A poison pill is a defensive strategy used by companies to prevent hostile takeovers. This tactic involves issuing new shares or rights to existing shareholders, making the company less attractive or more expensive for the potential acquirer. For example, a company might grant existing shareholders the right to purchase additional shares at a discount if a single shareholder surpasses a certain ownership threshold, diluting the acquirer's stake. One well-known instance of a poison pill occurred during the 1980s when companies faced aggressive takeover bids. In this scenario, a target company offered rights to shareholders to buy shares at a reduced price once an unwanted acquirer gained substantial control. This action increased the cost and complexity of the takeover, effectively deterring the hostile bidder.

Table of Comparison

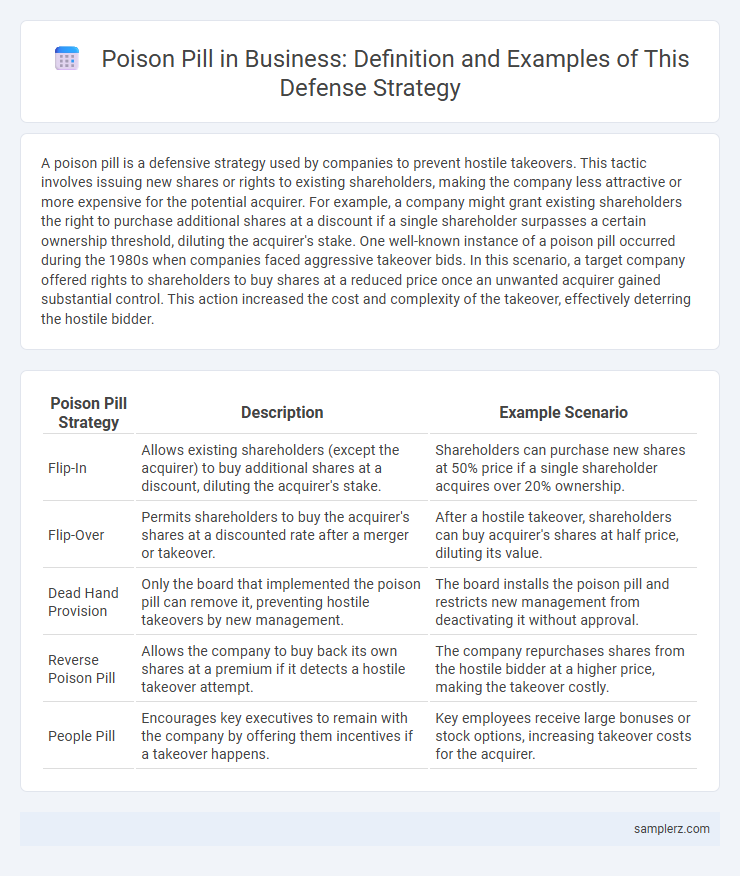

| Poison Pill Strategy | Description | Example Scenario |

|---|---|---|

| Flip-In | Allows existing shareholders (except the acquirer) to buy additional shares at a discount, diluting the acquirer's stake. | Shareholders can purchase new shares at 50% price if a single shareholder acquires over 20% ownership. |

| Flip-Over | Permits shareholders to buy the acquirer's shares at a discounted rate after a merger or takeover. | After a hostile takeover, shareholders can buy acquirer's shares at half price, diluting its value. |

| Dead Hand Provision | Only the board that implemented the poison pill can remove it, preventing hostile takeovers by new management. | The board installs the poison pill and restricts new management from deactivating it without approval. |

| Reverse Poison Pill | Allows the company to buy back its own shares at a premium if it detects a hostile takeover attempt. | The company repurchases shares from the hostile bidder at a higher price, making the takeover costly. |

| People Pill | Encourages key executives to remain with the company by offering them incentives if a takeover happens. | Key employees receive large bonuses or stock options, increasing takeover costs for the acquirer. |

Understanding Poison Pill Strategies in Business Defense

Poison pill strategies in business defense often involve issuing new shares at a discount to existing shareholders, diluting the ownership percentage of a potential hostile acquirer. Another common tactic is implementing shareholder rights plans that trigger when an unwanted party accumulates a significant stake, effectively making the takeover prohibitively expensive. These mechanisms protect companies by discouraging hostile bids and maintaining control within the current management.

