A bear hug in a business merger occurs when one company makes an unsolicited offer to buy another company at a significantly higher price than the target's current market value. This tactic puts intense pressure on the target company's management and board to accept the offer, as rejecting it might upset shareholders who stand to benefit from the premium. A famous example is Kraft Foods' 2014 offer to acquire Cadbury, where Kraft proposed a substantial premium on Cadbury's stock, compelling Cadbury's board to seriously consider the acquisition despite initial resistance. Bear hugs are used strategically in merger negotiations to gain rapid control or stake without immediately hostile takeovers. The entity making the offer often aims to outflank competitors by presenting an attractive financial proposition directly to the target's board. Data from M&A activity indicates that bear hugs lead to successful acquisitions in a significant number of cases, particularly when the premium exceeds 30% over market price.

Table of Comparison

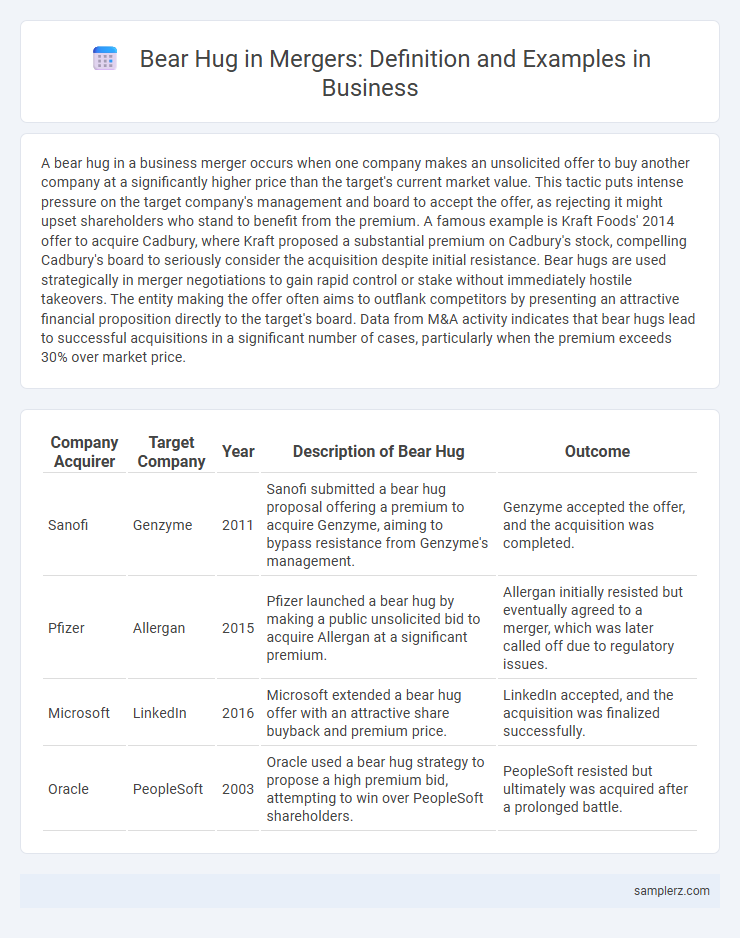

| Company Acquirer | Target Company | Year | Description of Bear Hug | Outcome |

|---|---|---|---|---|

| Sanofi | Genzyme | 2011 | Sanofi submitted a bear hug proposal offering a premium to acquire Genzyme, aiming to bypass resistance from Genzyme's management. | Genzyme accepted the offer, and the acquisition was completed. |

| Pfizer | Allergan | 2015 | Pfizer launched a bear hug by making a public unsolicited bid to acquire Allergan at a significant premium. | Allergan initially resisted but eventually agreed to a merger, which was later called off due to regulatory issues. |

| Microsoft | 2016 | Microsoft extended a bear hug offer with an attractive share buyback and premium price. | LinkedIn accepted, and the acquisition was finalized successfully. | |

| Oracle | PeopleSoft | 2003 | Oracle used a bear hug strategy to propose a high premium bid, attempting to win over PeopleSoft shareholders. | PeopleSoft resisted but ultimately was acquired after a prolonged battle. |

Understanding the Bear Hug Strategy in Mergers

A bear hug in mergers occurs when a company makes an unsolicited, highly attractive offer to acquire another firm, pressuring the target's board to seriously consider the deal. This strategy often involves offering a premium price well above the market value to expedite negotiations and limit competitive bids. Understanding the bear hug tactic is crucial for shareholders and executives as it can significantly influence merger outcomes and corporate control dynamics.

