Burn rate in business expenditure refers to the speed at which a company spends its available capital. For instance, a startup with $1 million in funding that spends $100,000 per month has a burn rate of $100,000. This metric helps businesses gauge how long their current cash reserves will last before requiring additional funding. Companies closely monitor burn rate to maintain financial stability and make informed decisions about scaling operations. Tech startups often face high burn rates due to investments in product development, marketing, and talent acquisition. Tracking monthly expenditure against revenue streams is essential for sustainable growth and planning future investments.

Table of Comparison

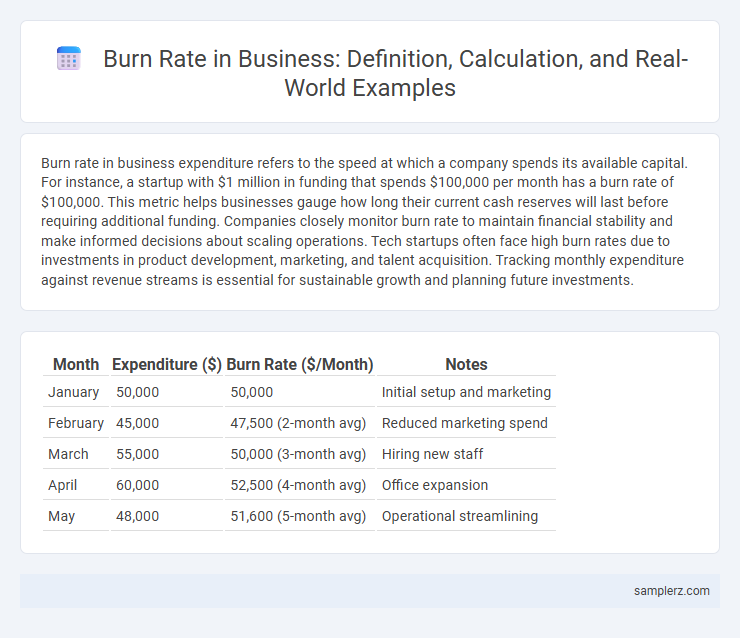

| Month | Expenditure ($) | Burn Rate ($/Month) | Notes |

|---|---|---|---|

| January | 50,000 | 50,000 | Initial setup and marketing |

| February | 45,000 | 47,500 (2-month avg) | Reduced marketing spend |

| March | 55,000 | 50,000 (3-month avg) | Hiring new staff |

| April | 60,000 | 52,500 (4-month avg) | Office expansion |

| May | 48,000 | 51,600 (5-month avg) | Operational streamlining |

Understanding Burn Rate in Business Expenditures

Burn rate in business expenditures refers to the rate at which a company spends its capital to cover operational costs, typically measured monthly. For example, a startup with $500,000 in funding that spends $50,000 per month on salaries, rent, and marketing has a burn rate of $50,000. Monitoring burn rate helps businesses determine their runway--the time remaining before funds are exhausted--enabling strategic financial planning and sustainability.

Real-Life Burn Rate Example: Startup Monthly Expenses

A startup with monthly expenses totaling $50,000 demonstrates a burn rate reflecting its cash outflow crucial for financial planning. Key components include $20,000 for salaries, $10,000 for office rent, $8,000 for marketing, and $12,000 for operational costs. Monitoring this burn rate helps startups manage cash runway and make informed funding decisions to sustain growth.

Calculating Burn Rate: Step-by-Step Guide

Calculating burn rate involves subtracting total monthly expenses from total cash reserves to determine the pace at which a company uses its capital. For example, a startup with $500,000 in cash and monthly expenses of $50,000 has a burn rate of $50,000, meaning it will exhaust its funds in 10 months if revenues remain constant. Monitoring burn rate helps businesses manage cash flow, forecast runway, and adjust spending to ensure financial sustainability.

Fixed vs Variable Costs in Burn Rate Analysis

Burn rate analysis in business expenditure highlights the distinction between fixed costs, such as rent and salaries, which remain constant regardless of production levels, and variable costs like raw materials and utilities, which fluctuate with operational activity. Understanding the proportion of fixed versus variable costs is crucial for accurately forecasting cash flow and managing financial sustainability during periods of revenue decline. Precise measurement of burn rate enables businesses to implement cost-control strategies and optimize resource allocation effectively.

Case Study: Burn Rate in a Tech Startup

A tech startup with monthly operating expenses of $150,000 and a cash reserve of $1.8 million exhibits a burn rate of $150,000 per month, indicating it will exhaust its funds in 12 months without additional revenue. Monitoring burn rate helps these startups gauge financial health and make strategic decisions about fundraising and cost management. Companies that reduce their burn rate by optimizing operational costs can extend their runway and increase chances of reaching profitability.

Managing Burn Rate for Financial Sustainability

A startup with monthly expenses of $50,000 and $300,000 in cash reserves has a burn rate of six months, highlighting the need to manage spending carefully to avoid insolvency. Tracking burn rate helps businesses identify when to reduce costs or seek additional funding, ensuring operational continuity. Effective burn rate management supports financial sustainability by aligning expenditure with revenue growth and cash flow projections.

The Impact of High Burn Rate on Cash Flow

A high burn rate, such as monthly expenses exceeding $500,000 while generating only $300,000 in revenue, rapidly depletes cash reserves and endangers operational sustainability. This negative cash flow forces businesses to seek urgent financing or cut critical costs, compromising growth initiatives. Maintaining a controlled burn rate is essential for preserving liquidity and supporting long-term strategic goals.

Burn Rate Examples from Different Industries

Tech startups often exhibit burn rates exceeding $100,000 per month due to heavy investments in software development and marketing. In the retail sector, burn rates can vary widely, with e-commerce companies spending around $50,000 monthly on inventory and advertising. Manufacturing firms typically face steady burn rates of $200,000 to $500,000 monthly, driven by raw materials, labor, and operational costs.

Reducing Burn Rate: Strategies for Businesses

Businesses aiming to reduce their burn rate should closely monitor monthly operating expenses, such as payroll, rent, and marketing costs, to identify areas for cost-cutting. Implementing remote work policies can significantly lower overhead expenses like office utilities and maintenance. Strategic renegotiation of vendor contracts and prioritizing high-impact investments enhance cash flow management, ultimately prolonging the runway for sustainable growth.

Monitoring Burn Rate: Best Practices for Entrepreneurs

Monitoring burn rate involves tracking monthly operating expenses against available capital to ensure sustainable cash flow. Entrepreneurs should analyze fixed costs like salaries and rent alongside variable expenses such as marketing and production to identify spending patterns. Implementing budgeting software and setting regular financial reviews helps detect unfavorable trends early, enabling timely adjustments to preserve runway.

example of burn rate in expenditure Infographic

samplerz.com

samplerz.com