A roll-up in business consolidation involves combining multiple smaller companies within the same industry into a larger single entity. This strategy is used to increase market share, reduce costs through economies of scale, and enhance competitive advantage. For example, a private equity firm may acquire several regional retail chains and merge them into one national brand to create a more powerful market presence. Data from recent roll-up cases shows significant improvements in operational efficiency and revenue growth post-consolidation. Entity consolidation allows businesses to streamline processes, leverage combined assets, and optimize supply chains. This roll-up method often results in higher valuation multiples due to the increased scale and market influence of the consolidated entity.

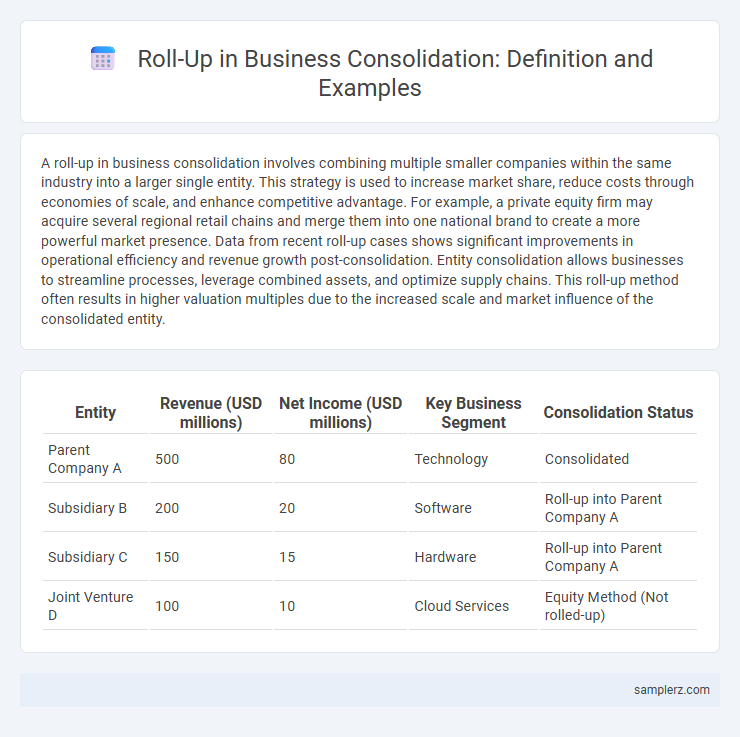

Table of Comparison

| Entity | Revenue (USD millions) | Net Income (USD millions) | Key Business Segment | Consolidation Status |

|---|---|---|---|---|

| Parent Company A | 500 | 80 | Technology | Consolidated |

| Subsidiary B | 200 | 20 | Software | Roll-up into Parent Company A |

| Subsidiary C | 150 | 15 | Hardware | Roll-up into Parent Company A |

| Joint Venture D | 100 | 10 | Cloud Services | Equity Method (Not rolled-up) |

Introduction to Roll-Up in Business Consolidation

A roll-up in business consolidation involves merging multiple smaller companies within the same industry to form a larger, more competitive entity, enhancing market share and operational efficiency. This strategy is commonly used in fragmented markets such as healthcare, technology, and retail, enabling economies of scale and streamlined management. By integrating diverse operations into a unified organization, roll-ups create value through cost reduction, increased purchasing power, and broader customer reach.

Key Characteristics of Roll-Up Strategies

Roll-up strategies in business consolidation involve acquiring multiple smaller companies within the same industry to achieve economies of scale, increase market share, and enhance operational efficiencies. Key characteristics include standardized processes across acquired entities, centralized management to control costs, and the integration of complementary products or services to create a unified brand presence. This approach often targets fragmented markets where individual businesses benefit from combined resources and strengthened competitive positioning.

Notable Roll-Up Examples in the Tech Industry

Notable roll-up examples in the tech industry include Cisco Systems, which executed a strategic roll-up by acquiring multiple smaller networking and software firms to dominate the IT infrastructure market. Another prominent example is Google's consolidation strategy through Alphabet, absorbing diverse tech companies like Nest and Android to expand its ecosystem. These roll-ups illustrate how tech giants leverage acquisitions to scale operations, increase market share, and diversify product offerings efficiently.

Roll-Up Case Study: Healthcare Sector Consolidation

In the healthcare sector consolidation, a roll-up strategy involved merging several regional outpatient clinics to create a unified network with greater bargaining power and streamlined operations. This consolidation enhanced patient service delivery by integrating electronic health records and standardizing care protocols across facilities. The roll-up increased market share and operational efficiency, resulting in significant cost savings and revenue growth.

Roll-Up Transactions in the Retail Market

Roll-up transactions in the retail market involve consolidating multiple small retail chains into a single, larger entity to achieve economies of scale and increased market share. For instance, the acquisition of regional grocery stores by larger supermarket chains allows centralized procurement, streamlined operations, and enhanced bargaining power with suppliers. This strategy accelerates growth and competitiveness by unifying fragmented retail assets under one corporate structure.

Benefits of Roll-Up for Small Businesses

Roll-up consolidation allows small businesses to combine multiple entities under a single corporate structure, streamlining operations and reducing overhead costs. This strategy boosts purchasing power, enhances market reach, and increases negotiating leverage with suppliers and customers. By unifying financial reporting and management, roll-ups improve efficiency and create attractive opportunities for investors.

Common Challenges During Roll-Up Consolidations

Roll-up consolidations often encounter challenges such as data integration inconsistencies, where differing accounting systems and reporting standards across entities complicate the aggregation process. Managing cultural and operational disparities can impede alignment, leading to delays and increased costs. Ensuring accurate intercompany eliminations and addressing regulatory compliance across jurisdictions remain critical hurdles in achieving seamless financial consolidation.

Successful Roll-Up Models in Financial Services

Successful roll-up models in financial services often involve acquiring multiple small wealth management firms to create a larger entity with increased assets under management (AUM) and enhanced operational efficiencies. Firms like United Capital and Mercer Advisors leveraged targeted acquisitions to expand geographic reach and cross-sell complementary financial products. These roll-ups drive economies of scale, improved client service, and higher valuations through consolidated revenue streams and cost synergies.

Legal and Regulatory Considerations in Roll-Ups

Roll-up strategies in business consolidation require careful navigation of legal and regulatory frameworks such as antitrust laws, securities regulations, and industry-specific compliance standards. Ensuring thorough due diligence, including the assessment of potential legal liabilities and regulatory approvals, is critical to mitigate risks and avoid sanctions from bodies like the Federal Trade Commission or the Securities and Exchange Commission. Structuring agreements with clear terms on governance, liability, and disclosure obligations facilitates regulatory compliance and smooth integration during roll-ups.

Future Trends of Roll-Up Consolidation in Business

Roll-up consolidation, where multiple smaller companies in the same industry are acquired and merged to form a larger entity, is increasingly driven by advancements in AI and data analytics, enabling more efficient integration and value realization. Future trends highlight the rise of sector-specific roll-ups in technology, healthcare, and renewable energy, leveraging specialized expertise to accelerate growth and innovation. Investors are focusing on scalable business models and digital infrastructure, making roll-up consolidation a key strategy for achieving economies of scale and market dominance in highly fragmented industries.

example of roll-up in consolidation Infographic

samplerz.com

samplerz.com