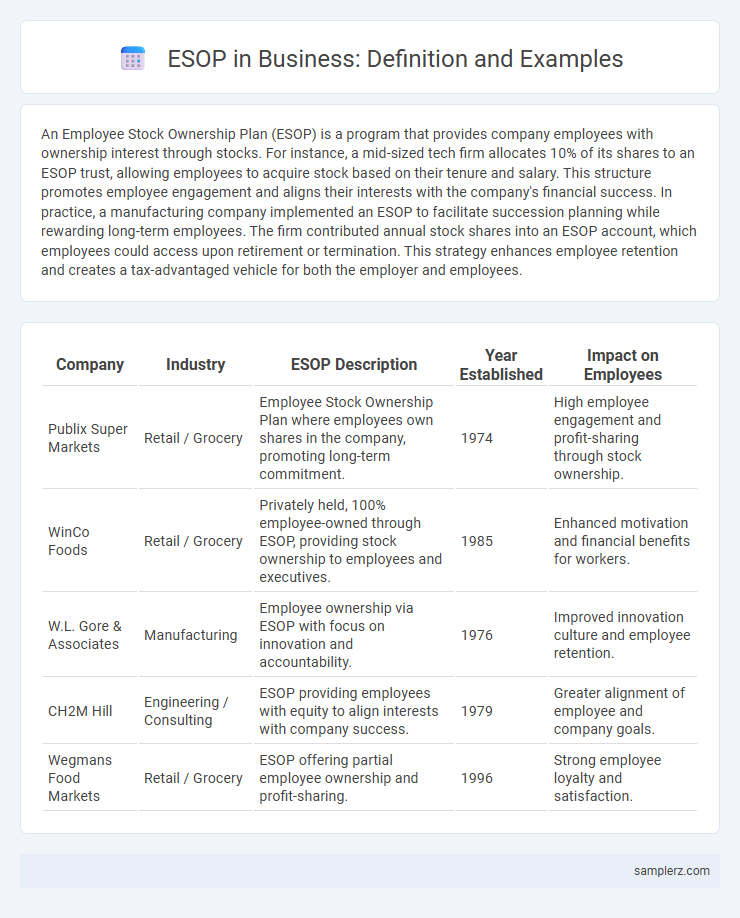

An Employee Stock Ownership Plan (ESOP) is a program that provides company employees with ownership interest through stocks. For instance, a mid-sized tech firm allocates 10% of its shares to an ESOP trust, allowing employees to acquire stock based on their tenure and salary. This structure promotes employee engagement and aligns their interests with the company's financial success. In practice, a manufacturing company implemented an ESOP to facilitate succession planning while rewarding long-term employees. The firm contributed annual stock shares into an ESOP account, which employees could access upon retirement or termination. This strategy enhances employee retention and creates a tax-advantaged vehicle for both the employer and employees.

Table of Comparison

| Company | Industry | ESOP Description | Year Established | Impact on Employees |

|---|---|---|---|---|

| Publix Super Markets | Retail / Grocery | Employee Stock Ownership Plan where employees own shares in the company, promoting long-term commitment. | 1974 | High employee engagement and profit-sharing through stock ownership. |

| WinCo Foods | Retail / Grocery | Privately held, 100% employee-owned through ESOP, providing stock ownership to employees and executives. | 1985 | Enhanced motivation and financial benefits for workers. |

| W.L. Gore & Associates | Manufacturing | Employee ownership via ESOP with focus on innovation and accountability. | 1976 | Improved innovation culture and employee retention. |

| CH2M Hill | Engineering / Consulting | ESOP providing employees with equity to align interests with company success. | 1979 | Greater alignment of employee and company goals. |

| Wegmans Food Markets | Retail / Grocery | ESOP offering partial employee ownership and profit-sharing. | 1996 | Strong employee loyalty and satisfaction. |

Understanding ESOP: A Brief Overview

Employee Stock Ownership Plans (ESOPs) enable employees to acquire ownership stakes in the company, aligning their interests with corporate success and fostering motivation. In businesses like Publix Super Markets, ESOPs serve as a powerful tool for employee retention and wealth accumulation, with employees collectively owning a significant portion of shares. Understanding the structure and benefits of ESOPs is crucial for leveraging them as strategic incentives that enhance productivity and company loyalty.