Classic Examples of Poison Pill in Corporate Takeovers

Classic examples of poison pill strategies in corporate takeovers include the case of Netflix's 2012 defense against Carl Icahn, where the company issued preferred stock to dilute the potential acquirer's stake. Another notable instance is the 1985 use by People's Choice to implement a flip-in poison pill, discouraging hostile bids by allowing shareholders to purchase additional shares at a discount. These tactics effectively deterred unwanted acquisition attempts by making takeovers prohibitively expensive.

Flip-In Poison Pill: Real-World Case Studies

Flip-In Poison Pill strategies have been famously employed by companies like Netflix and PeopleSoft to deter hostile takeovers by diluting the acquirer's shares once a certain ownership threshold is crossed. Netflix implemented a Flip-In poison pill in 2012 to prevent activist Carl Icahn from gaining control, which effectively allowed existing shareholders other than Icahn to purchase additional shares at a discount. PeopleSoft's 2003 adoption of a Flip-In poison pill successfully delayed Oracle's hostile acquisition bid, buying time to negotiate a higher purchase price and better terms for shareholders.

Flip-Over Poison Pill: How Companies Protect Themselves

Flip-Over Poison Pill is a strategic defense mechanism used by companies to deter hostile takeovers by allowing shareholders to purchase the acquiring company's stock at a significant discount after a merger. This tactic dilutes the value of the acquirer's shares, making the takeover prohibitively expensive and less attractive. Leading corporations like Disney and Netflix have successfully employed flip-over poison pills to maintain control and protect shareholder interests during acquisition attempts.

Notable Poison Pill Implementations in Mergers & Acquisitions

A notable poison pill example is the 1985 takeover defense by Netflix, which adopted a shareholder rights plan to fend off an unsolicited bid. Another significant case is the 1987 implementation by Netflix, where its poison pill enabled the company to maintain control against a hostile acquisition attempt. These strategic defenses have set benchmarks in mergers and acquisitions for preserving company autonomy while deterring aggressive takeovers.

Famous Legal Battles Over Poison Pill Measures

The 1985 battle between Revlon and Pantry Pride marked a landmark case in poison pill defense, where Revlon adopted a shareholder rights plan to thwart Pantry Pride's hostile takeover attempt. The Delaware Supreme Court's decision in Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc. clarified the fiduciary duties of the board during takeover defenses, shaping the legal landscape for poison pill adoption. Other notable cases, such as Moran v. Household International, reinforced the legality and strategic importance of poison pills in deterring unfriendly acquisitions.

Effectiveness of Poison Pill Tactics in Preventing Hostile Bids

Poison pill tactics, such as shareholder rights plans, effectively deter hostile bids by significantly diluting the value of shares if an unwanted acquirer surpasses a specified ownership threshold, thereby making takeovers prohibitively expensive. Empirical studies show a marked decrease in successful hostile takeovers among companies employing poison pills, highlighting their role in increasing negotiation leverage and protecting management autonomy. These defense mechanisms preserve company valuation and shareholder interests by discouraging unsolicited acquisition attempts without necessitating immediate legal battles.

Boardroom Decisions: Deploying a Poison Pill Defense

Boardroom decisions to deploy a poison pill defense typically involve issuing new shares to existing shareholders at a discount, diluting the ownership stake of a potential acquirer and deterring hostile takeovers. This strategy empowers the board to maintain control and protect company valuation by complicating the acquisition process. Activating a poison pill often requires careful legal consultation and shareholder approval, ensuring alignment with corporate governance standards.

Shareholder Impact: Reactions to Poison Pill Announcements

Shareholder reactions to poison pill announcements often include immediate stock price volatility, reflecting uncertainty about potential takeover outcomes. Research shows that while some investors view poison pills as management tools to protect long-term shareholder value, others perceive them as mechanisms to entrench current leadership at the expense of shareholder wealth. Empirical evidence suggests that poison pill adoption can lead to mixed market responses, with short-term declines offset by stabilization or gains in firms demonstrating strong defensive legitimacy.

Evolution of Poison Pill Strategies in Modern Business

Poison pill strategies have evolved from simple shareholder rights plans to sophisticated mechanisms tailored to deter hostile takeovers in modern business environments. Companies now implement variations such as flip-in and flip-over pills, leveraging subscription rights and dilution tactics to protect board control. These adaptive defenses reflect a strategic shift, integrating legal, financial, and technological factors to safeguard corporate autonomy.

example of poison pill in defense Infographic

samplerz.com

samplerz.com