An example of an angel investor in business is Ron Conway, a prominent Silicon Valley figure known for funding early-stage startups. Conway's investments have significantly impacted companies like Google, Facebook, and Twitter, providing crucial seed capital during their initial growth phases. His role as an angel investor involves not only financial support but also mentorship and strategic advice to founders. Angel investors typically provide capital to startups in exchange for equity ownership or convertible debt, filling a critical funding gap before venture capital rounds. Their investments often range from $25,000 to $100,000, targeting innovative companies with high growth potential. This form of investment contributes to economic development by enabling entrepreneurs to scale their business models and access new markets.

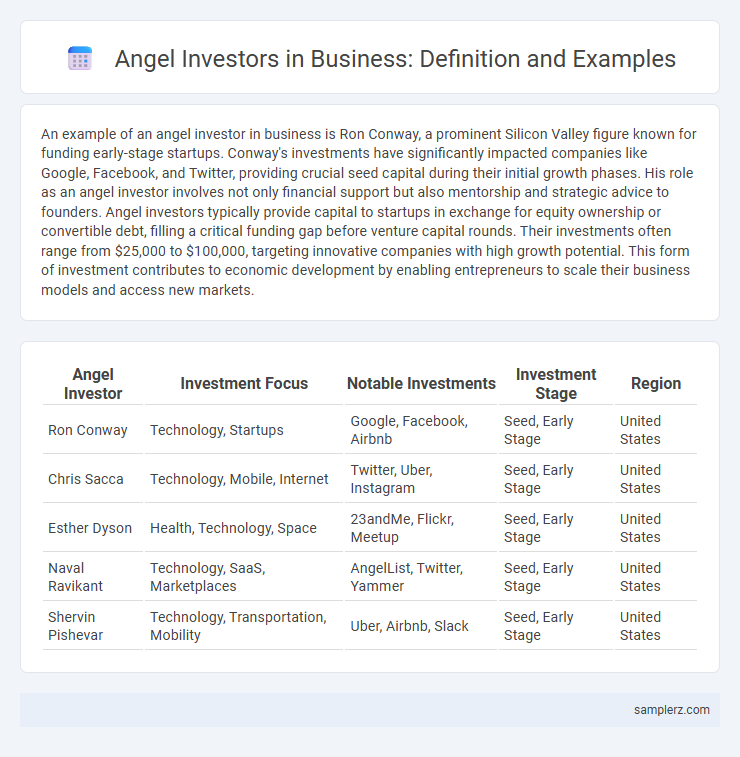

Table of Comparison

| Angel Investor | Investment Focus | Notable Investments | Investment Stage | Region |

|---|---|---|---|---|

| Ron Conway | Technology, Startups | Google, Facebook, Airbnb | Seed, Early Stage | United States |

| Chris Sacca | Technology, Mobile, Internet | Twitter, Uber, Instagram | Seed, Early Stage | United States |

| Esther Dyson | Health, Technology, Space | 23andMe, Flickr, Meetup | Seed, Early Stage | United States |

| Naval Ravikant | Technology, SaaS, Marketplaces | AngelList, Twitter, Yammer | Seed, Early Stage | United States |

| Shervin Pishevar | Technology, Transportation, Mobility | Uber, Airbnb, Slack | Seed, Early Stage | United States |

Understanding Angel Investors in Business

Angel investors play a crucial role in business by providing early-stage capital to startups in exchange for equity or convertible debt. These investors often bring valuable industry experience and mentorship, helping entrepreneurs navigate initial challenges and scale their ventures. Understanding the motivations and expectations of angel investors is essential for securing funding and fostering successful business growth.

Key Characteristics of Angel Investment

Angel investment typically involves high-net-worth individuals providing early-stage capital to startups in exchange for equity or convertible debt. Key characteristics include risk tolerance, hands-on mentorship, and willingness to invest in unproven business models with high growth potential. These investors often seek significant influence in company decisions and expect substantial returns within five to seven years.

Real-World Examples of Angel Investments

Angel investors played a crucial role in the early growth of companies like Uber, where early funding from investors such as Garry Tan enabled rapid expansion and product development. In another instance, Jeff Clavier's angel investment in Fitbit provided the necessary capital to scale manufacturing and marketing efforts. These real-world examples demonstrate how angel investments can catalyze innovation and business growth at critical startup stages.

Notable Angel Investors and Their Portfolios

Notable angel investors such as Ron Conway, known for early investments in Google and Airbnb, have significantly shaped the tech startup landscape. Chris Sacca, with a portfolio including Twitter, Uber, and Instagram, exemplifies strategic angel investing that fuels innovation. These investors leverage extensive networks and industry insight to identify high-potential ventures, driving substantial returns and market disruption.

Case Studies: Startups Funded by Angels

Angel investors played a pivotal role in the early financing of Airbnb, providing $600,000 in seed funding that helped the startup scale its platform globally. Early angel investment in Uber enabled the company to expand rapidly across major cities, securing over $1 million in initial capital from notable angel groups. Dropbox's success story highlights how angel funding of $1.2 million facilitated product development and market entry, laying the foundation for its billion-dollar valuation.

Impact of Angel Investment on Startup Growth

Angel investment significantly accelerates startup growth by providing early-stage financial support and strategic mentorship that fuels product development and market expansion. Startups receiving angel funding often experience enhanced credibility, attracting further venture capital and customer trust, which drives rapid scaling. Data shows startups backed by angel investors grow 30% faster and have a 25% higher survival rate compared to those without such support.

Sectors Attracting Angel Investment

Tech startups, especially in artificial intelligence and fintech, consistently attract significant angel investment due to high growth potential and innovation. Healthcare and biotechnology sectors also receive substantial funding from angel investors aiming to capitalize on medical advancements and personalized medicine. Consumer products and clean energy ventures are increasingly gaining angel investment as markets expand and sustainability becomes a priority.

Successful Business Stories Backed by Angels

Tech startup Airbnb unlocked remarkable growth after receiving early angel investment from Paul Graham, co-founder of Y Combinator, which propelled its global expansion and market dominance. Another prime example is Uber, whose initial backing from angel investor Chris Sacca provided crucial funding and mentorship, accelerating its transformation into a leading ride-sharing platform. These success stories highlight how angel investors offer essential capital and strategic guidance, fostering innovation and scaling businesses in competitive industries.

How Angel Investors Evaluate Opportunities

Angel investors evaluate opportunities by analyzing the startup's market potential, competitive landscape, and scalability to ensure high return prospects. They scrutinize the founding team's experience, vision, and commitment as crucial indicators of execution capability. Financial projections and exit strategies are assessed to gauge investment viability and risk mitigation.

Lessons Learned from Angel Investment Cases

Angel investment cases reveal critical lessons for entrepreneurs and investors, such as the importance of thorough due diligence to evaluate the startup's potential and risks. Successful angel investors emphasize hands-on mentorship and strategic networking, which significantly increase the chances of startup growth and scalability. Investors learn to diversify their portfolios across industries and stages to mitigate risk and maximize returns over time.

example of angel in investment Infographic

samplerz.com

samplerz.com