Key Features of Successful ESOPs

Successful ESOPs typically include clear employee ownership percentages, strong communication channels, and well-defined vesting schedules to motivate and retain talent. These plans often feature tax advantages for both employees and employers, fostering long-term financial growth and commitment. Effective governance structures and regular valuation updates ensure transparency and alignment with company performance, driving overall business success.

Notable Companies with ESOP Structures

Notable companies with ESOP structures include Publix Super Markets, which has one of the largest employee-owned models in the U.S., and W.L. Gore & Associates, famed for its innovative culture driven by employee ownership. These businesses leverage ESOPs to enhance employee engagement, align interests with company performance, and foster long-term financial benefits for workers. ESOP implementation in these companies demonstrates a strategic approach to corporate governance and employee incentivization.

Case Study: ESOP Implementation in Tech Firms

Tech firms like Microsoft and Google have successfully implemented Employee Stock Ownership Plans (ESOPs) to boost employee motivation and retention. These programs granted employees equity stakes, aligning their interests with company growth and fostering innovation. The ESOPs contributed to significant increases in productivity and company valuation, setting industry benchmarks for employee engagement.

Employee Benefits Through ESOP Participation

Employee Stock Ownership Plans (ESOPs) enhance employee benefits by aligning workforce incentives with company performance and providing retirement savings through equity ownership. Companies like Publix Super Markets and Procter & Gamble have successfully implemented ESOPs, resulting in increased employee motivation, retention, and wealth accumulation. These plans distribute shares to employees, fostering a sense of ownership and directly linking financial rewards to the company's growth and profitability.

Comparing ESOP to Traditional Ownership Models

ESOPs (Employee Stock Ownership Plans) empower employees with company shares, aligning their interests with long-term business performance and enhancing motivation and retention. Traditional ownership models often concentrate shares among founders, investors, or a small group of stakeholders, potentially limiting employee engagement and wealth distribution. ESOPs provide tax advantages and succession planning benefits, distinguishing them from conventional equity structures in fostering inclusive corporate ownership.

Steps to Establish an ESOP in Your Business

To establish an Employee Stock Ownership Plan (ESOP) in your business, begin by conducting a feasibility study to assess the financial readiness and potential benefits for both the company and employees. Next, collaborate with financial advisors, legal experts, and valuation specialists to design the plan structure, ensuring compliance with ERISA and IRS regulations. Finalize the ESOP implementation by obtaining board approval, securing financing if necessary, and executing the trust agreement to transfer shares to employees.

ESOP Success Stories: Inspiring Business Transformations

Publix Super Markets demonstrates a notable ESOP success story, where employee ownership has driven increased productivity and long-term financial stability since its ESOP establishment in 1974. The company's ESOP structure aligns employee interests with business growth, resulting in consistent revenue growth and employee satisfaction. Another example is W.L. Gore & Associates, where ESOP-driven culture fosters innovation and collaborative decision-making, contributing to its sustained market leadership in advanced materials.

Common Challenges in Managing ESOPs

Common challenges in managing Employee Stock Ownership Plans (ESOPs) include maintaining accurate valuation of company stock, ensuring regulatory compliance, and effectively communicating the plan's benefits to employees. Companies often struggle with liquidity issues when employees request stock distributions, impacting cash flow management. Addressing these challenges requires strategic planning and robust administrative systems to sustain ESOP success and employee engagement.

The Future of ESOPs in Modern Business

ESOPs (Employee Stock Ownership Plans) are increasingly adopted by modern businesses as strategic tools to enhance employee engagement and drive long-term growth. Companies like Publix Super Markets and W.L. Gore set industry benchmarks by leveraging ESOPs to foster ownership culture and improve financial performance. The future of ESOPs lies in integrating advanced technology and sustainability goals to create more dynamic, inclusive ownership structures.

example of ESOP in business Infographic

samplerz.com

samplerz.com