Sweat equity in a startup refers to the non-monetary investment made by founders or early employees through their time, effort, and expertise. For example, a co-founder of a tech startup who develops the initial software without receiving a salary is contributing sweat equity. This form of investment often translates into ownership shares or equity in the company. Another common example involves marketing specialists or product developers working during the early stages without immediate pay to help grow the business. Their contributions add significant value, allowing the startup to minimize upfront expenses while building a product or brand. The sweat equity accrued can be converted into stock options or equity stakes, aligning their interests with the startup's success.

Table of Comparison

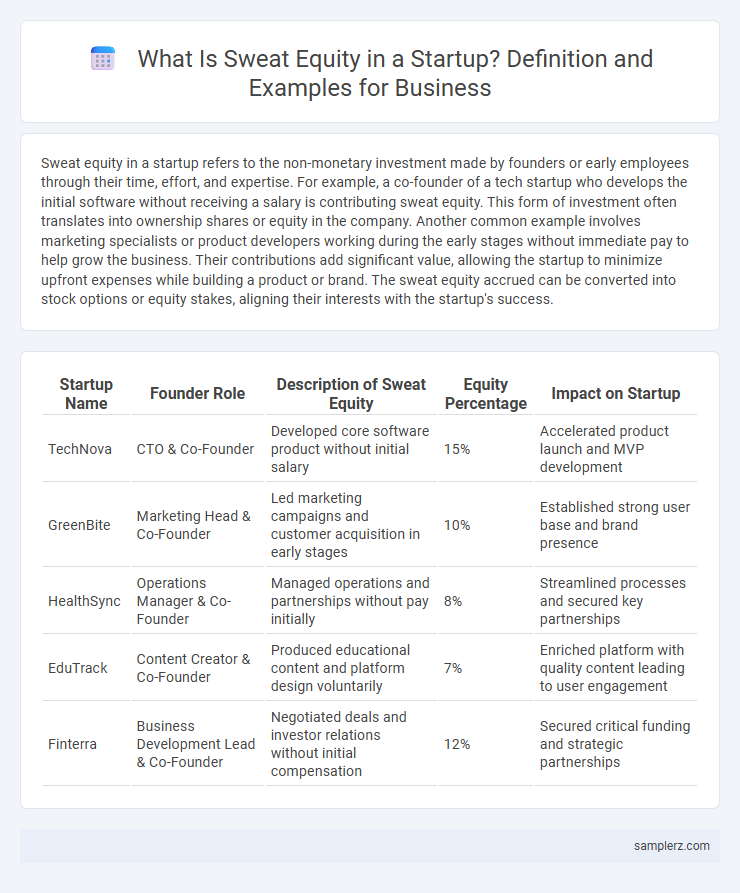

| Startup Name | Founder Role | Description of Sweat Equity | Equity Percentage | Impact on Startup |

|---|---|---|---|---|

| TechNova | CTO & Co-Founder | Developed core software product without initial salary | 15% | Accelerated product launch and MVP development |

| GreenBite | Marketing Head & Co-Founder | Led marketing campaigns and customer acquisition in early stages | 10% | Established strong user base and brand presence |

| HealthSync | Operations Manager & Co-Founder | Managed operations and partnerships without pay initially | 8% | Streamlined processes and secured key partnerships |

| EduTrack | Content Creator & Co-Founder | Produced educational content and platform design voluntarily | 7% | Enriched platform with quality content leading to user engagement |

| Finterra | Business Development Lead & Co-Founder | Negotiated deals and investor relations without initial compensation | 12% | Secured critical funding and strategic partnerships |

Understanding Sweat Equity in Startups

Sweat equity in startups refers to the non-monetary investment founders and early employees contribute through their time, effort, and expertise to build the company's value. This form of equity often translates into ownership shares or stock options, reflecting their crucial role in product development, market entry, and business growth during the startup's initial phases. Understanding sweat equity is vital for accurately valuing contributions that drive innovation and long-term success in emerging businesses.

