value and corporate governance structures in evolving market conditions.

Lessons Learned from Greenmail Negotiation Examples

Greenmail negotiation incidents reveal critical lessons about corporate governance and shareholder rights, emphasizing the importance of transparent communication and preemptive defense strategies. Businesses learn that preparing poison pills or shareholder rights plans can reduce vulnerability to hostile buyouts driven by greenmail tactics. Understanding these examples helps companies safeguard their valuation and maintain long-term shareholder trust during aggressive negotiation phases.

example of greenmail in negotiation Infographic

samplerz.com

samplerz.com