Key Features of a Bear Hug in Business Acquisitions

A bear hug in business acquisitions involves an unsolicited, high-premium offer to the target company's board, emphasizing speed and decisiveness. Key features include a generous price significantly above market value, minimal negotiation to pressure swift acceptance, and public or private delivery intended to highlight seriousness. This strategy leverages urgency and attractiveness to limit resistance and expedite shareholder approval.

Classic Real-World Bear Hug Examples

The Pfizer and Allergan merger attempt in 2015 exemplifies a classic bear hug, where Pfizer directly approached Allergan's board with a lucrative offer that pressured acceptance. This strategy leveraged the substantial premium on Allergan's stock to create urgency and minimize competitive bids. Bear hugs compel target companies to seriously consider acquisition proposals to avoid hostile takeovers or shareholder dissatisfaction.

Notable Bear Hug Attempts in Corporate Mergers

In 2017, Kraft Heinz's unsolicited bid for Unilever exemplified a high-profile bear hug attempt, leveraging aggressive purchase terms to pressure the target. The $143 billion offer combined direct engagement with Unilever's board and a public announcement to compel consideration. This strategy highlighted how bear hugs serve to accelerate merger negotiations by reducing the target's ability to seek alternative bids.

Impact of Bear Hug Tactics on Target Companies

Bear hug tactics in mergers involve an acquirer presenting an unsolicited, premium offer directly to the target company's board, creating significant pressure to accept the deal. This approach often leads to a rapid increase in the target's stock price as shareholders anticipate a buyout, while the board faces heightened scrutiny and strategic reevaluation. The intense leverage exerted by the acquirer can disrupt existing management plans and may result in accelerated negotiations or defensive measures to preserve company autonomy.

Legal and Ethical Implications of Bear Hugs

A bear hug in mergers occurs when a company makes an unsolicited, generous offer to buy another firm, compelling the board to seriously consider the proposal due to its financial attractiveness. Legally, this tactic raises concerns about shareholder rights and potential coercion, as the target's management may feel pressured to accept without thorough evaluation. Ethically, bear hugs can challenge corporate governance principles by undermining transparent negotiation processes and potentially disregarding the long-term interests of employees and other stakeholders.

Famous Bear Hug Offers: Case Studies

In the realm of business mergers, the bear hug tactic gained notoriety with KKR's hostile yet lucrative offer for RJR Nabisco in 1988, which triggered one of the largest leveraged buyouts in history. Another landmark case is Carl Icahn's bid for Time Warner in 1989, where his aggressive share acquisition pressured the company into negotiations. These case studies highlight how bear hugs strategically leverage market expectations to facilitate high-stakes corporate takeovers.

Bear Hug Outcomes: Successes and Failures

A notable example of a bear hug in business mergers is when Company A made an unsolicited, generous buyout offer to Company B, pressuring its board to accept due to public shareholder appeal. Successful bear hug outcomes often result in swift acquisitions and premium payouts for target shareholders, while failures occur when the target company rejects the offer and engages in defensive measures, causing prolonged conflicts or deal collapses. The effectiveness of bear hugs largely depends on the target's board receptiveness and shareholder pressure dynamics, influencing merger completion rates and deal valuations.

How Companies Respond to Bear Hug Proposals

Companies typically respond to bear hug proposals by carefully evaluating the offer's terms and strategic fit before deciding whether to negotiate, accept, or reject. Legal and financial advisors are often engaged to assess valuation, potential synergies, and risks involved in the unsolicited acquisition attempt. Firms may also communicate with shareholders to gauge support or consider alternative defense strategies such as seeking white knights or implementing poison pills.

Lessons Learned from Bear Hug Merger Examples

Bear hug mergers reveal the importance of transparent communication and strategic timing to avoid conflicts and resistance from target companies. Examples show that companies receiving unsolicited acquisition offers benefit from assessing the proposal's financial terms and potential cultural integration challenges before responding. These lessons emphasize thorough due diligence and the need to balance assertiveness with diplomacy in high-stakes negotiations.

example of bear hug in merger Infographic

samplerz.com

samplerz.com