A bear hug in business refers to an aggressive takeover strategy where one company offers to buy another at a price significantly higher than the current market value. This approach pressures the target company's board to accept the offer due to its attractiveness to shareholders. For example, in 2006, Oracle launched a bear hug bid to acquire PeopleSoft, offering a premium price that made the takeover hard to reject. Bear hugs can create leverage for the acquiring company by speeding up negotiations and limiting resistance from the target's management. The high premium offer often appeals directly to shareholders, compelling quicker decision-making. Bear hugs are common in mergers and acquisitions when a swift, strategic buyout is desired without prolonged hostilities.

Table of Comparison

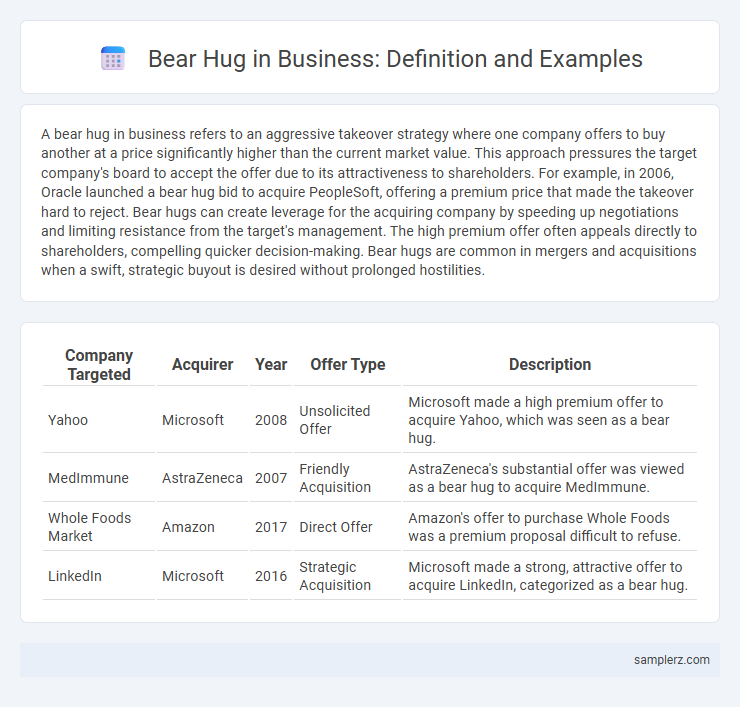

| Company Targeted | Acquirer | Year | Offer Type | Description |

|---|---|---|---|---|

| Yahoo | Microsoft | 2008 | Unsolicited Offer | Microsoft made a high premium offer to acquire Yahoo, which was seen as a bear hug. |

| MedImmune | AstraZeneca | 2007 | Friendly Acquisition | AstraZeneca's substantial offer was viewed as a bear hug to acquire MedImmune. |

| Whole Foods Market | Amazon | 2017 | Direct Offer | Amazon's offer to purchase Whole Foods was a premium proposal difficult to refuse. |

| Microsoft | 2016 | Strategic Acquisition | Microsoft made a strong, attractive offer to acquire LinkedIn, categorized as a bear hug. |

Introduction to Bear Hug in Business

A bear hug in business occurs when a company makes an unsolicited, generous offer to acquire another company at a premium price to pressure the target's board into acceptance. This aggressive takeover strategy aims to bypass lengthy negotiations by presenting an irresistible financial proposal. Prominent examples include Carl Icahn's 1985 bid for TWA, which pressured the airline's management to reconsider their resistance to acquisition.

Understanding the Bear Hug Tactic

A bear hug in business refers to an aggressive takeover strategy where a company offers a premium price to acquire a target firm, making refusal difficult due to high shareholder returns. This tactic is commonly used to pressure a reluctant management team into accepting a buyout by overwhelming them with an attractive offer. Understanding the bear hug involves recognizing its dual role as both a negotiation tool and a strategic move to quickly gain control while minimizing prolonged resistance.