Key Benefits of Sweat Equity for Entrepreneurs

Sweat equity in startups allows entrepreneurs to acquire significant ownership without initial capital investment, aligning their personal stakes with the company's growth and success. This form of equity fosters strong motivation and commitment, enhancing productivity and driving innovation crucial for scaling the business. Moreover, sweat equity can attract investors by demonstrating the founders' confidence and dedication, increasing the startup's valuation and funding potential.

Real-World Sweat Equity Examples in Early-Stage Startups

Founders of early-stage startups often receive sweat equity by contributing time and expertise instead of cash, such as software developers building a minimum viable product (MVP) or marketers driving initial customer acquisition. A notable example includes Airbnb's founders who worked tirelessly on platform development and user growth before securing external funding, earning significant equity in return. This form of sweat equity aligns the founders' efforts directly with company valuation, incentivizing long-term commitment and growth.

Sweat Equity: Founders vs. Early Employees

Sweat equity in startups often distinguishes between founders and early employees by the value of their non-monetary contributions, such as time, expertise, and effort invested in building the company. Founders typically receive larger equity stakes reflecting their risk and initial vision, while early employees earn sweat equity through stock options tied to achieving milestones or tenure. This allocation incentivizes commitment and aligns interests, crucial for startup growth and investor confidence.

Case Study: Sweat Equity for Technical Co-Founders

Technical co-founders of startups often receive sweat equity as compensation for their crucial role in product development and innovation, substituting cash salaries in early-stage ventures. A notable case study involves Dropbox, where co-founder Arash Ferdowsi contributed significant coding expertise and operational strategy in exchange for substantial equity, aligning his interests with the company's long-term growth. This model incentivizes technical founders to prioritize scalable, high-quality solutions while sharing the financial risks and rewards tied to the startup's success.

How Advisors Leverage Sweat Equity in Startups

Advisors leverage sweat equity in startups by exchanging their industry expertise, mentorship, and strategic guidance for ownership stakes without immediate cash compensation. This approach aligns advisors' interests with the company's growth, incentivizing them to contribute actively to key decisions, networking opportunities, and problem-solving processes. Sweat equity enables startups to attract high-caliber advisors crucial for scaling while conserving limited financial resources.

Sweat Equity Arrangements with Freelancers or Contractors

Sweat equity arrangements with freelancers or contractors often involve granting ownership stakes or profit-sharing opportunities in exchange for their professional services, allowing startups to conserve cash while leveraging expert skills. These agreements typically specify the percentage of equity granted, the vesting schedule, and performance milestones to align incentives and protect both parties. Clear contractual terms ensure that freelancers' contributions are recognized as valuable investments, fostering long-term commitment and business growth.

Legal Frameworks for Allocating Sweat Equity

Sweat equity in startups is commonly allocated through shareholder agreements and equity vesting schedules, ensuring clarity on ownership and responsibilities. Legal frameworks often require clear documentation of the value of services contributed and explicit terms governing equity dilution or transfer restrictions. Compliance with jurisdiction-specific corporate laws is essential to validate sweat equity shares and protect founders' interests.

Potential Risks of Sweat Equity Investments

Sweat equity in startups often involves founders or early employees contributing time and expertise in exchange for ownership, but this carries potential risks such as dilution of shares if additional funding rounds occur and the eventual valuation does not reflect initial contributions. Legal disputes may arise over the valuation of sweat equity, especially when formal agreements lack clear terms, leading to conflicts during equity distribution or exit events. Furthermore, reliance on sweat equity can jeopardize financial stability if essential operational tasks are undervalued or delayed, impacting overall business growth and investor confidence.

Measuring and Valuing Sweat Equity Contributions

Sweat equity in startups is often measured by quantifying the hours founders or early employees dedicate to product development, marketing, or operations without immediate cash compensation. Valuing these contributions involves assigning a fair market rate to the time invested, typically benchmarking against industry-standard salaries for equivalent roles. Accurate accounting of sweat equity ensures equitable ownership distribution and aligns incentives for sustained startup growth.

example of sweat equity in startup Infographic

samplerz.com

samplerz.com