Notable Bear Hug Offers in Corporate History

In 1984, Carl Icahn's bear hug offer for TWA involved acquiring a significant stake to pressure the board for a buyout or restructuring. Another notable case is Sanofi's 2014 bear hug approach to Genzyme, which led to a $20.1 billion acquisition, highlighting strategic consolidation in the pharmaceutical sector. These instances demonstrate how bear hugs serve as aggressive takeover tactics that leverage shareholder influence to initiate corporate transactions.

Bear Hug Example: Kraft’s Approach to Cadbury

Kraft's 2009 bear hug offer to Cadbury exemplified an aggressive takeover strategy, where Kraft initially proposed a friendly merger before escalating to a tender offer at a premium price to pressure Cadbury shareholders. This approach leveraged a high-value proposition, aiming to bypass prolonged negotiations and board resistance by appealing directly to shareholders. Kraft's strategy ultimately led to Cadbury's acquisition, highlighting the effectiveness of a bear hug in securing control through financial incentives.

Bear Hug in Tech: Microsoft’s Bid for Yahoo

Microsoft's bid for Yahoo in 2008 exemplifies a bear hug in the tech industry, where Microsoft offered a premium price to acquire Yahoo, signaling a friendly but firm takeover attempt. This strategic move aimed to quickly secure Yahoo's acceptance and consolidate Microsoft's position against rivals like Google. The bear hug tactic leveraged financial appeal and market influence, pressuring Yahoo's board to seriously consider the acquisition.

Hostile vs. Friendly Bear Hugs: Real-World Cases

Bear hugs in business describe aggressive takeover bids where an acquiring company offers above-market premiums to buy a target firm, forcing board consideration. Friendly bear hugs occur when the target company is open to acquisition, leading to smoother negotiations, exemplified by Disney's bid for Pixar in 2006. Hostile bear hugs, such as Carl Icahn's approach to Time Warner in 2010, involve unsolicited offers aiming to pressure the board despite initial resistance.

Legal and Ethical Implications of Bear Hug Strategies

Bear hug strategies in business involve a firm proposal to acquire a company at a premium price, often creating pressure on the target's board to accept the offer, which raises significant legal and ethical concerns regarding shareholder rights and fiduciary duties. The aggressiveness of bear hugs may lead to disputes over disclosure obligations under securities law and the potential manipulation of market perception, challenging regulatory frameworks designed to protect investors. Ethical implications include the risk of coercion, undermining the autonomy of the target company's management, and raising questions about fair negotiation practices in hostile takeover scenarios.

CEO Responses to Bear Hug Proposals

CEO responses to bear hug proposals often involve quick evaluation of the offer's premium and strategic fit to protect shareholder value. Some CEOs reject these all-cash or high-premium bids outright to maintain company independence, while others engage in negotiations to improve terms or seek alternatives. Proactive communication with the board and shareholders is essential for CEOs to manage pressure and ensure alignment during bear hug situations.

Outcomes of Famous Bear Hug Attempts

The 2008 bear hug by Microsoft towards Yahoo resulted in a high-profile, but ultimately unsuccessful takeover attempt that pressured Yahoo's board and shareholders to consider strategic alternatives. In 2016, the bear hug from Qualcomm to NXP Semiconductors culminated in a $47 billion acquisition, significantly expanding Qualcomm's product portfolio and market reach. These outcomes illustrate how bear hugs can either trigger shareholder value debates or lead to major mergers reshaping industry landscapes.

Key Takeaways from Bear Hug Examples

Bear hug offers in business occur when a company presents an overwhelmingly attractive acquisition proposal directly to the target's shareholders, bypassing management resistance. Key takeaways include the strategy's ability to signal strong confidence in valuation, pressure on management for negotiations, and potential for swift deal closure. Successful bear hugs often hinge on transparent communication of value and timing alignment with market conditions.

example of bear hug in business Infographic

samplerz.com

samplerz.com